Diversify Your Wealth

Did You Know that Art Can Be a Highly Effective Strategy for Asset Protection and Capital Preservation?

In a turbulent world where governments are increasingly looking for ways to access your wealth – whether through taxes, expropriation, social programs or regulatory measures – and where loss of purchasing power due to inflation is threatened by money printing, investing in artwork stored in a bonded warehouse is a legal and proven solution to protect your assets.

Diversify Your Wealth

Because Security Also Equals Returns!

Did You Know that Art Can Be a Highly Effective Strategy for Asset Protection and Capital Preservation?

In a turbulent world where governments are increasingly looking for ways to access your wealth – whether through taxes, expropriation, social programs or regulatory measures – and where loss of purchasing power due to inflation is threatened by money printing, investing in artwork stored in a bonded warehouse is a legal and proven solution to protect your assets.

Now Available for Private Investors

The Advantage of Tangible Assets

This option is not only for trusts, foundations, or offshore companies, but also for individual investors who want to keep their assets safe and discreet as they face challenges within our uncertain times.

Why is this so important? Because tangible assets such as art offer a unique range of benefits that are invaluable in times of economic uncertainty and volatile financial markets. An outstanding example of this is Deutsche Bank, which has invested in over 55,000 pieces of art by over 5,000 artists.

Now Available for Private Investors

The Advantage of Tangible Assets

This option is not only for trusts, foundations, or offshore companies, but also for individual investors who want to keep their assets safe and discreet as they face challenges within our uncertain times.

Why is this so important? Because tangible assets such as art offer a unique range of benefits that are invaluable in times of economic uncertainty and volatile financial markets. An outstanding example of this is Deutsche Bank, which has invested in over 55000 pieces of art by over 5000 artists.

Timeless

Hedge Across Generations

First, works of art provide an effective safeguard against inflation. While monetary assets can lose value, tangible assets often retain their value and can even prove to be an inflation-proof investment. Works of art are timeless and can retain or increase their value over generations.

Photo: Impala & Gas, NYC 1959, William Klein ©William Klein

Value 2018 EUR: 15,000

Value 2022 EUR: 30,000

Appreciation EUR: 15,000

Ø ANNUALLY + 20.0 %

Timeless

Hedge Across Generations

First, works of art provide an effective safeguard against inflation. While monetary assets can lose value, tangible assets often retain their value and can even prove to be an inflation-proof investment. Works of art are timeless and can retain or increase their value over generations.

Photo: Impala & Gas, NYC 1959, William Klein ©William Klein

Value 2018 EUR: 15,000

Value 2022 EUR: 30,000

Appreciation EUR: 15,000

Ø ANNUALLY + 20.0 %

Data Protected

Discrete and Anonymous

Second, they provide much-needed anonymity. Especially in an era where data protection and privacy are becoming increasingly important, tangible assets such as art allow for discreet wealth preservation. Their ownership can be kept out of the public eye, which assures your privacy and security.

Data Protected

Discrete and Anonymous

Second, they provide much-needed anonymity. Especially in an era where data protection and privacy are becoming increasingly important, tangible assets such as art allow for discreet wealth preservation. Their ownership can be kept out of the public eye, which assures your privacy and security.

Art Photography

A Tangible Asset Understood By Everyone

Third, tangible assets cross international borders. Art is a universal language and internationally recognized. It can easily be moved and traded across national borders. This enables broader diversification and risk spreading, independent of geopolitical developments, currencies, and locations.

Photo: Vivian Maier: January 9, Florida, 1957, Vivian Maier © Vivian Maier Estate

Value 2010 EUR: 2,650

Value 2022 EUR: 17,500

Appreciation EUR: 14,850

Ø ANNUALLY + 46.69 %

Art Photography

A Tangible Asset Understood By Everyone

Third, tangible assets cross international borders. Art is a universal language and internationally recognized. It can easily be moved and traded across national borders. This enables broader diversification and risk spreading, independent of geopolitical developments, currencies, and locations.

Photo: Vivian Maier: January 9, Florida, 1957, Vivian Maier © Vivian Maier Estate

Value 2010 EUR: 2,650

Value 2022 EUR: 17,500

Appreciation EUR: 14,850

Ø ANNUALLY + 46.69 %

Wealth Planning

Wealth Planning with Tax Advantages

Fourth, tangible assets offer tax advantages. In many countries, investments in works of art can offer tax benefits, including inheritance tax exemption or reduced capital gains taxes. This makes tangible assets a wise choice for long-term wealth planning.

Wealth Planning

Wealth Planning with Tax Advantages

Fourth, tangible assets offer tax advantages. In many countries, investments in works of art can offer tax benefits, including inheritance tax exemption or reduced capital gains taxes. This makes tangible assets a wise choice for long-term wealth planning.

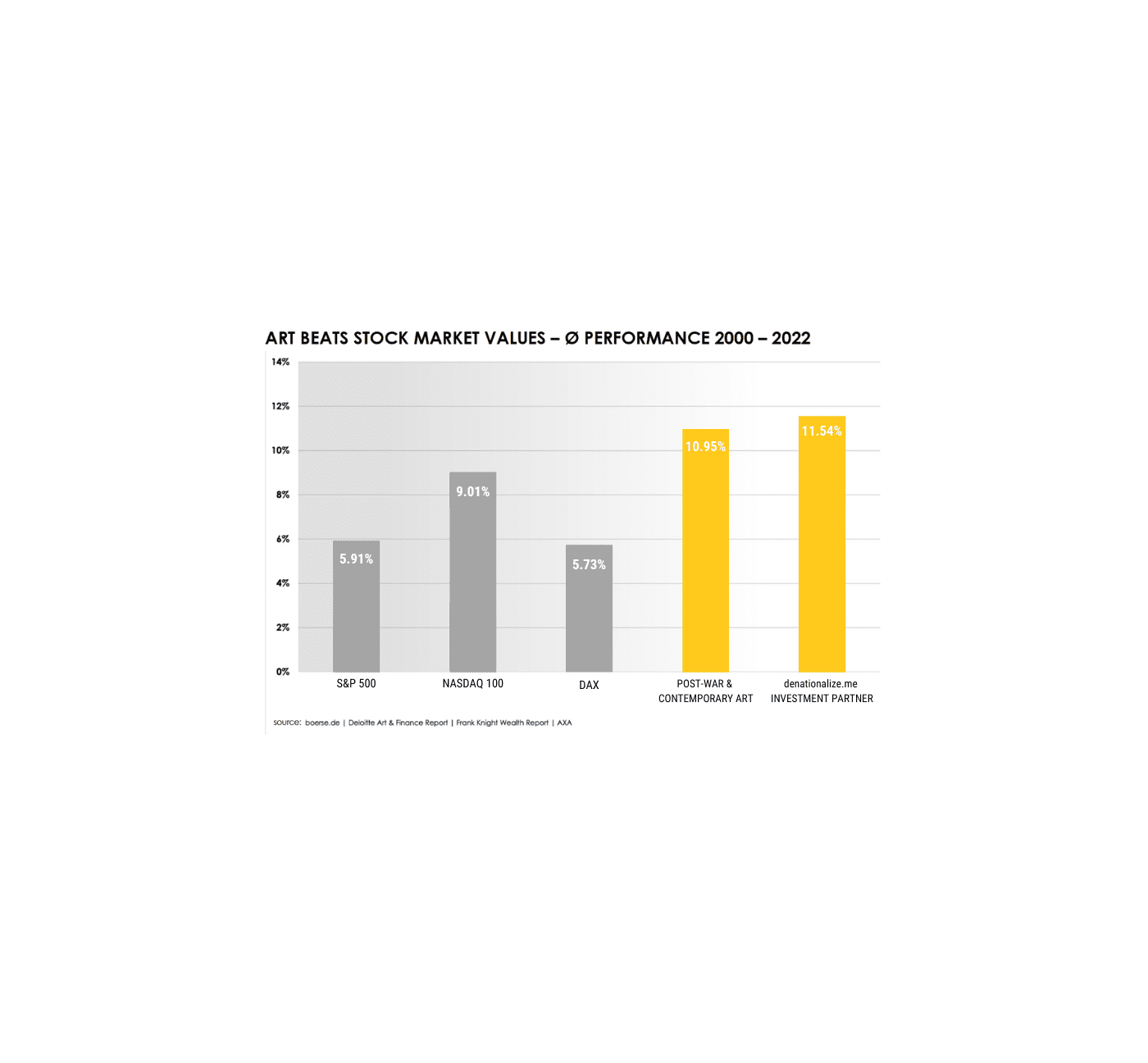

Average Performance 2000 - 2022

Art Outperforms the Stock Market

No other investment has proven to be as sustainable in capital appreciation as art. The appreciation of artworks remains remarkably stable, even in times of economic turmoil, when conventional investments can record significant losses.

The art market has shown impressive growth, achieving an annual appreciation of over 10.95% for over 20 years, as documented in the Deloitte Art&Finance Report. Our partner has achieved even better results in its art management, with an average appreciation of 11.54% since 2000.

Average Performance 2000 - 2022

Art Outperforms the Stock Market

No other investment has proven to be as sustainable in capital appreciation as art. The appreciation of artworks remains remarkably stable, even in times of economic turmoil, when conventional investments can record significant losses.

The art market has shown impressive growth, achieving an annual appreciation of over 10.95% for over 20 years, as documented in the Deloitte Art&Finance Report. Our partner has achieved even better results in its art management, with an average appreciation of 11.54% since 2000.

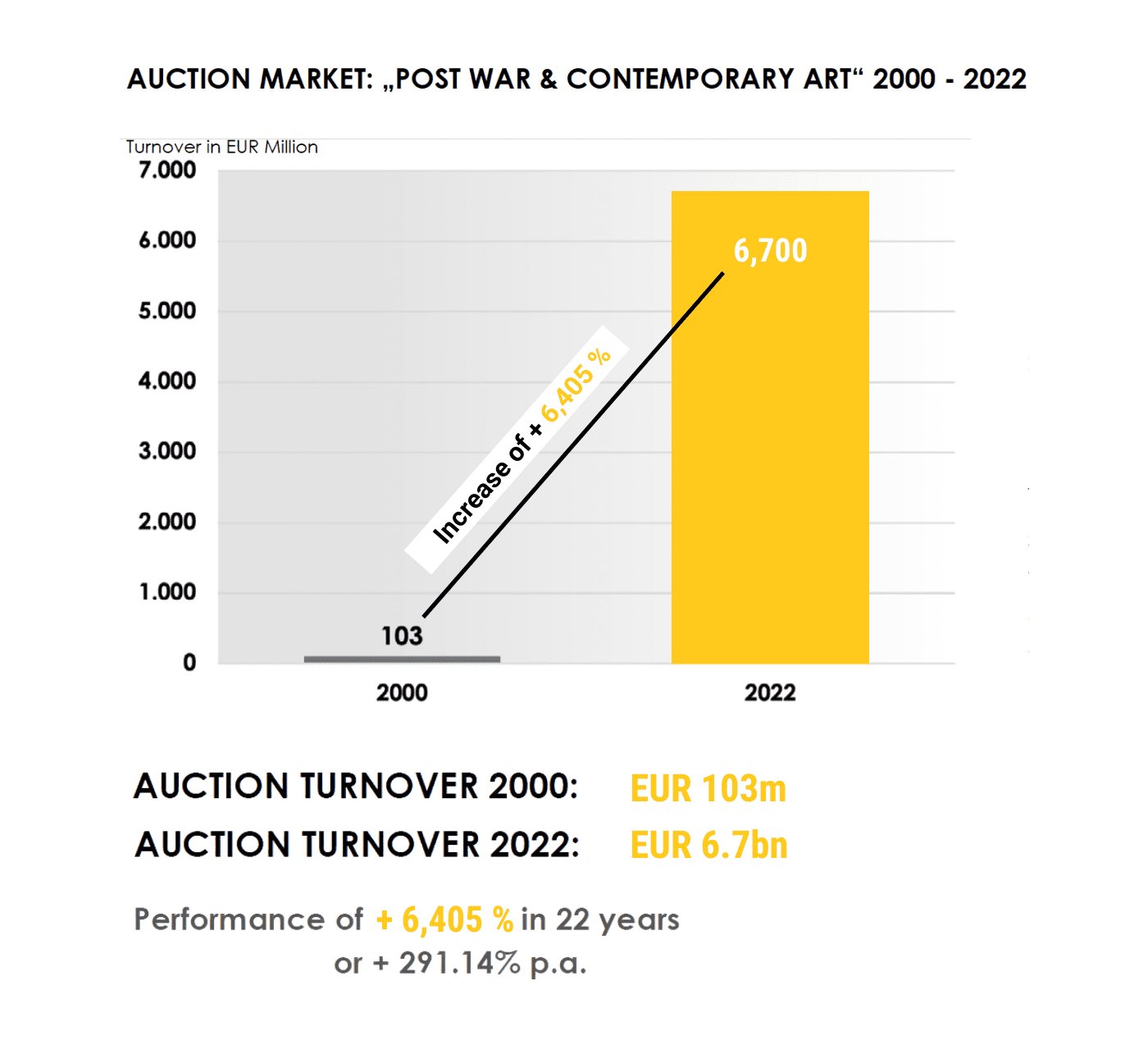

Development From 2000 - 2022

Auction Market for Contemporary Art

The index for “post-war and contemporary art” recorded the most impressive development in the last 22 years.

Our partner focuses on contemporary photography, which falls into the category of “post-war and contemporary art”.

Development From 2000 - 2022

Auction Market for Contemporary Art

The index for “post-war and contemporary art” recorded the most impressive development in the last 22 years.

Our partner focuses on contemporary photography, which falls into the category of “post-war and contemporary art”.

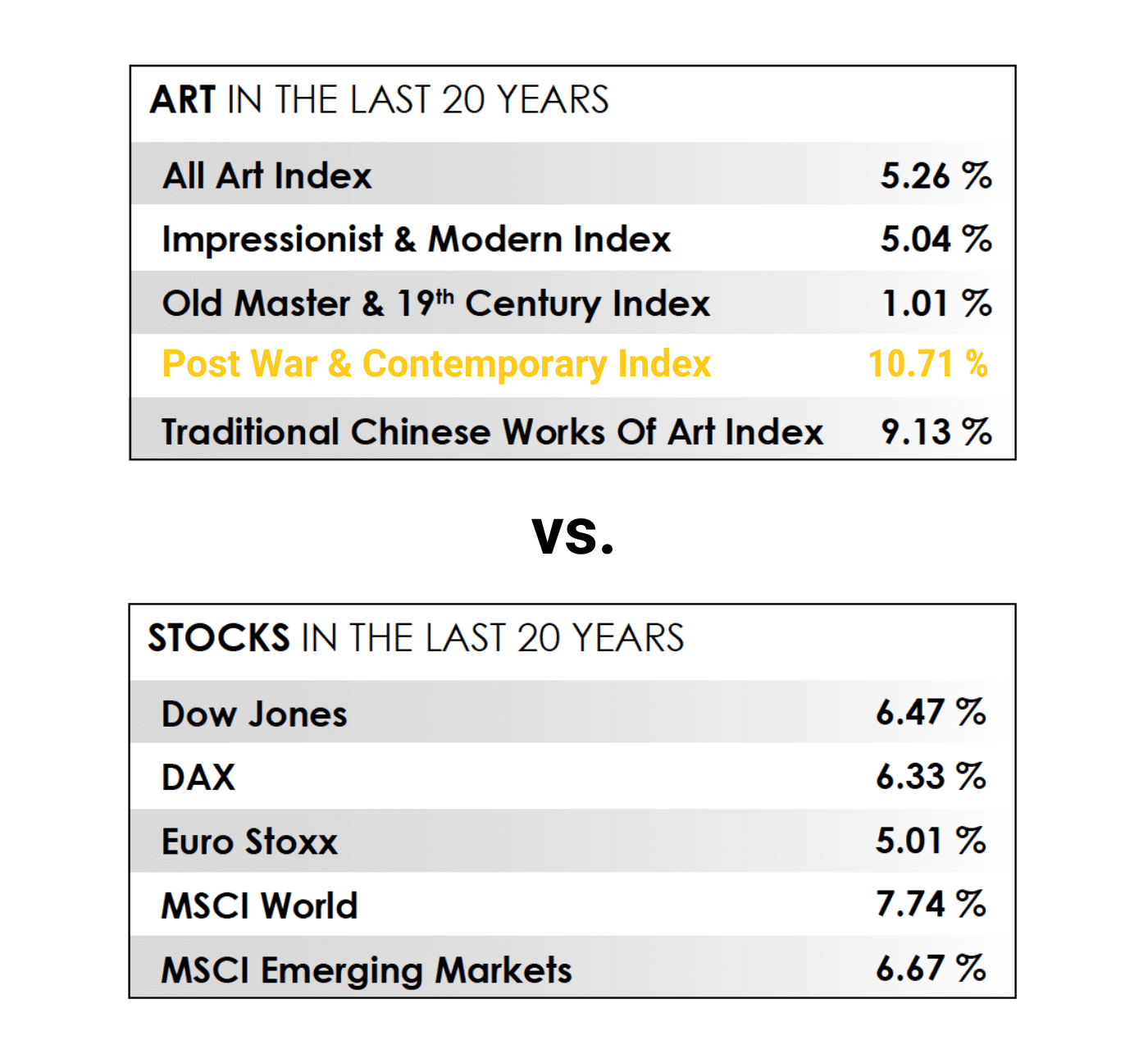

Development From 2000 - 2022

Art in Direct Comparison to the Stock Market

The art market has experienced an extremely positive development in recent decades and enjoys a reputation of being stable and successful. Unlike other financial markets, it shows only minor fluctuations. Art maintains its value over the centuries despite armed conflicts and economic crises.

Development From 2000 - 2022

Art in Direct Comparison to the Stock Market

The art market has experienced an extremely positive development in recent decades and enjoys a reputation of being stable and successful. Unlike other financial markets, it shows only minor fluctuations. Art maintains its value over the centuries despite armed conflicts and economic crises.

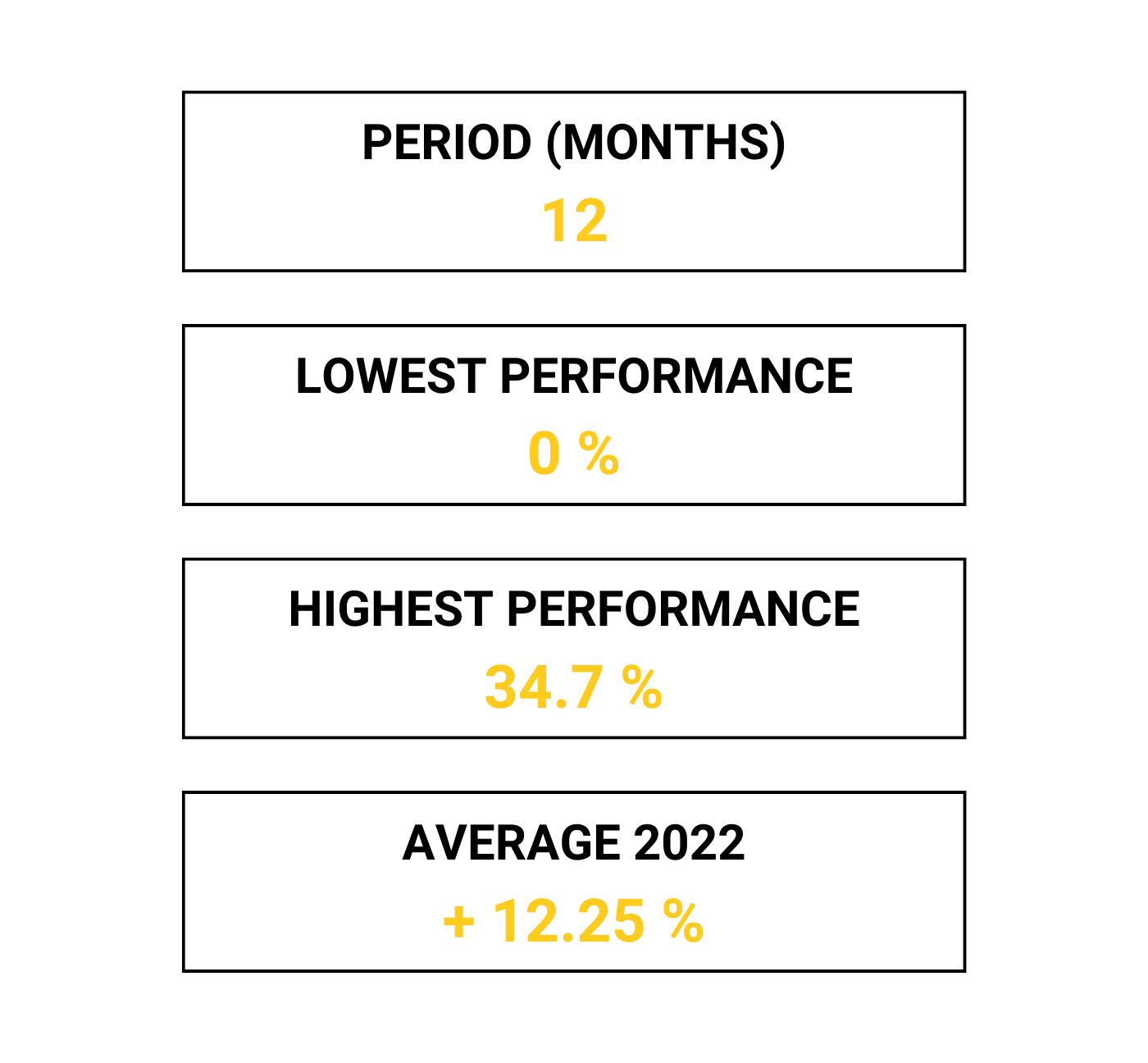

Appreciation 2022

Appreciation of the Art Portfolio in 2022

In 2022 no customer portfolio was below the previous year’s value. All assets were thus successfully secured & increased. This underlines the successful strategy of optimally preserving and growing assets, wealth and capital through Art.

Appreciation 2022

Appreciation of the Art Portfolio in 2022

In 2022 no customer portfolio was below the previous year’s value. All assets were thus successfully secured & increased. This underlines the successful strategy of optimally preserving and growing assets, wealth and capital through Art.

Grow Your Capital

Financially Convincing Art

Investing in artwork is an extremely sound investment strategy that offers many compelling reasons:

Grow Your Capital

Financially Convincing Art

Investing in artwork is an extremely sound investment strategy that offers many compelling reasons:

Invest with denationalize.me

The Perfect Balance for Your Assets

Together with our established partner, denationalize.me offers this unique service to our community with the highest levels of discretion and professionalism. This solution meets many requirements, including anonymity, tax-free with the proper strategic approach, inflation protection, strong appreciation, and a secure long-term investment that protects your wealth over generations.

The very best part is that all new and old payment methods are accepted.

This way, you create the perfect balance between security and income opportunities for your assets.

Photo: August Sander: Three Young Farmers, 1914, August Sander © The Photographic Collection / Sk Stiftung Kultur – August Sander Archive

Value 2006 EUR: 3,600

Value 2022 EUR: 11,000

Appreciation EUR: 7,400

Ø ANNUALLY + 12.01 %

Invest with denationalize.me

The Perfect Balance for Your Assets

Together with our established partner, denationalize.me offers this unique service to our community with the highest levels of discretion and professionalism. This solution meets many requirements, including anonymity, tax-free with the proper strategic approach, inflation protection, strong appreciation, and a secure long-term investment that protects your wealth over generations.

The very best part is that all new and old payment methods are accepted.

This way, you create the perfect balance between security and income opportunities for your assets.

Photo: August Sander: Three Young Farmers, 1914, August Sander © The Photographic Collection / Sk Stiftung Kultur – August Sander Archive

Value 2006 EUR: 3,600

Value 2022 EUR: 11,000

Appreciation EUR: 7,400

Ø ANNUALLY + 12.01 %

Known from: