International Company Setup

If you are considering tax optimization opportunities within the European system, you don’t have to look only at models like the US LLC. As a leader in the structuring and management of US LLCs in the European market, we are fully aware of the attractiveness and advantages of a tax-free environment as offered by an LLC.

We strive to offer entrepreneurs the opportunity to operate in a tax-optimized setting as a perpetual traveler, even in those cases where a US LLC might not be the most attractive option.

International Company Setup

An Alternative to the Popular US LLC

If you are considering tax optimization opportunities within the European system, you don’t have to look only at models like the US LLC. As a leader in the structuring and management of US LLCs in the European market, we are fully aware of the attractiveness and advantages of a tax-free environment as offered by an LLC.

We strive to offer entrepreneurs the opportunity to operate in a tax-optimized setting as a perpetual traveler, even in those cases where a US LLC might not be the most attractive option.

Optimal Tax Solutions

The Limited Partnership (LP) in Cyprus

In this context, we have thoroughly studied European alternatives and identified a solution that could be particularly relevant for this target group: the Limited Partnership (LP) in Cyprus. This legal form is recognized as a tax-transparent company in Cyprus and may be a more advantageous choice than a US LLC in certain situations.

While the US LLC has its own advantages, in some cases it can bring increased tax and legal complexity. In such scenarios, the formation of a Cyprus LP may be considered less complex yet still tax advantageous. In certain constellations, the Cyprus Limited Partnership might be a great alternative to the US LLC.

Optimal Tax Solutions

The Limited Partnership (LP) in Cyprus

In this context, we have thoroughly studied European alternatives and identified a solution that could be particularly relevant for this target group: the Limited Partnership (LP) in Cyprus. This legal form is recognized as a tax-transparent company in Cyprus and may be a more advantageous choice than a US LLC in certain situations.

While the US LLC has its own advantages, in some cases it can bring increased tax and legal complexity. In such scenarios, the formation of a Cyprus LP may be considered less complex yet still tax advantageous. In certain constellations, the Cyprus Limited Partnership might be a great alternative to the US LLC.

Different Possibilities

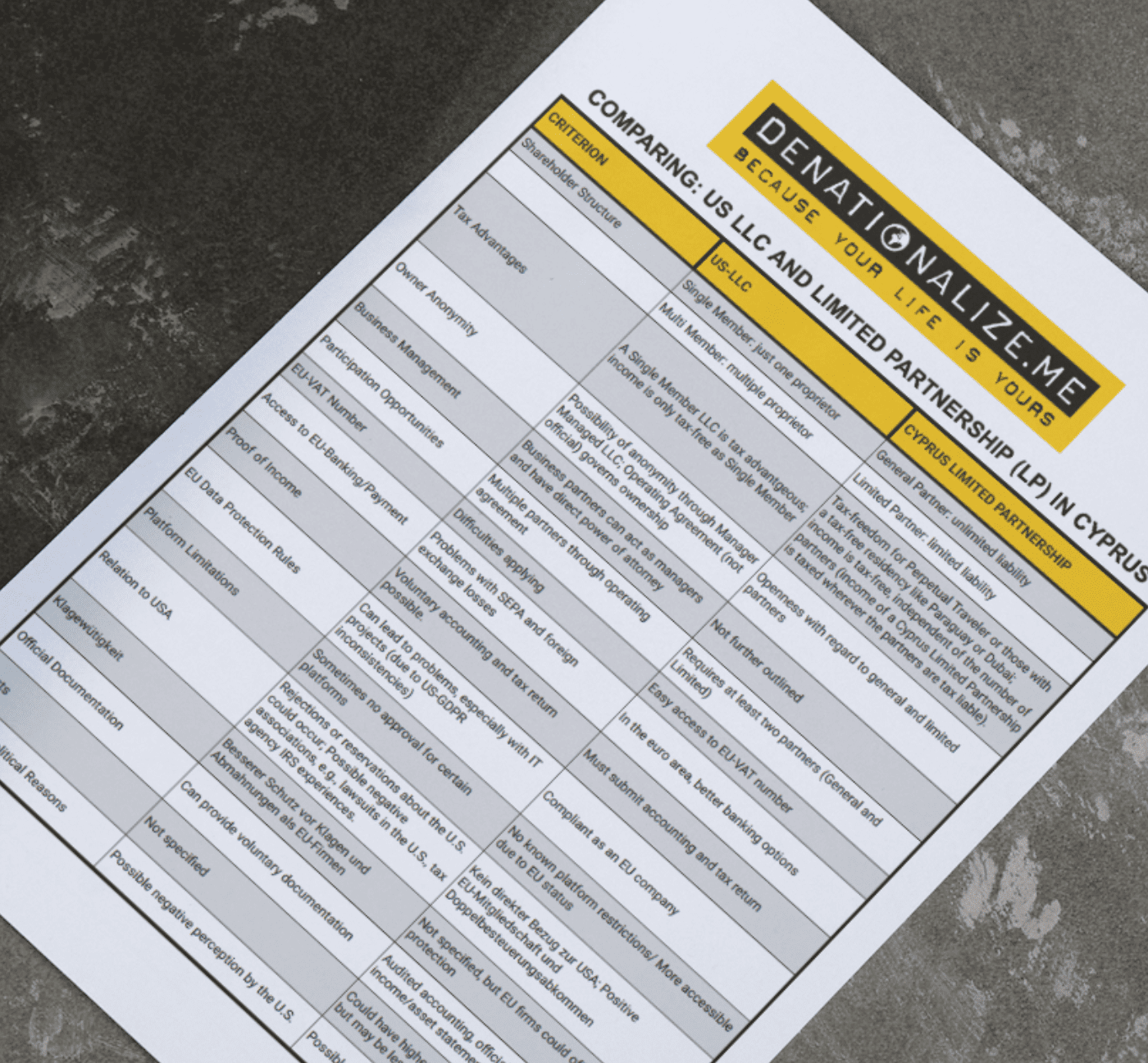

Comparing: US LLC and Limited Partnership (LP) in Cyprus

There is already an in-depth article on this topic in our blog. There is not one optimal solution – everything depends on your individual situation, your intentions and your preferences. But with the expertise and contacts of denationalize.me, the chances are extremely good that you will achieve your goal.

See for yourself – there is nothing that a brief overview cannot solve.

Attention: You should not serve clients from Cyprus with this structure, otherwise local taxation could occur.

Different Possibilities

Comparing: US LLC and Limited Partnership (LP) in Cyprus

There is already an in-depth article on this topic in our blog. There is not one optimal solution – everything depends on your individual situation, your intentions and your preferences. But with the expertise and contacts of denationalize.me, the chances are extremely good that you will achieve your goal.

See for yourself – there is nothing that a brief overview cannot solve.

Attention: You should not serve clients from Cyprus with this structure, otherwise local taxation could occur.

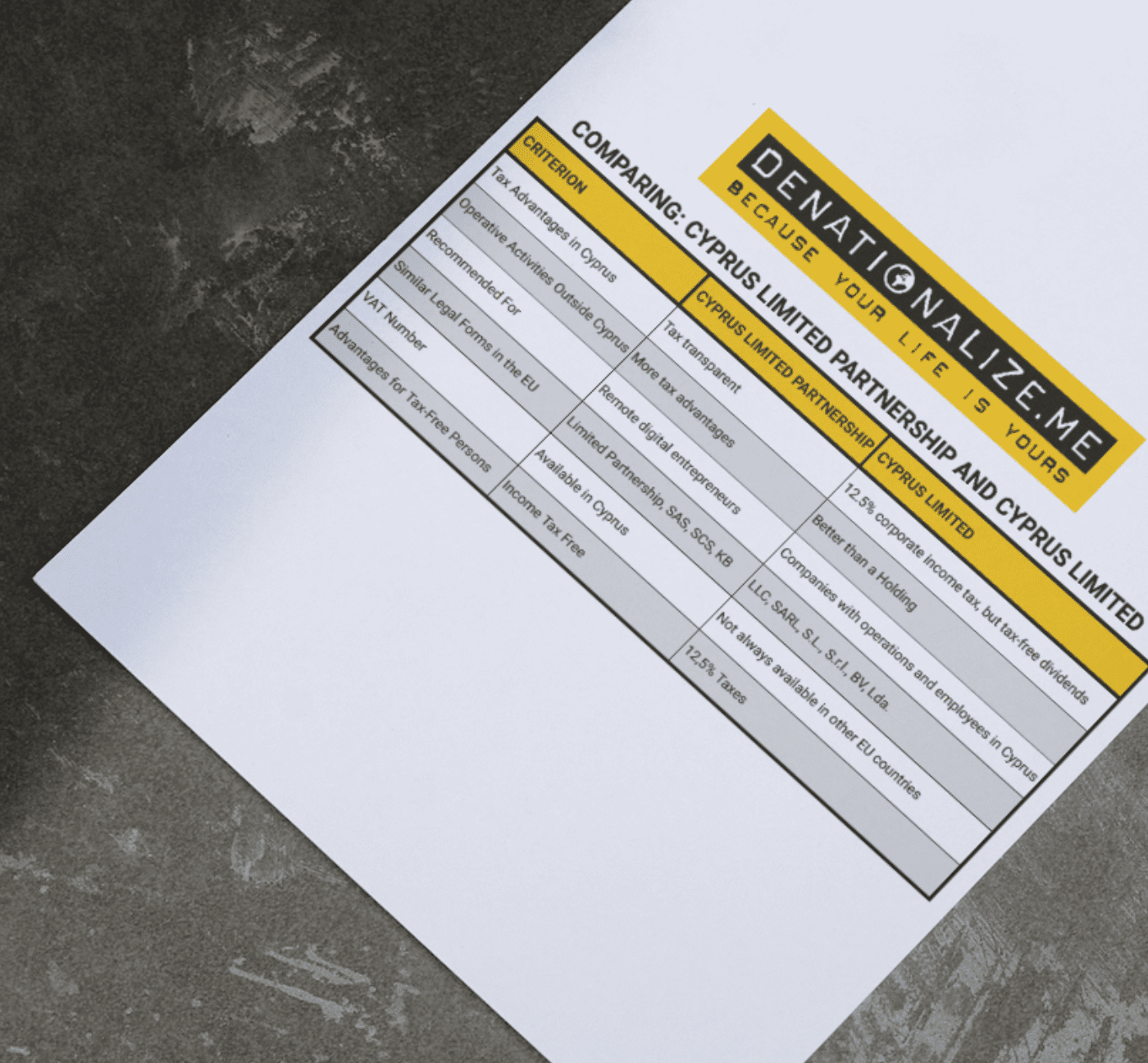

Different Possibilities

Comparing: Cyprus Limited Partnership and Cyprus Limited

Online traders often opt for a Limited in Cyprus, but the more tax advantageous Limited Partnership remains underestimated. Many are unaware of the tax transparency of the limited partnership. In addition, with tax residency in Cyprus’ non-dom program, dividends are tax exempt, but partnership income is not. Therefore, some prefer the 12.5% corporate tax of the Limited.

Outside Cyprus, however, the limited partnership shows its advantages, especially for remote digital entrepreneurs. Other EU countries such as Malta or Ireland offer similar legal forms, but in terms of VAT numbers, Cyprus offers optimal conditions. As long as partners have tax flexibility, the Cyprus Limited Partnership offers significant advantages, but these are often overlooked.

Different Possibilities

Comparing: Cyprus Limited Partnership and Cyprus Limited

Online traders often opt for a Limited in Cyprus, but the more tax advantageous Limited Partnership remains underestimated. Many are unaware of the tax transparency of the limited partnership. In addition, with tax residency in Cyprus’ non-dom program, dividends are tax exempt, but partnership income is not. Therefore, some prefer the 12.5% corporate tax of the Limited.

Outside Cyprus, however, the limited partnership shows its advantages, especially for remote digital entrepreneurs. Other EU countries such as Malta or Ireland offer similar legal forms, but in terms of VAT numbers, Cyprus offers optimal conditions. As long as partners have tax flexibility, the Cyprus Limited Partnership offers significant advantages, but these are often overlooked.

A Good Alternative

A Vision for Entrepreneurs – The Best Tax Options in the World

denationalize.me brings a breath of fresh air to the traditional tax optimization industry. While many only have business in mind, our core motivation is deeper: we have the vision to offer the best tax options to entrepreneurs worldwide.

That said, in many cases, US LLCs are a prime option: easier incorporation, lower cost of €2000, and less bearaucracy. But if the US LLC does not suit you, the Cyprus Limited Partnership is an excellent alternative. Here, too, you remain income tax free and get a tailor-made solution for your business.

A Good Alternative

A Vision for Entrepreneurs – The Best Tax Options in the World

denationalize.me brings a breath of fresh air to the traditional tax optimization industry. While many only have business in mind, our core motivation is deeper: we have the vision to offer the best tax options to entrepreneurs worldwide.

That said, in many cases, US LLCs are a prime option: easier incorporation, lower cost of €2000, and less bearaucracy. But if the US LLC does not suit you, the Cyprus Limited Partnership is an excellent alternative. Here, too, you remain income tax free and get a tailor-made solution for your business.

Our Offer

Our Cyprus LP Offer

For only 5000 € you get an all-round carefree package for a Cyprus LP with denationalize.me. In addition to the incorporation, this includes accounting, VAT number, audits, and our expertise. In an environment where LLCs may not be the right choice, the Cyprus LP shines through.

We are practitioners with over a decade of experience. Whether Cyprus Limited, US LLC or the often overlooked Cyprus Limited Partnership – we know what we’re doing and we can set you up broadly on the international playing field.

Our Offer

Our Cyprus LP Offer

For only 5000 € you get an all-round carefree package for a Cyprus LP with denationalize.me. In addition to the incorporation, this includes accounting, VAT number, audits, and our expertise. In an environment where LLCs may not be the right choice, the Cyprus LP shines through.

We are practitioners with over a decade of experience. Whether Cyprus Limited, US LLC or the often overlooked Cyprus Limited Partnership – we know what we’re doing and we can set you up broadly on the international playing field.

Known From: