Tax Advantages and Anonymity

If you mainly do business in your home country, the importance of your local bank account may not be a priority. This is often considered secondary as long as you do not operate internationally.

As soon as business goes beyond national borders, you are often operating offshore. An offshore company is a legal entity that is registered in a country where it has little or no economic activity. These countries, often referred to as “offshore financial centers”, usually offer tax advantages and greater anonymity for the owners.

Tax Advantages and Anonymity

Strategic Importance of Offshore Business

If you mainly do business in your home country, the importance of your local bank account may not be a priority. This is often considered secondary as long as you do not operate internationally.

As soon as business goes beyond national borders, you are often operating offshore. An offshore company is a legal entity that is registered in a country where it has little or no economic activity. These countries, often referred to as “offshore financial centers”, usually offer tax advantages and greater anonymity for the owners.

Legal and Sensible

Demystifying the Offshore Perception: Geographical Facts, Not Moral Judgments

Offshore, however, often has an unpleasant connotation, as if there is something rotten that just won’t go away. But if you look at it closely, “offshore” simply means “in a country other than the one in which you live or work”. It’s a geographical description, not a moral one.

A good example is the US LLC. For Americans it is simply a form of company, but for others it means doing business “offshore”. So if a German or British owns a US LLC and has a bank account in the USA, he has both a foreign company and an offshore bank account – fully legal and not punishable on any way!

Legal and Sensible

Demystifying the Offshore Perception: Geographical Facts, Not Moral Judgments

Offshore, however, often has an unpleasant connotation, as if there is something rotten that just won’t go away. But if you look at it closely, “offshore” simply means “in a country other than the one in which you live or work”. It’s a geographical description, not a moral one.

A good example is the US LLC. For Americans it is simply a form of company, but for others it means doing business “offshore”. So if a German or British owns a US LLC and has a bank account in the USA, he has both a foreign company and an offshore bank account – fully legal and not punishable on any way!

Untangling Offshore Banking

Clever Tax Avoidance Instead of Hasty Tax Evasion

Many see offshore banking as shady, as it is associated with tax evasion and money laundering. However, there is a big difference between tax evasion (illegal) and tax avoidance (legal means of reducing tax obligations).

Governments around the world have successfully painted a negative picture of offshore banking, ironically, while some of its biggest critics are secretly profiting from it.

Now we reveal to you the truth behind this other scam you’ve been sold.

Untangling Offshore Banking

Clever Tax Avoidance Instead of Hasty Tax Evasion

Many see offshore banking as shady, as it is associated with tax evasion and money laundering. However, there is a big difference between tax evasion (illegal) and tax avoidance (legal means of reducing tax obligations).

Governments around the world have successfully painted a negative picture of offshore banking, ironically, while some of its biggest critics are secretly profiting from it.

Now we reveal to you the truth behind this other scam you’ve been sold.

Secure Your Money

The World Is Big. So Are Your Assets.

Maybe you think offshore banking is okay, but it just doesn’t fit your vibe right now.

“Offshore” doesn’t just refer to some remote island or something that is reserved exclusively for millionaires and billionaires.

It’s a question of perspective. What is inland for one person is “offshore” for another. And that alone makes it neither good nor bad. It is simply a business decision based on the needs and circumstances of the individual.

“Going offshore” is also a form of asset protection because it makes confiscating your money more challenging.

Why should everyone know what you own?

Keep your assets discreet and avoid prying eyes!

Secure Your Money

The World Is Big. So Are Your Assets.

Maybe you think offshore banking is okay, but it just doesn’t fit your vibe right now.

“Offshore” doesn’t just refer to some remote island or something that is reserved exclusively for millionaires and billionaires.

It’s a question of perspective. What is inland for one person is “offshore” for another. And that alone makes it neither good nor bad. It is simply a business decision based on the needs and circumstances of the individual.

“Going offshore” is also a form of asset protection because it makes confiscating your money more challenging.

Why should everyone know what you own?

Keep your assets discreet and avoid prying eyes!

Secure Your Money

Our Service: Offshore Account in Georgia

denationalize.me offers secure and modern banking and brokerage solutions in Georgia. With our TBC Concept bank account and brokerage service, you can take advantage of the benefits to protect, grow and invest your wealth globally. Whether you’re looking for straightforward account management and a variety of currency options, or tax-free brokerage and limitless access to global markets, you’ve come to the right place.

Secure Your Money

Our Service: Offshore Account in Georgia

denationalize.me offers secure and modern banking and brokerage solutions in Georgia. With our TBC Concept bank account and brokerage service, you can take advantage of the benefits to protect, grow and invest your wealth globally. Whether you’re looking for straightforward account management and a variety of currency options, or tax-free brokerage and limitless access to global markets, you’ve come to the right place.

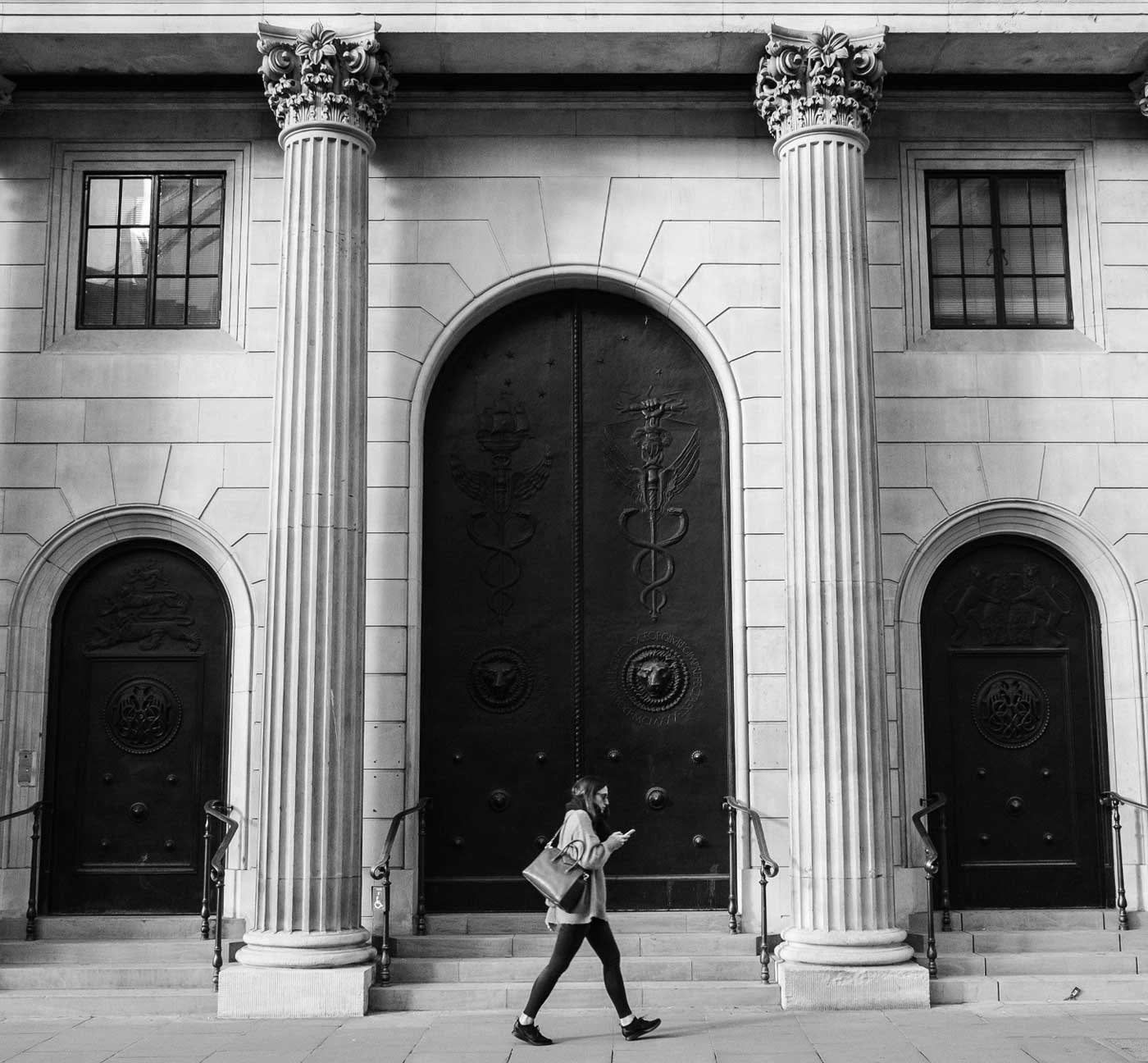

A Business Account with Global Advantages and Discretion

Offshore Account in the USA

JP Morgan Chase Bank offers a special business account in Florida for international business people, ideal for parking and utilizing funds worldwide. This account, coupled with a US LLC, allows personal transactions with the anonymity of a business account. It offers up to 500 fee-free transactions monthly, unlimited electronic deposits, cash deposits up to $25,000 USD with no fees, and Zelle and Bill Pay for fast wire transfers and bill payments in the US. Account holders enjoy premium banking services, high deposit protection, and the ability to build a credit history without CRS reporting. Account opening requires a minimum deposit of $100,000 and the formation of a Florida LLC, with a total cost of USD $3,950.

A Business Account with Global Advantages and Discretion

Offshore Account in the USA

JP Morgan Chase Bank offers a special business account in Florida for international business people, ideal for parking and utilizing funds worldwide. This account, coupled with a US LLC, allows personal transactions with the anonymity of a business account. It offers up to 500 fee-free transactions monthly, unlimited electronic deposits, cash deposits up to $25,000 USD with no fees, and Zelle and Bill Pay for fast wire transfers and bill payments in the US. Account holders enjoy premium banking services, high deposit protection, and the ability to build a credit history without CRS reporting. Account opening requires a minimum deposit of $100,000 and the formation of a Florida LLC, with a total cost of USD $3,950.

Fast and Discreet Account in the Dominican Republic for Global Citizens

Offshore Account in the Dominican Republic

In the Dominican Republic, you can open an anonymous bank account within a week. This is ideal for non-residents who value discretion and security. The country offers financial privacy due to its non-participation in the Common Reporting Standard (CRS) and limited tax treaties. Benefits include IBAN access, integration into the Central American payment network SIPA, accounts in USD and EUR, and low account maintenance fees. Opening an account requires personal presence in Santo Domingo, but no proof of address. The country’s leading banks, including Banco Popular, BHD and Santa Cruz, allow residents and non-residents to open accounts.

Fast and Discreet Account in the Dominican Republic for Global Citizens

Offshore Account in the Dominican Republic

In the Dominican Republic, you can open an anonymous bank account within a week. This is ideal for non-residents who value discretion and security. The country offers financial privacy due to its non-participation in the Common Reporting Standard (CRS) and limited tax treaties. Benefits include IBAN access, integration into the Central American payment network SIPA, accounts in USD and EUR, and low account maintenance fees. Opening an account requires personal presence in Santo Domingo, but no proof of address. The country’s leading banks, including Banco Popular, BHD and Santa Cruz, allow residents and non-residents to open accounts.

A variety of banks for individual needs: Why choosing the right bank is crucial and how diversification offers financial security!

Banks are not interchangeable – depending on your needs, one bank and its account offering may suit you better than another.

Known From:

Current Guidelines

Offshore Banking in the Light of the OECD

In recent years, the OECD – Organization for Economic Cooperation and Development – has increased international financial transparency in order to combat tax evasion. It has standardized the automatic exchange of information and listed non-cooperating tax havens. This has a significant impact on offshore banking. The OECD also emphasizes that companies should have genuine economic activities in their country of business, not just for tax reasons (Economic Substance Regulation).

With the right planning and advice, you can still benefit from the advantages of offshore banking while complying with all legal and tax requirements.

So there is no need to shy away from it. What counts is the correct and informed approach in order to act in a legal and tax-optimized manner.

Current Guidelines

Offshore Banking in the Light of the OECD

In recent years, the OECD – Organization for Economic Cooperation and Development – has increased international financial transparency in order to combat tax evasion. It has standardized the automatic exchange of information and listed non-cooperating tax havens. This has a significant impact on offshore banking. The OECD also emphasizes that companies should have genuine economic activities in their country of business, not just for tax reasons (Economic Substance Regulation).

With the right planning and advice, you can still benefit from the advantages of offshore banking while complying with all legal and tax requirements.

So there is no need to shy away from it. What counts is the correct and informed approach in order to act in a legal and tax-optimized manner.

So, is it still worth going abroad?

Transparency and Compliance

The days of “black money” are over. Offshore banks have strict KYC (Know Your Customer) and AML (Anti Money Laundering) processes. This means that customers must provide detailed information about their financial activities.

These regulations require foreign banks to share information about their account holders:

- CRS: Common Reporting Standards

- Multilateral exchange of information between countries

- Current accounts, savings accounts, custody accounts, accounts of foundations and trusts, accounts of companies with predominantly passive income, etc.

- FATCA: Foreign Account Tax Compliance Act (exchange of information with the USA)

- All foreign financial institutions (FFIs) must report the assets and identity of US persons

- TIEAs: Tax Information Exchange Agreements

- Individually negotiated bilateral agreement between countries

- Primarily concluded by high-tax countries with each other and with tax havens

- DTAs: Double Taxation Agreements

- They regulate how much of a certain type of tax each country can levy

So is it still worth going abroad? Absolutely. Even though absolute secrecy may be a thing of the past, the benefits of asset diversification, protection and global financial opportunities absolutely remain.

So, is it still worth going abroad?

Transparency and Compliance

The days of “black money” are over. Offshore banks have strict KYC (Know Your Customer) and AML (Anti Money Laundering) processes. This means that customers must provide detailed information about their financial activities.

These regulations require foreign banks to share information about their account holders:

- CRS: Common Reporting Standards

- Multilateral exchange of information between countries

- Current accounts, savings accounts, custody accounts, accounts of foundations and trusts, accounts of companies with predominantly passive income, etc.

- FATCA: Foreign Account Tax Compliance Act (exchange of information with the USA)

- All foreign financial institutions (FFIs) must report the assets and identity of US persons

- TIEAs: Tax Information Exchange Agreements

- Individually negotiated bilateral agreement between countries

- Primarily concluded by high-tax countries with each other and with tax havens

- DTAs: Double Taxation Agreements

- They regulate how much of a certain type of tax each country can levy

So is it still worth going abroad? Absolutely. Even though absolute secrecy may be a thing of the past, the benefits of asset diversification, protection and global financial opportunities absolutely remain.

Secure and Efficient Banking

Indispensable Touchstones in Offshore Banking

Offshore banking can be an excellent way to protect assets and benefit from special advantages. However, when choosing the right offshore bank, it is important to consider various factors to minimize potential risks.

These include the bank’s license, access to its financial reports, online banking security, card offering, KYC policy and the overall reputation of offshore banking.

Secure and Efficient Banking

Indispensable Touchstones in Offshore Banking

Offshore banking can be an excellent way to protect assets and benefit from special advantages. However, when choosing the right offshore bank, it is important to consider various factors to minimize potential risks.

These include the bank’s license, access to its financial reports, online banking security, card offering, KYC policy and the overall reputation of offshore banking.

All Is Not Lost Yet

There Is a Legal Escape Route Everywhere

- “Tax haven” USA: For non-US citizens, the USA is indeed a tax haven. The USA has not signed the CRS (Common Reporting Standard), which means that it is not obliged to disclose information on bank accounts of non-US citizens to other countries.

- No CRS exchange of existing business accounts under USD 250k: Existing accounts with a balance of less than USD 250,000 are often exempt from CRS reporting requirements.

- Account balance is only exchanged on the reporting date: Only the balance on the reporting date (usually December 31) is exchanged. This means that financial movements that take place after this date are not reported in the current year.

All Is Not Lost Yet

There Is a Legal Escape Route Everywhere

- “Tax haven” USA: For non-US citizens, the USA is indeed a tax haven. The USA has not signed the CRS (Common Reporting Standard), which means that it is not obliged to disclose information on bank accounts of non-US citizens to other countries.

- No CRS exchange of existing business accounts under USD 250k: Existing accounts with a balance of less than USD 250,000 are often exempt from CRS reporting requirements.

- Account balance is only exchanged on the reporting date: Only the balance on the reporting date (usually December 31) is exchanged. This means that financial movements that take place after this date are not reported in the current year.

Risk Prevention and Utilization of Opportunities

An offshore account is a financial account that is opened in a foreign country and can offer various financial benefits. There are several reasons why individuals or companies may consider an offshore account:

Our Offers for Your Banking without Borders

In today’s complex, digitalized world, sound knowledge is not only your strongest weapon, but also your duty. Therefore our motto is that information is only worth something if you can use it for your benefit. Only then will your life be self-determined and free.

With the experience of thousands of successful consultations, we show you how to benefit from the advantages of the globalized world. Our topic-specific eBooks and exclusive video courses provide you with practical and relevant information. That way you can free yourself quickly, adequately and with legal certainty from unnecessary tax burdens and bureaucratic shackles.

Banking Encyclopedia

The Banking Encyclopedia is your comprehensive guide to the world of finance that does away with outdated beliefs. Dive into the reality of why the money that you have in the bank does not really belong to you, but to the bank, and learn how you can change that.

eBook

Banking Encyclopedia

The Banking Encyclopedia is your comprehensive guide to the world of finance that does away with outdated beliefs. Dive into the reality of why the money that you have in the bank does not really belong to you, but to the bank, and learn how you can change that.

Secret Knowledge Video Course

Immerse yourself in the multifaceted world of finance:

Bank Accounts & Compliance: Explore the details of bank accounts and the importance of compliance in this area.

Asset protection & investment: How do we protect our assets from increasingly invisible global threats and invest them intelligently?

Crypto and Co.: An introduction for anyone who wants to immerse themselves in the world of cryptocurrencies. Understand before you speak!

Secret Knowledge Video Course

Immerse yourself in the multifaceted world of finance:

Bank Accounts & Compliance: Explore the details of bank accounts and the importance of compliance in this area.

Asset protection & investment: How do we protect our assets from increasingly invisible global threats and invest them intelligently?

Crypto and Co.: An introduction for anyone who wants to immerse themselves in the world of cryptocurrencies. Understand before you speak!

denationalize.me Company Setup

Consultation with Christoph Heuermann

Christoph and the denationalize.me team are on hand to offer you tailored advice on all financial matters. From the optimal structure of your bank account, effective asset protection and intelligent investment strategies to an introduction to the world of cryptocurrencies – we will accompany you on your path to financial security and prosperity.

denationalize.me Company Setup

Consultation with Christoph Heuermann

Christoph and the denationalize.me team are on hand to offer you tailored advice on all financial matters. From the optimal structure of your bank account, effective asset protection and intelligent investment strategies to an introduction to the world of cryptocurrencies – we will accompany you on your path to financial security and prosperity.

Stay Up To Date

Discover the Latest Blog Articles

Because your life is yours – we are always one step ahead. This is the only way we can develop pragmatic and targeted solutions for you. To ensure that you always have your finger on the pulse, you can find the most important news, trends and developments in our blog.

Here you will find a list of the latest blog articles on the topic of banking. Written by experts with years of experience in the industry. Always prepared in such a way that you easily get the information that is relevant to you.

Stay Up To Date

Discover the Latest Blog Articles

Because your life is yours – we are always one step ahead. This is the only way we can develop pragmatic and targeted solutions for you. To ensure that you always have your finger on the pulse, you can find the most important news, trends and developments in our blog.

Here you will find a list of the latest blog articles on the topic of banking. Written by experts with years of experience in the industry. Always prepared in such a way that you easily get the information that is relevant to you.

Videos

Be Informed on YouTube

We regularly provide information on various topics on YouTube. You can also find videos on setting up a company abroad that will provide you with valuable knowledge. Take a look at our channel!

Videos

Be Informed on YouTube

We regularly provide information on various topics on YouTube. You can also find videos on setting up a company abroad that will provide you with valuable knowledge. Take a look at our channel!