Freedom with No Boundaries

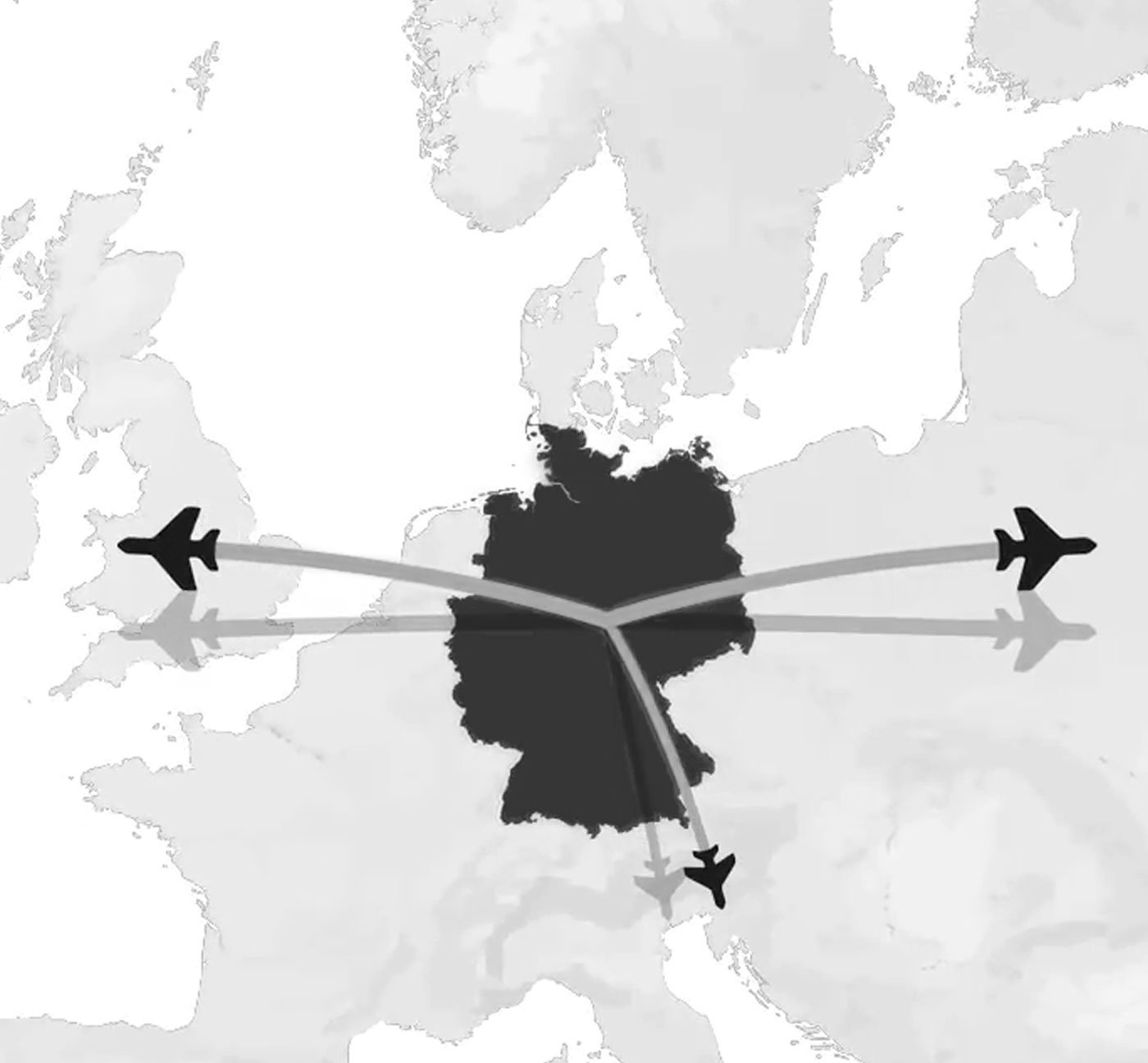

For people in the DACH area (Germany, Austria, and Switzerland) the concept of the perpetual traveler revolves around one decisive act: deregistering at the citizens’ office. It stands for the conscious step of distancing oneself from established norms and social expectations and marks the zenith of personal freedom.

Being denationalized or stateless embodies pure self-determination, living a life according to one’s own standards and preferences. It is about crossing borders and living a life that is truly yours. This opens the door to navigating and using different systems flexibly according to your own ideas, needs and preferences.

Freedom with No Boundaries

Deregistration as the Gateway to Freedom

For people in the DACH area (Germany, Austria, and Switzerland) the concept of the perpetual traveler revolves around one decisive act: deregistering at the citizens’ office. It stands for the conscious step of distancing oneself from established norms and social expectations and marks the zenith of personal freedom.

Being denationalized or stateless embodies pure self-determination, living a life according to one’s own standards and preferences. It is about crossing borders and living a life that is truly yours. This opens the door to navigating and using different systems flexibly according to your own ideas, needs and preferences.

Key Steps

What Do You Really Need?

With the right preparation, deregistration and the transition to perpetual traveler* can be completed in just a few days. These basic steps require less extensive planning and more focused organization:

- Small savings to even begin thinking about creating a location-independent income

- Terminations: Apartment, job and all non-essential contracts and memberships

- Sale of possessions to increase liquidity

- Compliance setup (bank accounts, companies, necessary documents, mobile plan)

- International insurances

- An immense thirst for discovery to enjoy freedom

*Assuming you don’t want to directly immigrate to another country.

Key Steps

What Do You Really Need?

With the right preparation, deregistration and the transition to perpetual traveler* can be completed in just a few days. These basic steps require less extensive planning and more focused organization:

- Small savings to even begin thinking about creating a location-independent income

- Terminations: Apartment, job and all non-essential contracts and memberships

- Sale of possessions to increase liquidity

- Compliance setup (bank accounts, companies, necessary documents, mobile plan)

- International insurances

- An immense thirst for discovery to enjoy freedom

*Assuming you don’t want to directly immigrate to another country.

Just Be Careful and Everything Will Be Fine

Center of Vital Interest

The expectation is that leaving one system will lead to entering the system of another country. However, since the invention of the internet at the latest, the concept of having no residency – denationalize.me refers to this as perpetual traveling – has become a unique alternative. After all, it is better to live as a permanent tourist than as a subject.

However, in order to take advantage of the numerous benefits – such as tax exemption and no social security obligations – deregistration is a necessary step, but not the only step.

It is much more important to avoid a center of vital interest- not only in your home country, but in all other countries around the world that you visit. At least as long as you don’t want to settle anywhere. Or if your new center of vital interest would have no negative consequences due to it being in a tax-free country.

Just Be Careful and Everything Will Be Fine

Center of Vital Interest

The expectation is that leaving one system will lead to entering the system of another country. However, since the invention of the internet at the latest, the concept of having no residency – denationalize.me refers to this as perpetual traveling – has become a unique alternative. After all, it is better to live as a permanent tourist than as a subject.

However, in order to take advantage of the numerous benefits – such as tax exemption and no social security obligations – deregistration is a necessary step, but not the only step.

It is much more important to avoid a center of vital interest- not only in your home country, but in all other countries around the world that you visit. At least as long as you don’t want to settle anywhere. Or if your new center of vital interest would have no negative consequences due to it being in a tax-free country.

Medium- to Long Term Solution

Compliance-Setup

In our daily work, we deal intensively with a central challenge that many emigrants, perpetual travelers, people without a permanent residence and digital nomads share: Requesting a new utility bill and tax number after officially deregistering.

Why is this step so important? Quite simply, you can’t live completely detached from all systems. It may well be possible to take advantage of tax benefits, but some bureaucratic hurdles and official requirements remain. Sooner or later, you will be asked where your actual place of residency is – be it for banking transactions or even to apply for a new passport, without which you would be truly lost.

We know what you need and how to help you with compliance issues.

Medium- to Long Term Solution

Compliance-Setup

In our daily work, we deal intensively with a central challenge that many emigrants, perpetual travelers, people without a permanent residence and digital nomads share: Requesting a new utility bill and tax number after officially deregistering.

Why is this step so important? Quite simply, you can’t live completely detached from all systems. It may well be possible to take advantage of tax benefits, but some bureaucratic hurdles and official requirements remain. Sooner or later, you will be asked where your actual place of residency is – be it for banking transactions or even to apply for a new passport, without which you would be truly lost.

We know what you need and how to help you with compliance issues.

For example, a distinction should be made between a positive and a negative center of vital interest. Those who have the possibility of providing a positive center of vital interest have greater legal security than those who cannot. This is the 183-day rule, but it is not just relevant in this case.

Know the Difference:

Known From:

Avoidance Regulations

Pitfalls for Entrepreneurs

Avoidance rules are highly relevant for entrepreneurs in Germany (and fortunately not so relevant for most other countries) in order to prevent unintended tax consequences. In the event of a location change, the exit tax can treat an entrepreneur’s shares as if they had been sold. In the case of sole traders, the unbundling rule can be applied if intangible assets are involved. In addition, one may be confronted with extended limited tax liability, which applies to domestic profits for up to 10 years – this is not to be confused with general limited tax liability, which is aimed at certain income, e.g. rental income, salaries.

The overlapping taxation, especially within the framework of the double taxation agreement with Switzerland, can have further pitfalls in store. And tax aspects should be taken into account when relocating functions, where parts of the company are moved abroad.

However, it is possible to avoid these pitfalls with the right planning and advice. denationalize.me can provide valuable support in this regard.

Avoidance Regulations

Pitfalls for Entrepreneurs

Avoidance rules are highly relevant for entrepreneurs in Germany (and fortunately not so relevant for most other countries) in order to prevent unintended tax consequences. In the event of a location change, the exit tax can treat an entrepreneur’s shares as if they had been sold. In the case of sole traders, the unbundling rule can be applied if intangible assets are involved. In addition, one may be confronted with extended limited tax liability, which applies to domestic profits for up to 10 years – this is not to be confused with general limited tax liability, which is aimed at certain income, e.g. rental income, salaries.

The overlapping taxation, especially within the framework of the double taxation agreement with Switzerland, can have further pitfalls in store. And tax aspects should be taken into account when relocating functions, where parts of the company are moved abroad.

However, it is possible to avoid these pitfalls with the right planning and advice. denationalize.me can provide valuable support in this regard.

If You Do It Right, They Have Nothing On You

Don’t Fear the Tax Office

However, those who take this step are often confronted with inquiries from the tax office, which wants to check the tax obligations of emigrants by means of specific questionnaires. These questions mainly concern the place of residence, existing assets and other tax-relevant details. The aim is to clarify which tax obligations and commitments still exist in Germany.

Although there are important avoidance rules such as exit taxation and transfer of functions, these laws also offer their own “loopholes”. You have a certain amount of leeway when answering the questions and should be careful not to fall into any traps – and with us you can overcome these bureaucratic hurdles with ease.

If You Do It Right, They Have Nothing On You

Don’t Fear the Tax Office

However, those who take this step are often confronted with inquiries from the tax office, which wants to check the tax obligations of emigrants by means of specific questionnaires. These questions mainly concern the place of residence, existing assets and other tax-relevant details. The aim is to clarify which tax obligations and commitments still exist in Germany.

Although there are important avoidance rules such as exit taxation and transfer of functions, these laws also offer their own “loopholes”. You have a certain amount of leeway when answering the questions and should be careful not to fall into any traps – and with us you can overcome these bureaucratic hurdles with ease.

The Wildcard in the World of Perpetual Travel

The PT Package

Compared to other popular setups, such as Cyprus or Dubai, the PT package offers a more economical solution with less bureaucracy and hassle. It is particularly attractive for those who don’t necessarily want to live in a country, but still want to enjoy the benefits of a residency permit and tax advantages.

This removes the main barriers to compliance:

- US LLC: This is the operational component of the setup. The LLC (Limited Liability Company) is particularly suitable for online entrepreneurs, service providers and e-commerce platforms. denationalize.me helps you choose the right US state for the incorporation of the LLC.

- Nevis Holding: Optional, but recommended for better asset protection. Nevis is described as a safe and reliable tax haven where it is extremely difficult to seize assets.

- Residency Permit in Paraguay: denationalize.me offers assistance in obtaining a temporary residency permit in Paraguay, a country with no minimum residency requirements and a simple immigration process.

Tax number and Certificate of residency in Paraguay: Another optional component, but one that facilitates tax compliance in many jurisdictions.

The Wildcard in the World of Perpetual Travel

The PT Package

Compared to other popular setups, such as Cyprus or Dubai, the PT package offers a more economical solution with less bureaucracy and hassle. It is particularly attractive for those who don’t necessarily want to live in a country, but still want to enjoy the benefits of a residency permit and tax advantages.

This removes the main barriers to compliance:

- US LLC: This is the operational component of the setup. The LLC (Limited Liability Company) is particularly suitable for online entrepreneurs, service providers and e-commerce platforms. denationalize.me helps you choose the right US state for the incorporation of the LLC.

- Nevis Holding: Optional, but recommended for better asset protection. Nevis is described as a safe and reliable tax haven where it is extremely difficult to seize assets.

- Residency Permit in Paraguay: denationalize.me offers assistance in obtaining a temporary residency permit in Paraguay, a country with no minimum residency requirements and a simple immigration process.

Tax number and Certificate of residency in Paraguay: Another optional component, but one that facilitates tax compliance in many jurisdictions.

Cooperation

Deregistration.de

Our partners at Deregistration.de are experienced supporters for complex bureaucratic issues in Germany. With over eight years of expertise, they offer a holistic solution from preparation to deregistration. Deregistration.de has already successfully deregistered over 30,000 people and enables digital deregistration throughout Germany. Various service packages facilitate the completion of tasks such as deregistration of residence, GEZ termination and contract terminations in a digital and uncomplicated way. The experienced team of experts at Deregistration.de knows the pitfalls of German bureaucracy and lends a helping hand to support you with your emigration plans.

Cooperation

Deregistration.de

Our partners at Deregistration.de are experienced supporters for complex bureaucratic issues in Germany. With over eight years of expertise, they offer a holistic solution from preparation to deregistration. Deregistration.de has already successfully deregistered over 30,000 people and enables digital deregistration throughout Germany. Various service packages facilitate the completion of tasks such as deregistration of residence, GEZ termination and contract terminations in a digital and uncomplicated way. The experienced team of experts at Deregistration.de knows the pitfalls of German bureaucracy and lends a helping hand to support you with your emigration plans.

Stay Up To Date

Thematically Relevant Blog Articles

We are always one step ahead. This is the only way we can develop pragmatic and targeted solutions for you. To ensure that you always stay ahead of the curve, you can find the most important news, trends and developments on our blog.

Here you will find a list of the relevant blog articles on the topic of deregistration. Written by experts with years of experience in the industry. Prepared in such a way that you easily get the information that is relevant to you.

Stay Up To Date

Thematically Relevant Blog Articles

We are always one step ahead. This is the only way we can develop pragmatic and targeted solutions for you. To ensure that you always stay ahead of the curve, you can find the most important news, trends and developments on our blog.

Here you will find a list of the relevant blog articles on the topic of deregistration. Written by experts with years of experience in the industry. Prepared in such a way that you easily get the information that is relevant to you.

Videos

Inform Yourself on YouTube

We regularly provide information on various topics on YouTube. You can also find videos on deregistration that will provide you with valuable knowledge. Take a look at our channel!

Videos

Inform Yourself on YouTube

We regularly provide information on various topics on YouTube. You can also find videos on deregistration that will provide you with valuable knowledge. Take a look at our channel!