US LLC

Each country is characterized by particular strengths and weaknesses in different areas. Flag theory is based on the concept of “cosmopolitanism”, where you bring together the best of different countries, similar to shopping, where you look for the best products, whether they are the most reliable, the tastiest or the cheapest, that still fulfill their purpose.

According to this theory, different areas of life are seen as “flags” that can be internationalized. Sometimes a country can cover several of these “flags” or areas of life. It is up to you to choose the right combination and use it to achieve your goals.

US LLC

The Flag Theory: Your Key to a Global Lifestyle

Each country is characterized by particular strengths and weaknesses in different areas. Flag theory is based on the concept of “cosmopolitanism”, where you bring together the best of different countries, similar to shopping, where you look for the best products, whether they are the most reliable, the tastiest or the cheapest, that still fulfill their purpose.

According to this theory, different areas of life are seen as “flags” that can be internationalized. Sometimes a country can cover several of these “flags” or areas of life. It is up to you to choose the right combination and use it to achieve your goals.

Optimize Your Lifestyle and Finances

PT-Package: Your Path to Freedom

We not only inspire and guide you on your way to becoming a PT – Perpetual Traveler, Prior Tax Payer and Permanent Tourist – but also support you in meeting the most important requirements. Our practical and straightforward solution, the PT Package, is designed to advise and guide you at every stage of your journey.

It covers key aspects such as:

- Tax residency (seemingly or real tax residency) and residency permit

- Reputable offshore company with the most advantages and flexibility, especially for digital, globally active entrepreneurs with location-independent income

- Tax exemption, asset protection and protection against legal action

- Crypto-friendliness, as your money belongs to you and not to any bank

The PT Package offers significant savings and includes a fast tax number allocation, mail forwarding and compliance support. You can also read our blog article for more information on this.

Optimize Your Lifestyle and Finances

PT-Package: Your Path to Freedom

We not only inspire and guide you on your way to becoming a PT – Perpetual Traveler, Prior Tax Payer and Permanent Tourist – but also support you in meeting the most important requirements. Our practical and straightforward solution, the PT Package, is designed to advise and guide you at every stage of your journey.

It covers key aspects such as:

- Tax residency (seemingly or real tax residency) and residency permit

- Reputable offshore company with the most advantages and flexibility, especially for digital, globally active entrepreneurs with location-independent income

- Tax exemption, asset protection and protection against legal action

- Crypto-friendliness, as your money belongs to you and not to any bank

The PT Package offers significant savings and includes a fast tax number allocation, mail forwarding and compliance support. You can also read our blog article for more information on this.

Maximum Freedom for Global Business

Utilizing the Versatility of the US LLC

The US LLC is a flexible and cost-effective choice for service providers, digital product providers and crypto traders who want to live a “denationalized or stateless” life. It allows you to operate almost any business tax-free, use international business accounts and access payment services such as Paypal and Stripe.

Note, however, that the LLC remains tax-free as long as it does not have a foreign permanent establishment, which can cause problems when hiring employees in taxable countries. The solution is to focus on remote employees, especially those living in low-tax jurisdictions.

Denationalize.me can assess individual situations and offer alternative solutions. Keep in mind that the Corporate Transparency Act of 2024 could complicate the use of favorable LLCs. If needed, you can move your LLC to denationalize.me, where referral bonuses can reduce costs.

Maximum Freedom for Global Business

Utilizing the Versatility of the US LLC

The US LLC is a flexible and cost-effective choice for service providers, digital product providers and crypto traders who want to live a “denationalized or stateless” life. It allows you to operate almost any business tax-free, use international business accounts and access payment services such as Paypal and Stripe.

Note, however, that the LLC remains tax-free as long as it does not have a foreign permanent establishment, which can cause problems when hiring employees in taxable countries. The solution is to focus on remote employees, especially those living in low-tax jurisdictions.

Denationalize.me can assess individual situations and offer alternative solutions. Keep in mind that the Corporate Transparency Act of 2024 could complicate the use of favorable LLCs. If needed, you can move your LLC to denationalize.me, where referral bonuses can reduce costs.

The Ultimate Tax Haven

Asset Protection at the Highest Level: The Advantages of a Nevis Holding

For entrepreneurs who make above-average profits (from €10,000 per month), we recommend setting up a Nevis holding company as additional asset protection. Nevis, known as a tax haven, offers almost impregnable protection from creditors. Even with considerable effort, it has never been possible to seize the assets of a company in Nevis.

Despite anonymity and exemption from taxes and accounting obligations, business accounts in the Caribbean, access to brokers and crypto exchanges enable asset management without the risk of taxes and confiscation.

Nevis Holding can be linked to the US LLC or operated independently. However, we recommend keeping the companies separate to maximize asset protection and simplify KYC processes.

As a perpetual traveler, you can distribute profits flexibly between US LLC and Nevis Holding. For higher profits or special requirements, Nevis trusts or foundations are also worth considering. Denationalize.me offers comprehensive professional advice and possible discounts. This is even possible with a confirmed residency in Paraguay.

The Ultimate Tax Haven

Asset Protection at the Highest Level: The Advantages of a Nevis Holding

For entrepreneurs who make above-average profits (from €10,000 per month), we recommend setting up a Nevis holding company as additional asset protection. Nevis, known as a tax haven, offers almost impregnable protection from creditors. Even with considerable effort, it has never been possible to seize the assets of a company in Nevis.

Despite anonymity and exemption from taxes and accounting obligations, business accounts in the Caribbean, access to brokers and crypto exchanges enable asset management without the risk of taxes and confiscation.

Nevis Holding can be linked to the US LLC or operated independently. However, we recommend keeping the companies separate to maximize asset protection and simplify KYC processes.

As a perpetual traveler, you can distribute profits flexibly between US LLC and Nevis Holding. For higher profits or special requirements, Nevis trusts or foundations are also worth considering. Denationalize.me offers comprehensive professional advice and possible discounts. This is even possible with a confirmed residency in Paraguay.

Your Path to Residency

Your Residency Permit in Paraguay

Paraguay has established itself as a preferred immigration destination in recent years.

The country scores with a fast immigration process, low costs and no minimum length of stay. It also offers an attractive tax environment where foreign income is not taxed and a stable economy.

We have reported in detail on the Paraguayan residence permit process here. It takes around 5-6 weeks, with only two short stays in the country required.

You can travel in between – even to Europe. Since 2021, Paraguay does not require any specific financial criteria for immigrants. A clean criminal record and a notarized birth certificate are sufficient.

Your Path to Residency

Your Residency Permit in Paraguay

Paraguay has established itself as a preferred immigration destination in recent years.

The country scores with a fast immigration process, low costs and no minimum length of stay. It also offers an attractive tax environment where foreign income is not taxed and a stable economy.

We have reported in detail on the Paraguayan residence permit process here. It takes around 5-6 weeks, with only two short stays in the country required.

You can travel in between – even to Europe. Since 2021, Paraguay does not require any specific financial criteria for immigrants. A clean criminal record and a notarized birth certificate are sufficient.

Easy Tax Status and Data Protection

Tax Residency Certificate in Paraguay

In Paraguay, interested parties can obtain a tax residency certificate, which is particularly uncomplicated and cost-effective. A Paraguayan tax number must be applied for once, for which a Cedula is required. This process can take anywhere from a few days to several weeks, depending on the preparation, although it is not mandatory to stay in the country during this time.

Once you have the tax number, you must activate it by submitting monthly VAT returns in order to receive the tax certificate. This costs $50 per month and is optional if you stay in Paraguay for at least four months. With this certificate, you can avoid potential additional tax demands from other countries and can operate safely abroad for tax purposes.

In addition, Paraguay enables the KYC (Know Your Customer) process for most banks worldwide. Paraguay does not participate in the international exchange of information, which guarantees privacy and discretion.

Easy Tax Status and Data Protection

Tax Residency Certificate in Paraguay

In Paraguay, interested parties can obtain a tax residency certificate, which is particularly uncomplicated and cost-effective. A Paraguayan tax number must be applied for once, for which a Cedula is required. This process can take anywhere from a few days to several weeks, depending on the preparation, although it is not mandatory to stay in the country during this time.

Once you have the tax number, you must activate it by submitting monthly VAT returns in order to receive the tax certificate. This costs $50 per month and is optional if you stay in Paraguay for at least four months. With this certificate, you can avoid potential additional tax demands from other countries and can operate safely abroad for tax purposes.

In addition, Paraguay enables the KYC (Know Your Customer) process for most banks worldwide. Paraguay does not participate in the international exchange of information, which guarantees privacy and discretion.

Access to Security without Ties to the EU

Banking and Brokerage Solutions in Georgia

Open a TBC Concept account in Georgia and enjoy the freedom of a bank account outside the EU. Georgia, known for its stable and modern financial landscape, protects you from state surveillance and expropriation. You get an IBAN for your account, even if it is not in the EU.

This solution enables secure wealth management and offers advantages due to the crypto-friendly attitude of Georgian banks. Crypto transactions are simple and direct to a certain extent.

Benefit from low transfer fees, a choice of currencies and the ability to negotiate individual interest rates for larger deposits – all with denationalize.me!

Access to Security without Ties to the EU

Banking and Brokerage Solutions in Georgia

Open a TBC Concept account in Georgia and enjoy the freedom of a bank account outside the EU. Georgia, known for its stable and modern financial landscape, protects you from state surveillance and expropriation. You get an IBAN for your account, even if it is not in the EU.

This solution enables secure wealth management and offers advantages due to the crypto-friendly attitude of Georgian banks. Crypto transactions are simple and direct to a certain extent.

Benefit from low transfer fees, a choice of currencies and the ability to negotiate individual interest rates for larger deposits – all with denationalize.me!

Options

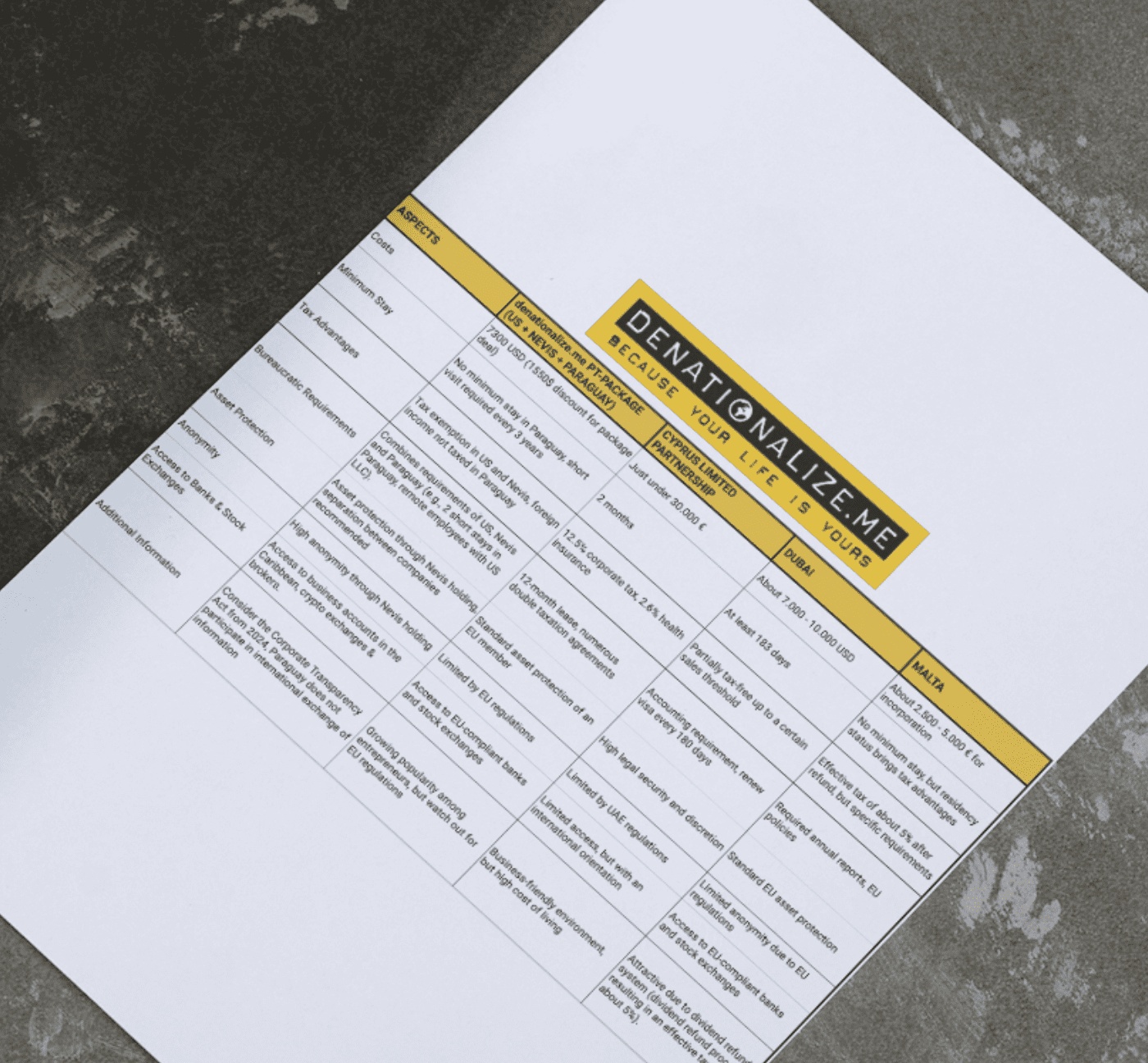

Comparison with Other Popular Setups

Various tax and residency options are available to entrepreneurs, including the stateless PT package (US+Nevis+Paraguay+Georgia), Cyprus Limited Partnership, Dubai and Malta. Costs vary, with the PT package being an attractive option at 8,000 € (~2150 € discount in package price).

There are varying minimum residency requirements, from no minimum residency in Paraguay to 183 days in Malta. Tax benefits also vary, from tax-free in the US and Nevis to an effective tax of around 5% in Malta.

Bureaucratic requirements and asset protection also play a role, while access to banks and stock exchanges varies depending on the choice. The Corporate Transparency Act of 2024 and EU regulations are worth noting.

Options

Comparison with Other Popular Setups

Various tax and residency options are available to entrepreneurs, including the denationalize.me PT Package (US + Nevis + Paraguay), Cyprus Limited Partnership, Dubai and Malta. Costs vary, with the PT Package being an attractive option at 8000 € (~2150 € discount in package price).

There are varying minimum residency requirements, from no minimum residency in Paraguay to 183 days in Malta. Tax benefits also vary, from tax-free in the US and Nevis to an effective tax of around 5% in Malta.

Bureaucratic requirements and asset protection also play a role, while access to banks and stock exchanges varies depending on the choice. The Corporate Transparency Act of 2024 and EU regulations are worth noting.

You Can Choose

Offers and Prices at a Glance

We not only inspire and guide you on your way to becoming a PT – Perpetual Traveler, Prior Tax Payer and Permanent Tourist – but also support you in meeting the most important requirements. Our practical and straightforward solution, the PT Package, is designed to advise and support you every step of the way.

It addresses key aspects such as:

Individual Offers:

- US LLC Setup: 2000 €

- Nevis Holding Company with Business Account: USD $4250

- Paraguay Cedula: 2700 €

- Bank and Brokerage Account in Georgia: 1200 €

Package Prices:

- US LLC + Paraguay: USD 4000 € (you save: 700 €)

- US LLC + Nevis: 5500 € (you save: ~750 €)

- Nevis + Paraguay: 6000 € (you save: ~950 €)

- US LLC + Nevis + Paraguay: 7300 € (you save: ~1650 €)

- US + Nevis + Paraguay + Georgia: 8000 € (you save: ~2150 €)

Additional Options:

- Tax Number (optional): +250 €

- Expedited Procedure (2-3 weeks instead of months) for Temporary Residency & Cedula (per document): +300 €

- Police Registration Confirmation (optional): +75 €

- VAT Declarations: +600 €

- Certificate of Residency: +250 €

You Can Choose

Offers and Prices at a Glance

We not only inspire and guide you on your way to becoming a PT – Perpetual Traveler, Prior Tax Payer and Permanent Tourist – but also support you in meeting the most important requirements. Our practical and straightforward solution, the PT Package, is designed to advise and support you every step of the way.

It addresses key aspects such as:

Individual Offers:

- US LLC Setup: 2000 €

- Nevis Holding Company with Business Account: USD $4250

- Paraguay Cedula: 2700 €

- Bank and Brokerage Account in Georgia: 1200 €

Package Prices:

- US LLC + Paraguay: USD 4000 € (you save: 700 €)

- US LLC + Nevis: 5500 € (you save: ~750 €)

- Nevis + Paraguay: 6000 € (you save: ~950 €)

- US LLC + Nevis + Paraguay: 7300 € (you save: ~1650 €)

- US + Nevis + Paraguay + Georgia: 8000 € (you save: ~2150 €)

Additional Options:

- Tax Number (optional): +250 €

- Expedited Procedure (2-3 weeks instead of months) for Temporary Residency & Cedula (per document): +300 €

- Police Registration Confirmation (optional): +75 €

- VAT Declarations: +600 €

- Certificate of Residency: +250 €

Discounts

Special Offers for Existing Clients

For Existing Customers or Company Transfers: You will receive our package prices even if you already have a company with us or would like to switch to us.

Switching from Another Provider: If you have set up a US LLC through another provider, you can easily switch to us free of charge, regardless of your previous provider. After the changeover, you only pay our standard annual fee of 1400 USD every 12 months. Simply contact us via usa@staatenlos.ch.

Adding Nevis to Your US LLC: Existing customers receive a $250 discount.

Non-Resident LLC Owners: Protect yourself with a Paraguay Cedula and benefit from a $300 discount.

Discounts

Special Offers for Existing Clients

For Existing Customers or Company Transfers: You will receive our package prices even if you already have a company with us or would like to switch to us.

Switching from Another Provider: If you have set up a US LLC through another provider, you can easily switch to us free of charge, regardless of your previous provider. After the changeover, you only pay our standard annual fee of 1400 USD every 12 months. Simply contact us via usa@staatenlos.ch.

Adding Nevis to Your US LLC: Existing customers receive a $250 discount.

Non-Resident LLC Owners: Protect yourself with a Paraguay Cedula and benefit from a $300 discount.

Get Christoph's Expertise

Seek Advice

If you are not sure whether the PT Package is right for you, don’t hesitate to contact us. Use our free messenger consultation to evaluate your situation and discuss possible alternatives. For more in-depth questions, Christoph is available for a personal consultation.

Get Christoph's Expertise

Seek Advice

If you are not sure whether the PT Package is right for you, don’t hesitate to contact us. Use our free messenger consultation to evaluate your situation and discuss possible alternatives. For more in-depth questions, Christoph is available for a personal consultation.

Known From: