Looking back, it was all a funny coincidence. Even though I was always inclined to the FDP (a libertarian party) in Germany when I was still at school, I had little understanding of liberal theory. I started studying political and administrative sciences at the University of Konstanz with the goal of one day becoming a civil servant in the well-paid global civil service industries. I was hoping to work at embassies, the UN or the EU. However, during my first semester I took a course (with a communist professor, of all people) on "Political Philosophy", which thankfully put me on the right track. I overslept the first hour because of a party the previous night and during that time a lecture topic was randomly assigned to me. It just happened to be "Friedrich August von Hayek", the classical liberal Nobel Prize winner, whose book "Road to Serfdom" I would be working through the next 4 months, along with other similar literature. I liked his ideas and compared Hayek's and John Stuart Mill's theory of freedom in my first term paper.

During the following semester break, I used the time to read many other books. Inspired by Murry Rothbard, Hans-Hermann Hoppe and Ayn Rand, my political views radicalized quickly. I tried to connect on the internet with the then (2012) quite small libertarian community in Germany. In August, I attended the first "Week of Freedom" sponsored by the German Hayek Society. This was followed by lots of engagement in the libertarian sector in Germany. For example, I founded the still active Hayek Club Konstanz, where I learned a lot about entrepreneurship, as we organized many successful events against the resistance of the far-left AStA (which tried to ban us several times). A scholarship at the Friedrich Naumann Foundation, internships with the FDP politician Frank Schäffler and the Viennese "Scholarium", and the attendance of many seminars and conferences (Students for Liberty) shaped my liberal development. Due to the border-location to Switzerland, I also got to know many local comrades and was a regular guest at institutions like the Modelhof or the Liberal Institute.

Already in my second semester, I realized that the career aspiration of working for the state was hardly compatible with my newly acquired values. Even the path to political consulting or political science didn't seem right for me anymore, especially not after my mandatory internships in the 4th semester. During a semester abroad in Madrid (2013) with my subsequent first trip to South America, I had a strong personal development and decided to finish my studies on paper, but to use the remaining 1 ½ years to intensively educate myself and lay the foundation for my self-employment. At conferences I already encountered the idea of perpetual traveling - traveling a lot, being free, and earning money online seemed just right for my life. Not only my new life but also a business idea was born. After all, there was hardly any good, usable information on any of these topics that were beginning to really shape my life.

I wouldn't necessarily call myself a liberal, as over time I've leaned heavily towards anarcho-capitalism, which I think is much more logically coherent. The problem with liberalism is its lack of enforceability on democratic paths in societies that are already largely state-enforced. During my studies and internships in Berlin and Brussels I realized that political freedom is a utopian goal. Many people do not want to be free at all, but would rather be well taken care of. Anarcho-capitalists implement freedom for themselves through the right life strategy (flag theory), rely on entrepreneurial creativity (free private cities), or build parallel societies through technology (blockchain). In my opinion, this is the more promising approach. Nevertheless, I am grateful to liberalism and fully share its core values, even if I only support them in a much more radical form.

staatenlos.ch (German) is my first and therefore biggest blog, on which I mainly concentrate. Accordingly, my customers are mostly German, but also Austrian, Swiss or Italian (South Tyrol). We now have English blogs too here at denationalize.me. And we have Spanish, French, Portuguese and Russian as well. However, I am responsible and capable to advise the whole world in my consultations, especially when it comes to British, Scandinavians and Australians.

My goal has always been to make the knowledge of large corporations and family offices available to the "little guy". In the beginning, my focus was mainly on self-employed and small online entrepreneurs. But by now I also often advise medium-sized companies and private individuals. The typical denationalize.me client earns between 50,000 € and 5 million € per year. However, not everyone is mobile and flexible, therefore my consultations often revolve around creating as many opportunities as possible within the location of my client. Especially in Germany and Switzerland you can maximize your situation with the right expertise when it comes to taxes. I am neither a tax consultant nor a lawyer, but I know my way around the world well enough to find creative legal ways that the typical tax administrator is not aware of. To finalize the process, my network of the few existing competent partner lawyers and tax advisors then takes care of the implementation.

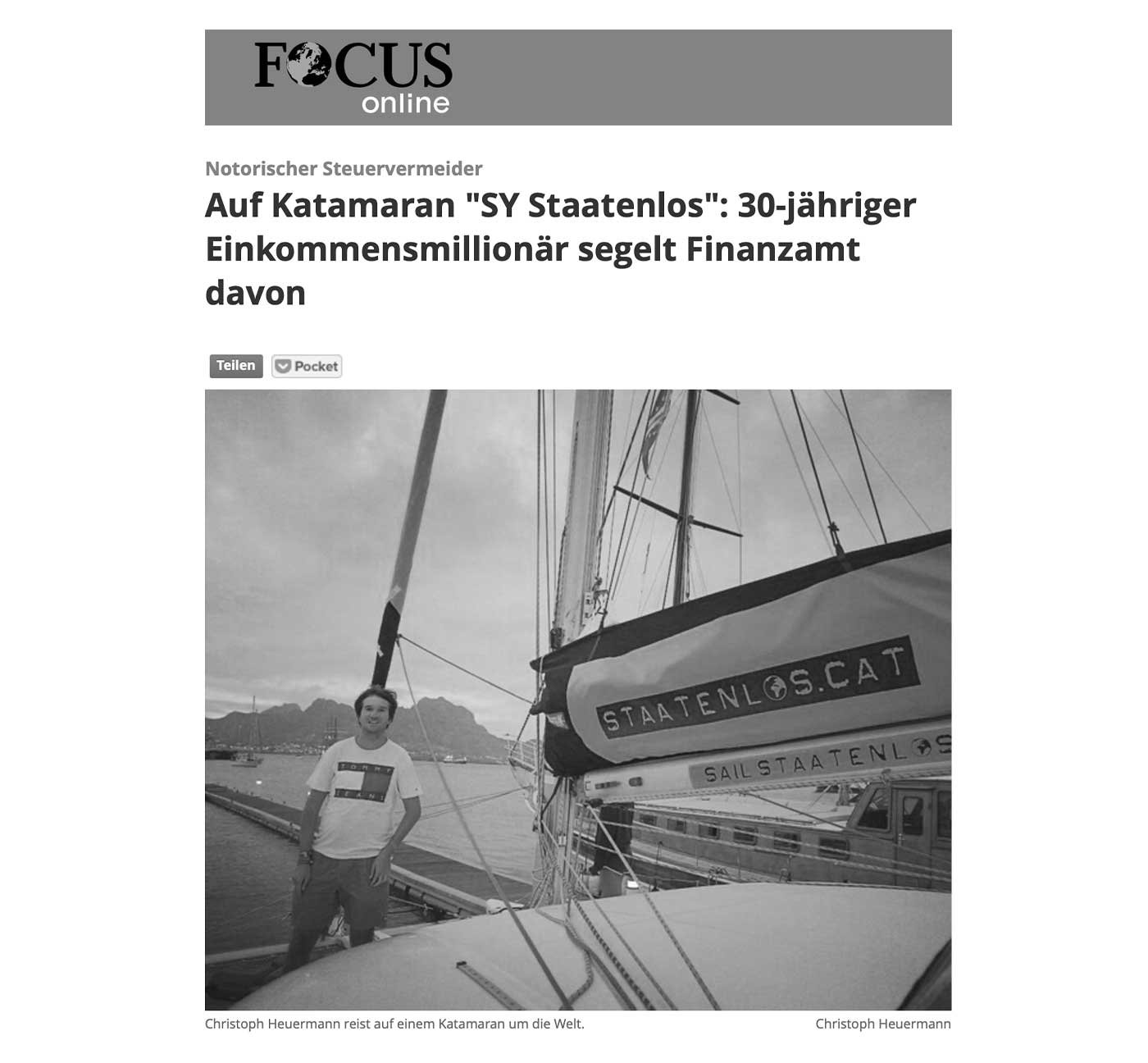

It certainly depends on your personality and goals in life. Even if there was a completely free country, I would probably still choose to travel. After all, I can enjoy even most communist countries with a lot of freedom because I don't trigger that system. For example, my favorite country is Argentina, a terrible bureaucratic tax hell, that is actually a great playground for living and visiting. Personally, I cannot imagine settling down - this planet is too beautiful to not discover every last corner of it. Meanwhile, I also live part of the year on my "staatenlos" (stateless) catamaran. Sailing around the world takes freedom to a whole new level.

At the same time, I am certainly trying to make free cities a reality. For a long time, I have explicitly supported ideas such as Free Private Cities or Seasteading (founding a state on the sea outside the 12-mile zone). I am heavily involved as a venture capitalist in an existing project of autonomous special zones in Honduras. I think privately run special zones, based on voluntary contracts that cannot be changed unilaterally, are a better solution for our coexistence than large nation states. Personally, I would like to see a world of ten thousand Liechtensteins and Monacos. Precisely because I also know that permanent travel is an option for only a fraction of the population, as they are too conditioned to home immobility.

Enough to fill books. In a nutshell, I would just like to emphasize that all states rely on the organizing principle of "coercion and violence" - i.e. robbery - along with the "knowledge problem" mentioned so importantly by Hayek. Why should a state know better what is good for us than we do? Why should we delegate our innate responsibility for our fellow human beings to an external authority? Why should we allow ourselves to be robbed and still be thankful for it? Why should we allow ourselves to be protected without a right to compensation if this protection does not work? Why should we get educated when we are being brainwashed? Why should we use roads that we could build ourselves? In short: the state is antisocial, not those who flee it. True freedom is incompatible with the state fiction. That is why I will fight to the last breath to enable people all over the world to live a more free life.

The problem of taxes can be defined on several levels. First, they are simply morally degenerate, since they propagate “coercion” and “violence” as a means of human coexistence. They dehumanize us by delegating our innate responsibility for our fellow human beings to a fictitious state construct that supposedly knows better what is good for us than we do. In this way, we are deprived of both the motivation and the opportunity for social responsibility. So taxes are antisocial – not those who avoid them.

Second, from a utilitarian point of view, they are not a good means to an end. They encourage emigration of high performers in the system and waste of funds. Taxes are particularly harmful in democracies because they are more susceptible to vote buying than any other government instrument. In countries like Germany, where 80% of the population are net state profiteers who directly or indirectly receive more from the state than they pay, this is particularly fatal. The spiral towards more taxation thus gets out of control quickly.

Of course, the question arises how to shape human coexistence on a free and voluntary basis. The best approach here is the idea of free private cities, which are currently being implemented as a pilot project in Honduras, for example, with my participation as an investor and ambassador. Here, people voluntarily sign a social contract that includes certain rights, duties and also taxes in order to be allowed to live in a certain area. This is contractually agreed on and cannot be terminated unilaterally by the private operator of this area, as is the case for nation states. Much more, the operator can even be sued for damages if contractual promises such as 100% security are not fulfilled. Imagine suing the German state for not protecting against burglary or theft.

Furthermore, the profit-oriented operation of that area ensures maximum efficiency, so that all minimally necessary community tasks can be organized for a fraction of the usual taxes in Germany. The freedom of trade and regulation in combination with creative inhabitants does the rest to ensure a reasonable infrastructure. A world of thousands of such zones would promise everyone life in areas that meet their personal needs. Communist models can also be tested - but only with voluntary entry, which will probably counteract the success of this social model.

Taxes can be avoided on several levels and on some levels not at all. I also pay quite a bit of sales and consumption taxes in the countries where I stay. I think that is justifiable because it helps finance the infrastructure I use. Even with a complete abstinence from consumption, you would still pay taxes, because taxes are incurred on even the most essential things. I still find indirect taxes relatively fair because everyone pays the same.

This is not the case with direct and progressive taxes, but fortunately these can be avoided. International tax law still lags far behind digitalization and will allow many legal ways out for the foreseeable future. On a personal level, all you have to do is decide to spend less than half of the year in your home country, give up "securities" such as a permanently available apartment, and take your spouse and children with you if you have them. There are still over 80 countries on our planet where you can live practically tax-free with the proper structures in place and so with a good quality of life. Some of the countries are Costa Rica, Uruguay, Thailand, or Dubai. These countries also have direct taxes - but only on certain industries like raw materials or banks, or only for services rendered in the country - and to a much more tolerable extent, so that tax evasion is not a concern.

One can also completely renounce the restrictions of state systems and remain a permanent tourist - perpetual traveler, as I call it. Whether one then travels to 60 countries a year like I do or only sets up base for 4 months at a time in 3 different countries is up to each person. Such a mobile lifestyle is very flexible and brings tons of benefits besides tax. But even if you think you have to stay in Germany, there are many ways to reduce your tax burden on a corporate level. Cooperatives, family foundations, and also foreign companies, for example in neighboring countries with single-digit corporate tax like Poland (9%) are good alternatives under certain conditions.

Definitely yes, but it takes a lot of courage to assert yourself against the prevailing school of thought centered around security in the area of family and friends, especially in Germany, and especially if things do not go so well at the beginning. First you are pitied, then laughed at, then envied.

We are conditioned to the idea that children need to go to school by our own experiences in the "forced school child abduction indoctrination system", as we like to call it. More and more families prefer to let their children learn freely, which is forbidden in Germany. This is often a strong motivation for families to emigrate. In addition to free learning, there are of course a variety of other ways to ensure optimal education for your children on the go.

Most problematic are usually the "sunken costs" of more mature students, who have already built up something in Germany and are climbing the career ladder. They are too comfortable in their situation to dare start a new life model. Even if they want to, they cannot deal with giving up what they invested so much time in over the last few decades. You have to make them understand that you only live once.

Our world is becoming more and more digitized and after 1 year of covid lockdown (at the latest), it should be clear that a large part of our modern services and industries can be mapped digitally. There are thousands of opportunities to start off as a remote employee or freelancer. But it certainly makes more sense to create your own company and thus generate added value for the world. And that certainly does not refer to 25-year-old life coaches, travel bloggers and (Ponzi) network marketers. Whether e-commerce, services, or finances is your thing depends heavily on your personal profile.

I am very pessimistic about the future of our planet in the next decade, but very optimistic about my own situation. Crises are very convenient for every true entrepreneur and investor, because there is a lot that can be done there. The pressure to regulate and prohibit is certainly increasing because the free market narrative is the ideal enemy, even if the actual dynamics are exactly the opposite. The next economic crisis that is about to hit, and which will far overshadow 2009, is once again being attributed to capitalism, although it is actually attributable to the excesses of the money-printing central banks, massive misguided economic incentives and insane covid measures. In a monetary system where the most essential components, namely interest and money supply, are managed centrally, it is the joke of the century to refer to it as a market economy.

Since I started my traveling life and business in 2015, there have been an extreme number of measures designed to reduce tax avoidance. Every law pushes the limits of what is feasible, but there are always new legal loopholes. The beauty is that tax avoidance is a race in which the individual will always outperform the state, provided they have the necessary knowledge, creativity and courage. This also makes my own entrepreneurial position practically a monopoly that one can try to copy but will never truly achieve. I myself am pretty sure that I will continue to live tax-free in 10 years.

90% of my own assets are tied up in illiquid long-term unlisted company investments (private equity). Despite my nomadic lifestyle, I am heavily invested in agriculture. For example, I am a partner in one of the largest walnut plantations in Georgia or own my own grape vines near Mendoza, Argentina. I am invested in companies in real estate, resource exploration and other industries, and I provide venture capital to potentially revolutionary projects such as the Free Private Cities outlined above. These are all projects that are built on solid foundations instead of hype and will therefore survive the next crisis well. On the other hand, I don't think much of stocks in the current market situation - the upside is simply far too small compared to the downside in the event of a potential crash.

I prefer to play speculatively with crypto currencies, in which I have been invested since 2012. Unfortunately, as a poor student, it was not enough for large sums of Bitcoin at the time. But in the past few years, like right now, I have been very happy with price gains of over 10,000% for some coins. I am not a HODLer, but regularly shift the profits into company shares. I consider the current crypto boom to be unsustainable and see a strong correction in the near future, which will be initiated by stricter regulation and a loss of trust (e.g. tether cover).

At the moment, I think it is best to invest in yourself and your survival. I bought and upgraded a catamaran in which I can survive difficult times and reach better areas self-sufficiently with enough water, electricity and food. Furthermore, my land holdings in good agricultural locations also provide food in emergencies. I can currently only recommend a large garden. The limits of the unthinkable are shifting.

Due to all of this, I do not think much of the concept of a pension. You have to be completely “brainwashed” to entrust your money to a pyramid scheme with the hope that you may get it back after several decades. My motto has always been to spend every day of my life as if I were retired. Without a bit of added value, however, life is boring, which many retirees accept. For that reason I will definitely work until I am old, but at the same time, at the age of 30+, I am no longer dependent on ever having to work. That is exactly why my investments have a more long-term character.

Books can be filled with the reply to this question, but at the same time one should not overthink it. In many cases it is sufficient to buy a flight ticket and deregister. Once thrown into the deep end, most things will take care of themselves. Of course, this depends on the individual life situation and is more recommended for a student with a university degree than for an employed family man.

From a tax point of view, it is important to deal with issues such as extended limited tax liability, exit taxation, disentanglement or relocation of functions. But these are only relevant if you earn some money in Germany. The typical freelancer or sole proprietor usually gets off with a black eye. But if you have a GmbH (LLC) and structured it incorrectly from the start (no holding company), then moving out of Germany can be very uncomfortable if you don’t know the solution. An average profit of just 100,000 € in a limited liability company leads to an exit tax of almost 330,000 € when deregistering from Germany.

It is important to understand that one does not formally become “stateless”. You remain a German citizen, can renew your passport at any time, access all kinds of other documents and also return to your home country at any time. Subsequent taxation is only permissible in exceptional cases, for example if the emigration was not planned for the long term from the outset. Anyone who has actually spent several years abroad can return without any problems and put the money they have earned tax-free into the German economy as long as there is a proof of origin.

I have described the best setup for German residents here. Above a certain income and/or wealth, the German system offers numerous legal opportunities to optimize your taxes. Legal forms such as cooperatives, family foundations and corporations in Germany and abroad make the tax burden bearable, even in Germany, when combined correctly. However, it is important to limit consumption – tax benefits only encourage investment.

Nevertheless, the financial and above all time expenditure for such structures should not be underestimated. I would rather live completely tax-free with expenses of 2000 € and have no bureaucracy to consider at all, such as bookkeeping. I prefer to have the option to consume all my money, even if my savings rate is actually over 80%. I'd rather spend time in a country with a pleasant climate, where I can fly my family from Germany, than eke out an existence in an envious society in a cold, wet country with a dilapidated infrastructure. Taxes are by no means the only or even the most important reason to turn your back on Germany.

At the moment I can hardly imagine this scenario. The few reasons for visiting Germany such as freeways without speed limits will soon be history. If I were invited to become German Emperor for a few years, I would be happy to provide my services for my home country. Tremendous changes are indeed necessary. A complete reform of the welfare state towards tolerable taxation and good incentives is only a small part. Germany could be the greatest country in the world, but above all it needs a major change in mentality. In a democracy with 80% net state beneficiaries, that will never happen.

Even after a “big bang” in one generation, this change in mentality cannot be achieved. It takes several decades for German society to heal once the system is put back in order. In this respect, I limit myself to short visits to people I value who have decided to live with the system. Finally, I can appreciate that most of humanity longs for security rather than freedom. Nevertheless, by implication, I will not allow my freedom to be taken away from me. Not now and certainly not in the future.

A perpetual traveler can neither be forbidden nor be put off from traveling. However, they focus more intensely on a few countries that offer as many freedoms as possible. Their mobility and overview of global dynamics help them to find a location worth living in for the long term. Potential risk areas, for which government travel warnings are issued, are usually of particular interest to them.

The global travel restrictions blindsided me on the Yemeni island of Socotra in mid-March, as I was without internet connection for a few days. I left on one of the last flights to Egypt and a short time later flew to Sao Paolo in Brazil via Dubai. Because of various local acquaintances, I wanted to spend the expected global lockdown on the Riviera Maya in Mexico, which was a very good decision for the time being. Only after Easter (mid-April) were there significant restrictions, which culminated in the flight from Playa del Carmen to Sweden at the end of April. By the way, everything was very relaxed back then without a mask when everyone thought that no planes were taking off. After an extensive road trip of 6000km through Sweden with skiing fun in the last open ski area in the world, Croatia opened up for entry at the end of May for economic reasons, which also included tourism. Since the beginning of June I explored all of Croatia and neighboring countries such as Slovenia and used the time to fulfill my long-cherished dream of owning my own ocean-going boat - the purchase of a Lagoon380 catamaran. Equipped accordingly and fully self-sufficient, we can now simply sail away from the next lockdowns.

In principle, I expect that freedom to travel will be restored, but many countries are now taking a different approach and no longer relying on extreme mass tourism. Because of their proximity to China, some Asian countries tend to focus more on luxury tourism and make it difficult for backpackers to enter the country. Others now want to enable a longer-term stay in the country via “Digital Nomad Visa”. Thanks to digitization enforced by lockdowns, location-independent working will flourish in the coming years and favor such programs. However, collecting countries may become more difficult in the next few years – but not impossible. Unfortunately, a covid vaccination will probably be mandatory.

Basically, I am more of a fan of Latin American countries because they correspond to my preferred way of life in many ways. These include Colombia, Peru or Argentina - unfortunately all countries that are driving very hysterical corona lockdowns and are thus being set back a decade in their economic development. There are more reasonable measures in Brazil and Mexico, which I also appreciate very much. Both are large, scenically diverse countries with many different climate zones, excellent food (at least for steak lovers), open-minded people, a positive mentality and zest for life and relatively good infrastructure at acceptable prices. I don't see high levels of crime as a counterargument, as this is much easier to calculate than in Germany, for example. Some areas are simply no-go zones, but also offer little that is interesting.