Today we want to talk about asset protection, specifically how you can protect your wealth by investing in art.

Today we want to talk about asset protection, specifically how you can protect your wealth by investing in art.

In a present marked by economic uncertainty and financial volatility, protecting one’s wealth is becoming increasingly important. The global financial landscape has undergone significant changes in recent decades, challenging traditional wealth protection strategies.

Governments are increasingly looking for ways to extract wealth from their citizens, whether through high taxes, expropriation, social programs or regulatory measures. The movement of capital only tends to become more and more restricted.

In this era of instability, investment in general is a legal and proven solution for asset protection —and investment in works of art stored in bonded warehouses even more. In this article we would like to take a closer look at the advantages of this strategy and explain why it can be very attractive (and quite smart) for individual investors. Neither art nor bonded warehouses are interesting on their own, but when combined they become an ideal investment for the protection of your wealth.

Why do we like the combination of art and bonded warehouses?

In the past, the use of art as an asset class was often limited to a select group of wealthy collectors and investors. With an impressive collection of over 55,000 works of art by more than 5,000 artists, Deutsche Bank has established a strong presence in the art world. This clearly demonstrates that art investments have found a permanent place in the portfolios of major financial institutions.

There were several reasons why works of art were only available to a selected minority Firstly, the acquisition of works of art often required considerable capital, as high-quality pieces commanded very high prices. Secondly, the art market was less transparent than it is today, and access to it was much more difficult. Information about artists, works and prices was limited and difficult to obtain. This meant that only a few experts and well-connected collectors could identify and acquire profitable works of art.

Moreover, it should be borne in mind that, in the past, the art world was virtually monopolised by traditional galleries and auction houses, which often created an elitist atmosphere. This excluded many potential investors who could be intimidated by this environment. There were also no easy and efficient ways of acquiring and trading in works of art.

However, much has changed in recent years.

At Denationalize.me we have been dealing with issues related to tax optimisation and the protection of your assets, your wealth, and your freedom for years.

The combination of art and tax-free storage is the perfect complement that we offer you today as an alternative, an option, a strategy, and a shield. Not only is it completely legal, but it also offers a host of advantages.

We work with an established partner who offers a comprehensive service: he will take care of advice, handling, purchase, storage, museum exhibition, insurance and sale of the works of art… all in one service.

Bonded warehouses are special facilities recognised by many countries around the world: they are enshrined in international law and subject to certain rules and regulations that allow for the legal safekeeping of goods, including works of art. In a world war, they would probably be the safest places from bombardment, as there is a high probability that several millions in goods of the aggressor side would be stored in such warehouses.

Storing works of art in bonded warehouses offers both security and protection as well as tax advantages, while maintaining anonymity and discretion at all times. Typical bonded warehouses are located in stable jurisdictions such as Switzerland or Singapore.

Today we are going to introduce you to a very interesting option to protect your assets in a very different way to what you are used to.

There are plenty of reasons to invest

The basic idea of asset protection is to diversify your wealth into tangible assets, works of art in this case. This approach offers a unique range of benefits. The world is becoming increasingly interconnected and investors are looking for ways to diversify their assets globally. This is where art comes in, as it is a universal and internationally recognised language.

Art pieces can be easily moved and traded across country borders, allowing for greater diversification and risk sharing, regardless of geopolitical events that may erupt.

One of the main advantages of fine art as an asset protection strategy is its ability to effectively protect such an investment against inflation. In times when paper money is losing value, tangible assets such as art often retain their value, and can even prove to be a very lucrative investment.

Art pieces are timeless and can retain or even increase in value over several generations.

This is an important protection against the loss of purchasing power caused by creeping inflation. Art can be considered a real asset that has historically proven to be an effective hedge against inflation.

According to Goldman Sachs, precious metals, works of art and classic cars can help protect purchasing power when prices of consumer goods and commodities rise rapidly.

Real assets have outperformed a 60/40 portfolio in periods of high inflation.

Real assets have outperformed a 60/40 portfolio in periods of high inflation.

No other investment has proven to be as sustainable in capital appreciation as art. Art appreciation remains remarkably stable, even in economically turbulent circumstances, while conventional investments have at times recorded significant losses.

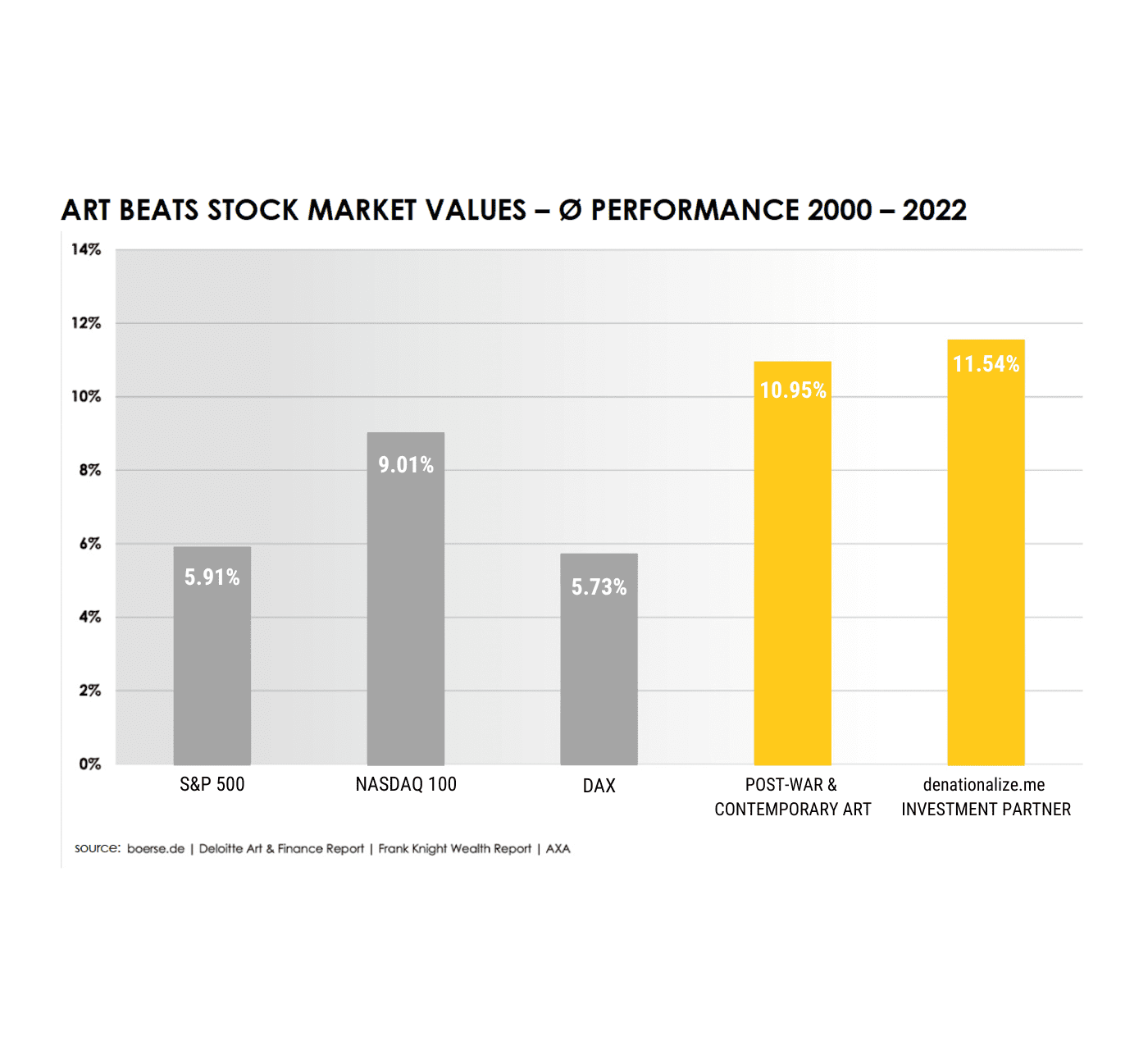

The art market shows impressive growth and has achieved an annual increase in value of over 10.95% for more than 20 years, as documented in the Deloitte Art & Finance Report. Our investment partner has performed even better in his career as an art manager, with an average appreciation of 11.54% since 2000. Our partner even outperforms the stock market!

Art outperforms the stock market: performance between 2000 and 2022

Art outperforms the stock market: performance between 2000 and 2022

Thus, while paper money continues to lose purchasing value, art remains a stable and valuable asset class.

Another significant advantage of art as an asset protection strategy is the discretion and anonymity it offers. In an age where data protection and privacy are increasingly important, investing in art allows wealth to be preserved discreetly.

Owning artwork can keep you out of the public eye, which greatly enhances your privacy and security as an investor.

This is especially relevant today, as many countries are increasingly pushing for asset transparency and doing everything they can to make you a transparent citizen. With art pieces, however, there are no business records or public documentation. Your ownership remains discreet. This advantage leads to another one, which considers tax aspects and which we will elaborate on later.

The anonymity offered by art investment also extends to the buying and selling of works of art (you can pay for the works you wish to acquire with any accepted means of payment) and to the transfer of works of art to others. You can discreetly choose a beneficiary other than yourself without any difficulty.

This way, your investment will remain discreet and safe.

The tax advantages of investing in art can be significant, and should not be underestimated. Works of art, for example, are often considered cultural property and are therefore exempt from inheritance tax in many countries. This makes art pieces a wise choice for estate planning.

The investment can also be of attractive for companies such as LLCs and cooperatives. The purchase of works of art can be declared as an operating expense for tax purposes and can greatly increase the value of your company’s own premises. With the right strategy, you may be able to secure permanent tax exemption too.

The fact that works of art can be stored in a secure bonded warehouse offers additional tax advantages, which is why we have decided to recommend this option to you today.

It is important to bear in mind that this investment in art should always be seen as a medium to long-term investment. We therefore recommend a holding period of at least 10 years, even though the tax advantages can be claimed much earlier. It is a store of value that will outlive crises and keep your wealth safe.

This type of asset protection (which, with the right strategy, can also be exempt from capital gains tax and inheritance tax) is not for short-term savings, but for long-term growth of your wealth.

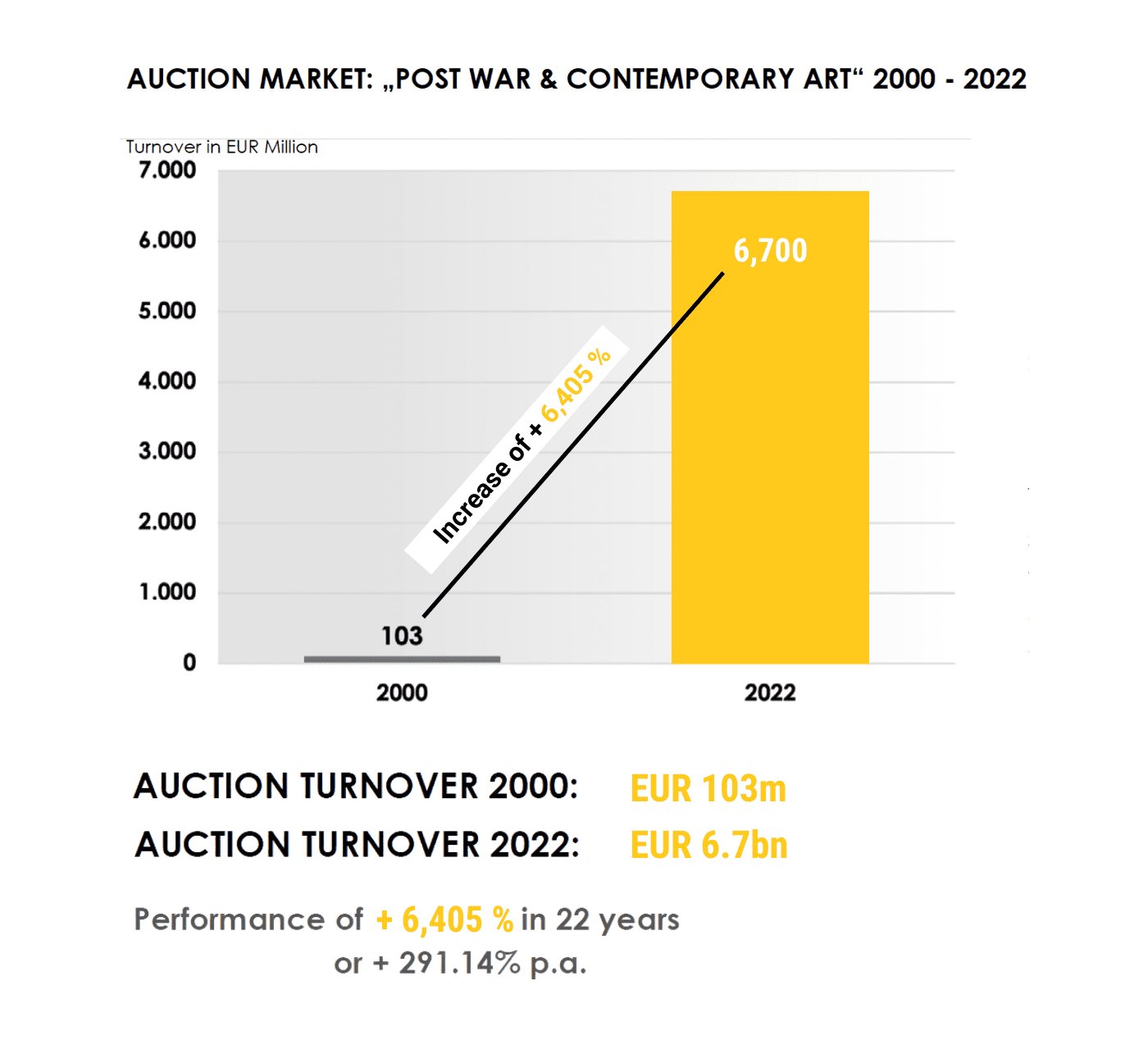

The contemporary art auction market

A particularly striking area of the art market is the ‘post-war and contemporary art’ index, which has experienced the most impressive development in the last 22 years. Here, our partner focuses on contemporary photography, which falls into this category. This market has not only generated historically high returns, but also offers many opportunities due to the growing interest in contemporary art.

There has been an increase of 6,405%. The auction turnover in 2000 was 103 million euros. In 2022 we reached EUR 6.7 billion. That is an increase of 6,405% in 22 years or 291.14% per year.

There has been an increase of 6,405%. The auction turnover in 2000 was 103 million euros. In 2022 we reached EUR 6.7 billion. That is an increase of 6,405% in 22 years or 291.14% per year.

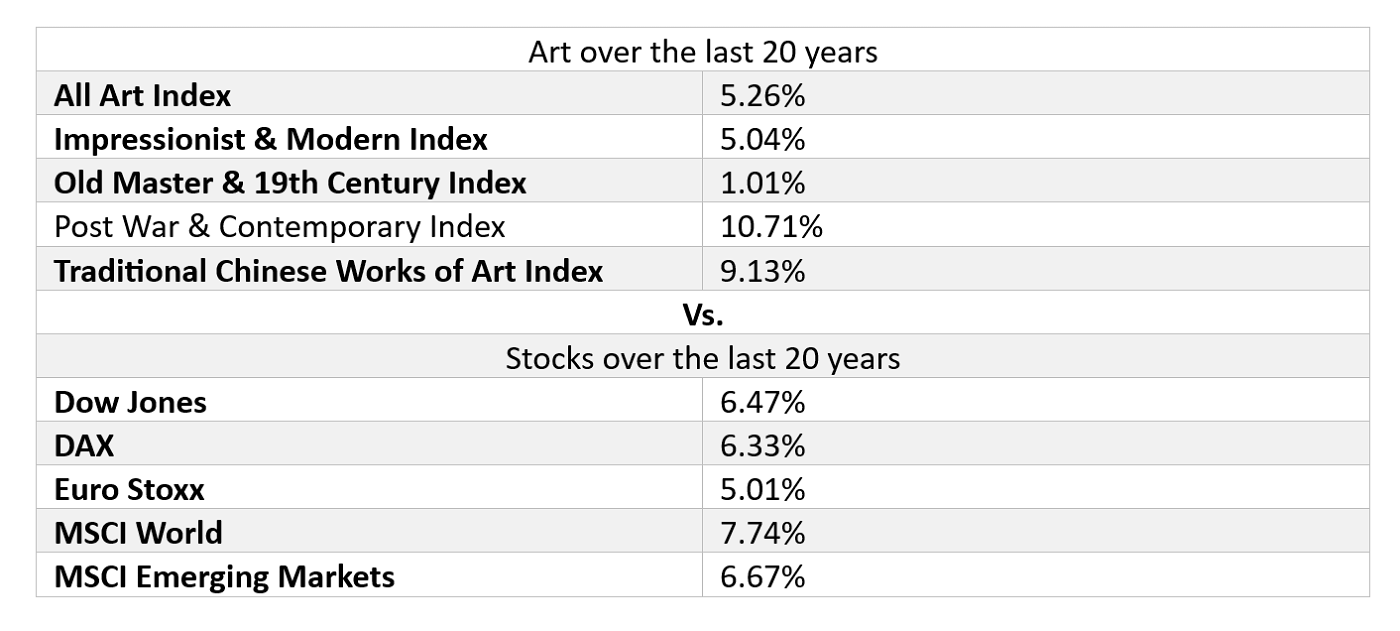

Art compared to shares

Another interesting aspect of the art market, and one that differentiates it from traditional assets such as stocks and bonds, is that art as a commodity shows little or no correlation with the fluctuations of financial markets.

This means that works of art can remain stable even in times of economic turbulence. This lack of correlation provides important diversification and protection for your overall portfolio, which further confirms the premise of this article.

The concerns of a first-time art investor

The concerns of a first-time art investor

One of the most widespread prejudices against art investments is the assumption that you need a considerable fortune to enter the art market. This is nothing more than a widespread false belief: even with a comparatively small capital of EUR 20,000 you can invest in art with our partner and diversify your portfolio to minimise the risk of devaluation.

Moreover, the offer is completely transparent, as the costs are much lower compared to other asset classes.

Another prejudice that can stop people from investing in art is the idea that you need to be an art expert to be successful, as well as the perception that investing in art is risky. The truth is that neither should alarm you, and here is why – and how to avoid it. After all, risk always comes from the unknown, and not necessarily from the uncertain:

- Rather than investing in one-off pieces, it is better to opt for editions that are released in limited numbers. The advantage of this investment lies in the fact that these pieces create international price comparability and the market remains transparent. The market value can be determined at any time, which is not the case with unique pieces.

- The insurance is based on the replacement value of the works of art and is subject to regular market checks, so the market value is always determined.

- The aim is to trade in works by established and internationally recognised artists. This reinforces the independence from a specific location/country/currency, which contributes to diversification and minimisation of risk.

- The choice is yours: you can decide whether your art portfolios are professionally stored and insured in a bonded warehouse or whether the artworks are delivered to your door. You can choose between highly professional bonded warehouses in Switzerland, Singapore, the United States or South America (if you wish to diversify your investment regionally).

In short, here are the main advantages and characteristics of investing in works of art:

- Capital protection

- No correlation with the markets

- Currency independence

- Tax advantages

- Affordable entry into the art market

- Medium to long term investment

- Established artists

- Anonymity in the bonded warehouses

- Inheritance tax exemption

- Insurance based on replacement value

- Transparent costs

- Possibility to use any accepted payment method

- Preferably limited editions rather than one-offs

Do not forget to take a look at the portfolio

Photograph: August Sander: Three Young Peasants, 1914, August Sander© Photographic Collection/ Sk Stiftung Kultur – August Sander Archive

Photograph: August Sander: Three Young Peasants, 1914, August Sander© Photographic Collection/ Sk Stiftung Kultur – August Sander Archive

Price in 2006: EUR 3,600

Price in 2022: EUR 11,000

Increase in value: EUR 7,400

Annual percentage increase +12.01%.

Photograph: William Klein: Impala & Gas, NYC 1959, William Klein ©

Photograph: William Klein: Impala & Gas, NYC 1959, William Klein ©

Price in 2018: EUR 15,000

Price in 2022: EUR 30,000

Increase in value: EUR 15,000

Annual percentage increase + 20.0%.

Photograph: Vivian Maier: January 9, Florida, 1957, Vivian Maier © Vivian Maier Estate

Photograph: Vivian Maier: January 9, Florida, 1957, Vivian Maier © Vivian Maier Estate

Price in 2010: EUR 2,650

Price in 2022: EUR 17,500

Increase in value: EUR 14,850

Annual percentage increase + 46.69%.

Invest in art

If you are looking for the perfect balance between security and the opportunity to make a return on your wealth, investing in art with our partners is the perfect solution: we offer you the highest level of discretion and professionalism with this unique wealth protection solution. Our team will personally accompany you in this investment and help you get started with as little as EUR 20,000. Of course, you can also start your investment with any other amount above EUR 20,000!

In an increasingly complex world where traditional asset protection strategies seem to be losing their effectiveness, investing in art offers a smart and sustainable way to protect and grow your wealth. Forget about precious metals: the gold ban is on the horizon… but not the artwork ban!

This solution meets many of the requirements we consider essential, such as anonymity, tax exemption in most countries with the right strategy, protection against inflation and a lucrative long-term return.

Even when it comes to selling your art pieces, you have several options: the sale can generally be handled in 5 ways, depending on how much effort you want to put into it. Our partners will be happy to assist you in this process so that you can sell your art without any worries. You decide which path to take!

Be part of this unique asset protection solution and define your financial future.

Do you want to stop worrying about how to effectively protect your wealth and look for a solid and reliable solution? Do not let the looming tax hikes, today’s rising inflation, unstable financial markets, and the imminent loss of family wealth keep you awake at night: join our partners in the exciting world of art and secure your wealth with this smart and proven investment. Exchange your sleepless nights for works of art that increase in value year after year.

If you are interested in this kind of investment, here you can find more information about the service. And, of course, if you need advice on how to live a freer life and possibly stop paying tax on your investment returns, or how to better protect your wealth, you may be interested in our consultancy service.

Did you like our blog article?

Support us by purchasing our products and services. Or build up a passive income by recommending us as an affiliate! And don’t forget to check out Christoph’s travel blog christoph.today!

Secret Knowledge Video Course

Learn Everything that You Need to Know for a Life as a Perpetual Traveler

Watch Video CourseEncyclopedia Collection

Acquire Expansive Knowledge about Banking, Companies, Citizenships, and Emigration.

Order eBooks

The concerns of a first-time art investor

The concerns of a first-time art investor