CBDCs are digital currencies issued by central banks but, most importantly, they are a great way for governments and states to control you even better.

Nowadays, in order to steal some of the money you earn through taxes, the Treasury asks you to make your tax return, where you must declare all your earnings.

Of course, governments have a lot of spies and informers at their disposal: notaries, tax advisors, tax offices in other countries and, above all, the banks and other financial institutions where you deposit your money.

However, there can be many loopholes in the exchange of information: you may not report everything you have on your tax return, automatic bank information exchange does not always work properly, and governments (or their treasuries) do not always cooperate as well as some would like.

However, what would happen if the state suddenly took control of all the movements of your money? By cutting out all the go-betweens and controlling the source, it ends up concentrating all the information in one place.

With CBDCs, the state could end up knowing what, when, how and how much you earn and buy. What’s more, it could take away or invalidate your money at any time.

What is a CBDC?

A CBDC (Central Bank Digital Currency) is the digital version of paper money. Banknotes and coins are digitised. Instead of a physical wallet, you would use a digital wallet from the central bank, similar to what happens now with bank cards, but you would have a single provider.

CBDCs give the central bank absolute control over the money supply and, ultimately, the power to impose policies that would not be accepted by the people voluntarily, as well as controlling the movement of any citizen’s money.

To give an example: normally, banks raise interest rates to fight inflation – to prevent people from spending too much and thus lowering prices – and to reduce demand. Using a CBDC, governments could allocate us a maximum monthly budget with a few clicks, i.e. they could decide not only what our money is worth (inflation), but also how much of our money we can use.

At this point, it is important not to confuse cashless payments, mobile payments, neobanks and QR codes with a fully centralised digital currency. A CBDC is not just another payment method. Do not make the mistake of believing that it will not have a negative impact on our lives.

A digital currency gives the state far-reaching powers. It is the governments absolute access to everything we do, have and spend.

Of course, in most cases, it will not start out as the sole legal tender. However, be in no doubt that, after a period of coexistence with other payment methods, it will eventually eliminate the possibility of making payments in cash or any alternative means.

Cash will soon become another tool of social control.

And now, you may be asking yourself “Ah, so… Is a CBDC a state cryptocurrency?”

Definitely not.

To give you an idea, central bank currencies are the exact opposite of cryptocurrencies. Just because they are both digital does not mean they are the same.

Transparency, decentralisation, free use and verification of the source code of cryptocurrencies – among many other things – are just some of the factors that distinguish them.

Is everything digital and not controlled by the government unstable?

That governments are concerned about cryptocurrencies and their decentralisation is nothing new. It is very funny that central banks around the world criticise cryptocurrencies on the grounds that they are not currencies because they are too volatile, as if fiat currencies (euros, USD, etc.) were not.

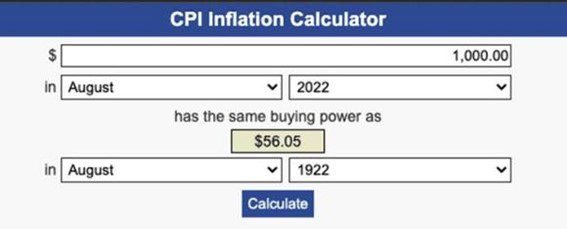

Today, you have the same purchasing power with 1000 US dollars as you did with 56 dollars 100 years ago.

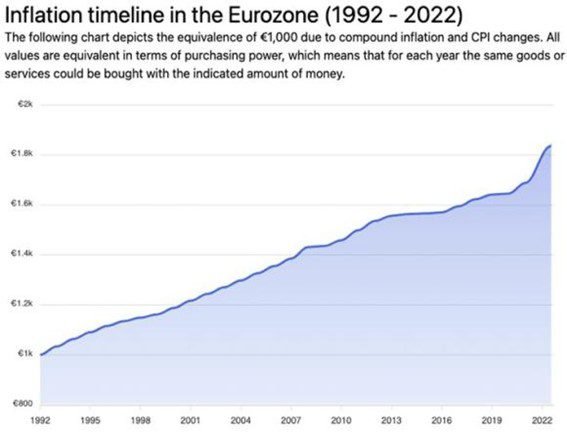

If you think that 100 years is too long, let us look at the last 30 years of euro purchasing power: the inflation rate in the euro area between 1992 and today is 85.52%, which is equivalent to a total increase of 855.23 euros. This means that 1000 euros in 1992 would be equivalent to 1855.23 euros in 2022.

If you think that 100 years is too long, let us look at the last 30 years of euro purchasing power: the inflation rate in the euro area between 1992 and today is 85.52%, which is equivalent to a total increase of 855.23 euros. This means that 1000 euros in 1992 would be equivalent to 1855.23 euros in 2022.

If that sounds stable to you…

Financial markets are generally volatile. Everything traded on stock exchanges is subject to fluctuations. Anything else is mere speculation.

Financial markets are generally volatile. Everything traded on stock exchanges is subject to fluctuations. Anything else is mere speculation.

When Cristiano Ronaldo put aside his Coca-Cola to drink water during a press conference, the price of the brand fell rapidly. Does this mean that Coca-Cola has lost its value? Does it mean that Coca-Cola is faltering? Despite everything, the soft drink is and always has been an icon, no matter how high its “stock price” is.

The same goes for Bitcoin, for example: much of what is said about this cryptocurrency is nothing but noise. Its value remains intact.

On the other hand, the loss of purchasing power and the resulting inflation are very real, and leave little room for speculation. It is rather an increase in the monetary base (money created out of thin air). Generally, this phenomenon is due to the government’s mismanagement to remedy the consequences of the previous government’s mismanagement.

Yes, it is a fact: the cryptocurrency market is still very young compared to “conventional currencies”. It is still very vulnerable to fraud and scams, but it is evolving more and more every day. There are a large number of people behind the different currencies who want to make them better and safer.

At Staatenlos, we are also committed to this idea, and we are involved in a startup that works on a decentralised exchange with no scaling problems and fully decentralised – to solve the so-called “trilemma” of security, scalability and decentralisation.

Today crypto is basically the “internet” in a world where everyone still uses “television”. Why is that?

Television has always been the means by which governments could exercise their censorship and control information, until the internet came along and made it much more difficult.

The “television” in this metaphorical example would be the fiat currencies: the dollar, the euro, the pound, the Swiss franc… currencies that have to be adapted nationally and are controlled by central banks.

Perhaps the turning point came when governments realised that they could not stop the development and rise of decentralised digital currencies.

They had to do something, and they had to do something fast: either they accepted defeat and were replaced by these new currencies or they surrendered to this phenomenon and tried to profit from it.

Therefore, governments concluded: “If you can’t beat them, join them”

Facebook has around 3 billion monthly active users. According to economist Fernando Ulrich, the social network is a “digital continent”.

In June 2019, the network announced its own digital currency (then called Libra). This news came as a surprise to many and is considered a major milestone in the trajectory of digital currencies.

Imagine if Facebook only accepted and made payments for advertising or its own employees’ salaries through its own currency from now on. Surely, we are talking about the epitome of scalability and virality. The possibility of this currency being accepted by the mainstream public would be enormous.

Now imagine some of the countries where the local currency is not worth much, such as Venezuela, Argentina or Sri Lanka: it stands to reason that the population would accept Facebook’s currency, even if only as a store of value.

The potential of this currency interferes with the sovereignty of other currencies, and that is something that central banks would never allow.

That is when the idea of creating a state-owned digital currency was born.

Digital currencies under the control of state and society

On 8 September 2022, the 40th Annual Monetary Policy Conference of the US Cato Institute was held under the theme “The State of Monetary Policy after 40 Years”, with the participation of Jerome Powell, Chairman of the Federal Reserve.

It focused on the problem of privacy and the difficulties of introducing a digital currency, which leads us to the key questions we need to ask in order to analyse this issue in depth:

- What are the safeguards for the implementation of CBDCs?

- What powers will the central bank have?

- What is the scope of oversight that will be exercised?

- What can a digital currency do?

- What problems will the introduction of CBDCs really solve?

- Will it really mean the end of cash?

- How will different CBDC systems communicate and exchange information?

- Do we really need a fully controlled digital currency?

It is not yet clear how the introduction of digital currencies will play out. The only thing that is certain is the growing interest of central banks (and the governments that run them) in making this transition.

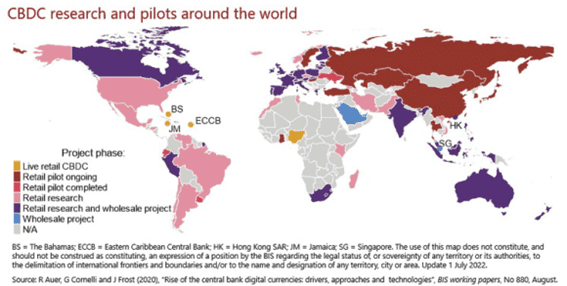

Many countries are testing the introduction and degree of acceptance of CBDCs (in the European Union, for example, this is more advanced than many believe):

If we draw a parallel with other tools of social control and manipulation used by the government, we can think of the very high national debt.

If we draw a parallel with other tools of social control and manipulation used by the government, we can think of the very high national debt.

In Staatenlos, we have already talked about the new and old taxes that governments have been creating to “free us from our assets”. Now let us think… How easy would it be to tax the population if the government had total control over your money? At the click of a button, they could collect the money they think you owe them.

Therefore, if you think that a digital euro (or the currency of whatever country you live in) is a good thing, think twice.

On the Atlantic Council’s website, you can find an interactive map showing the current (May 2022) status of CBDCs around the world (CBDC Tracker). In some countries, CBDCs have already been repealed or made inactive.

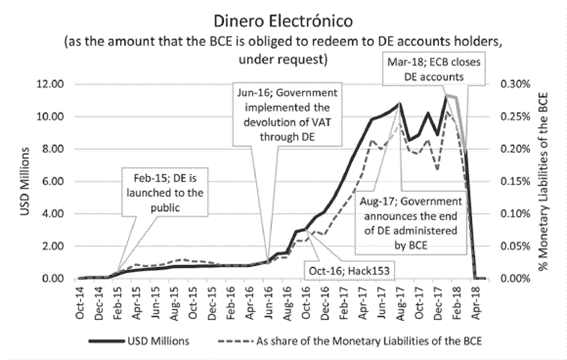

One example is Ecuador, which introduced its “Dinero Electrónico” (DE) to the population in February 2015. In March 2018, the country closed all its CBDC accounts.

Here are some of the criticisms of the CBDC tested in Ecuador:

- The DE is not fully backed, so it is still a parallel currency.

- The DE cannot be used for international payments

- DE facilitates criminal activities

- The DE has the potential to become a surveillance programme.

- Government could force public contract providers or the public to receive transfers in DE

- DE can only be used to buy digital things

To work, DE should have reached a critical mass of users (households and businesses) who see sufficient benefit in its use to advocate for its continuation. You can read the full study here.

However, Ecuador is not the only example; the introduction of a state-owned digital currency has also been tested in Japan.

This article from August 2022 says that the Bank of Japan is abandoning its digital currency due to lack of popular interest.

“Having examined the technical feasibility of switching from fiat currencies to CBDCs, the Bank of Japan definitely does not see the need for such a transition in the near future.” The reason would be that the Japanese population, traditionally accustomed to using cash, has moved in the wake of the COVID-19 pandemic towards other digital payment methods (e-money, credit cards, etc.).

The European Union’s plans

The European Central Bank (ECB) is one of the biggest advocates of CBDCs.

According to the ECB, CBDCs are “the only solution to ensure the continuity of the current monetary system”.

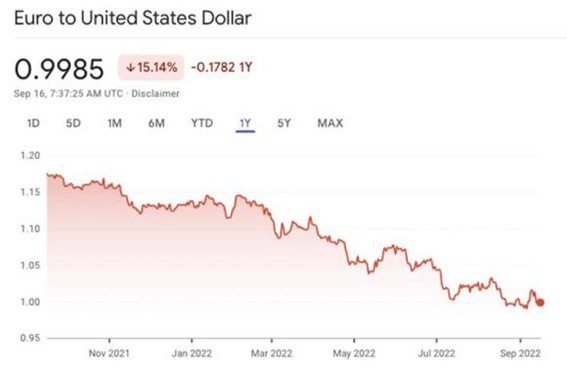

The euro has never been so devalued: CBDCs are one more motivation for the Parliament to stop the euro’s fall and save it. Its hope to guarantee it a new start.

And they want us to believe that they know more about “volatility” than anyone else…

And they want us to believe that they know more about “volatility” than anyone else…

Central bank officials have yet to decide how transactions will be settled with a digital euro and how intermediaries will be compensated before they decide to launch the development in September 2023, as this Coindesk article reports.

In a report on the key objectives of the digital euro written by Christine Lagarde and Fabio Panetta, the concern about “private sector digital solutions” is clear, especially if they are outside the European Union.

The difference is that not everything is imposed and mandatory in the private sector. Everyone applies their own rules and if you do not like them, you do not participate and that is it. Unfortunately, this would not be the case with a state-owned digital currency.

This ECB report is a call for popular support. If you agree with them, go ahead; but keep in mind that those who disagree should not be forced to join.

This article is only intended to get you to think actively and critically, and not just passively listen to the daily news.

The report also explains that the digital euro will not replace cash – we do not know to what extent this is true. There is no point in “not banning cash” but not accepting it anywhere. In the end, it comes to the same thing. If we were talking about a digital age, cash would theoretically no longer have a place. Therefore, they do not make it clear what lies ahead.

A “Working Paper Series” published by the ECB in August 2022 says the following (page 17 of the document):

“The so-called “privacy paradox” raises further concerns. While consumers attach great importance to data protection in surveys, in practice they are more likely to give their data away for free or for very little”.

And this is the key point on which the government relies: they promise “legality”, “stability” and “trust”, and many, many people will prefer security to freedom. Because this is how most people think and live, and will continue to do so: it is all they know.

The timetable foresees the introduction of the “digital euro banknote” in 2023.

China’s CBDC as a case study

Perhaps the most emblematic case is that of China, which is the country most interested in controlling more and more of its population. It is not surprising that the country also wants to use its currency on the road to global hegemony.

China could be a model for the West in adopting a centralised, digital currency.

This article from Wired highlights China’s reaction to Facebook’s announcement of the Pound, and further summarised a key aspect of this shift:

“There is no template for what a CBDC should look like in practice. Instead, government priorities, norms around privacy, constitutional limits and individual policy and design decisions in each country mean that CBDCs will vary from place-to-place. This makes them an interesting window into the future of finance in a digital world, and how norms around privacy will be shaped by these emerging technologies.”

In February 2020, the Financial Times reported that “[t]he People’s Bank of China has filed more than 80 patents related to its secret plans to launch a digital currency”.

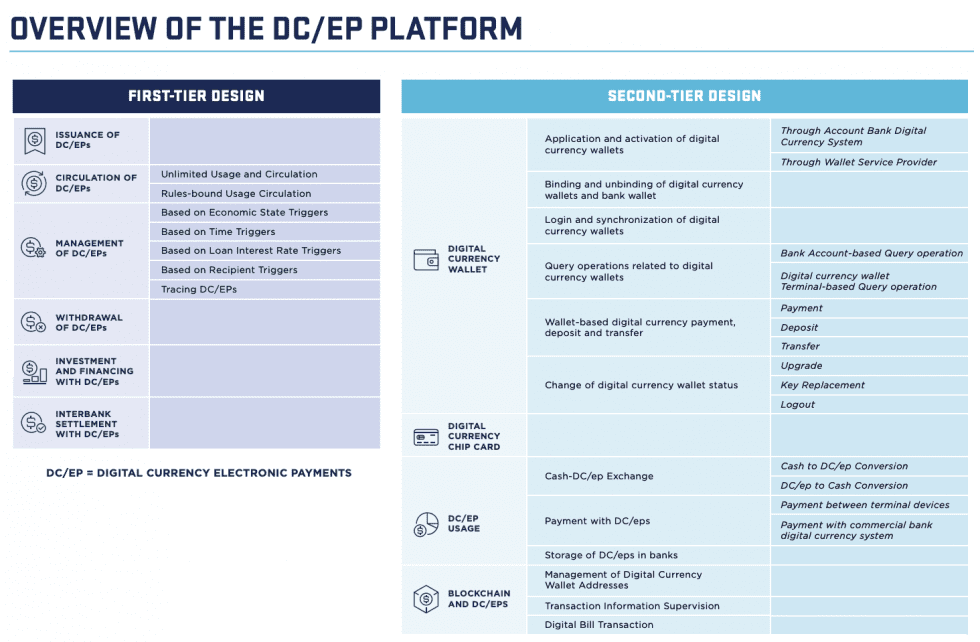

As early as June 2022, the digital Chinese yuan e-CNY will be tested not only for retail use, but also for business loans and tax payments. The digital currency – officially called Digital Currency Electronic Payment (DCEP) – has also been used for tax purposes in the city of Chongqing.

China’s digital currency is based on a two-tiered system: one for how money is distributed and another for how it is spent:

It is no surprise that the digital yuan is poised to wrest dominance from the dollar.

It is no surprise that the digital yuan is poised to wrest dominance from the dollar.

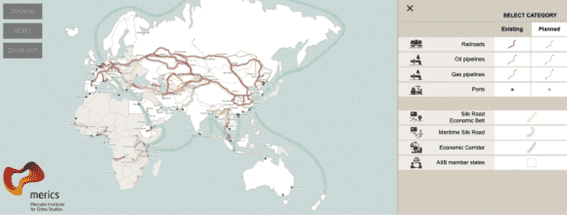

Add in the Belt and Road Initiative (BRI) – a strategic plan to connect the major economic channels of Asia, Europe and Africa to enable greater trade – and the effect is the same as the one of Facebook: that all transactions will be conducted exclusively with a Chinese digital currency.

But at what price?

But at what price?

The tone of this Cato Institute publication is not exactly hopeful either: the title of the article is “China’s Digital Yuan: A Threat to Freedom”.

There are so many well-written passages that it makes no sense to rewrite them here, otherwise part of the message would be lost. Anyway, here are the last two parts of the publication:

“ [The Chinese people] have already largely given up privacy by giving up cash to adopt digital payment systems, and they may end up in the next stage transacting CBDC in Alipay or WeChat Pay wallets, giving their data to both the government and private‐sector wallet providers. That would be the worst‐case scenario for civil liberties.

The fact that paper currency still remains popular in China is at least partly because of its unique capacity to allow people to keep their transactions private. That feature should not be undervalued. “.

Be careful what you wish for… it might come true.

The following is a very common argument from most people:

“I feel that the rulers want what is best for me, so I am not worried about giving them more control to do what (I think) is right”.

What they do not think about is that their beloved leaders will not rule forever, and that others may come along who are more power-hungry and/or less attuned to their tastes or that from one day to the next those beloved leaders may change and no longer be as good. Of course, with such a powerful tool as a state-controlled digital currency, the government, whoever it might be, would have us completely at its mercy.

Most people have not come to experience first-hand and consciously how damaging the state’s lust for power and control can be. It is not something that bothers them, at least as long as it does not interfere too much in their lives or as long as they think that they are more protected or that what is being done is being done for a fairer world.

The gradual loss of purchasing power, freedom and autonomy that the state causes in people’s lives is of no concern to anyone: the population remains meek within the system they know and which gives them security.

State digital currencies are getting closer every day and are expected to come into force in the next few years. They are a threat not only to banks, which will lose their role as intermediaries (and I see no reason to feel sorry for them), but to all the privacy and freedom of individuals.

Governments will be able to do many perverse things with this new technology. As we were saying, they could deduct taxes in a completely automated way and, why not, add any other kind of surcharge for bad consumption behaviour or lack of ecological awareness…

Cryptocurrencies exist precisely to circumvent this type of control. Do not fall for the fantasy they are trying to sell us: it’s not about greater integration, preservation of value, anti-money laundering and anti-corruption measures, secure and easy payments… None of that.

State-owned digital currencies will be the straw that breaks the camel’s back for many people to switch to private cryptocurrencies as a means of protection.

We all want convenient real-time payments, stable and robust trading operations, privacy on legitimate exchanges, and cross-border payments; but the way to achieve these goals is not by centralising everything.

The only path to freedom, protection and autonomy will be real, independent cryptocurrencies… or perhaps other means that we do not yet know about. But one thing is certain: the demand for secure and alternative ways to escape state control is extraordinarily high and will only grow. Fortunately, states will not be able to win this race to improve cryptography, not even with quantum computers. At least not cleanly, as they can always choose to ban cryptocurrencies they do not like.

Unfortunately, it is not science fiction

It is scary to think about how a state-owned digital currency or CBDC will give governments far-reaching powers beyond those they already have. It is especially scary when you consider that this power will be used as the group of people in charge deems appropriate, and I assure you that fighting terrorism is the least of it here.

We will be guinea pigs, not only subjected to experiments in mass manipulation, but also living locked in a cage, often with no hope of escape.

CBDCs are not about protecting anyone from anything, they are about protecting and further extending the power of states. Just look at China and its race towards the New World Order.

Keep a close eye on it, for the question of currency is an essential basis that the state does not want to give up control of.

Because your life is yours!

Did you like our blog article?

Support us by purchasing our products and services. Or build up a passive income by recommending us as an affiliate! And don’t forget to check out Christoph’s travel blog christoph.today!

Secret Knowledge Video Course

Learn Everything that You Need to Know for a Life as a Perpetual Traveler

Watch Video CourseEncyclopedia Collection

Acquire Expansive Knowledge about Banking, Companies, Citizenships, and Emigration.

Order eBooks