The development of the Catawba Digital Economic Zone (CDEZ) is changing the offshore business landscape in the USA. Today we are going to explain how Catawba LLCs work and the advantages they have.

While states such as Wyoming, Florida or Delaware were hitherto considered the best destinations for company start-ups, a small Native American reservation in South Carolina is establishing itself as a promising new player in the LLC landscape.

We regularly talk about the many advantages of USA LLCs so, if you read us regularly, it will come as no surprise to hear us say that they are a great option (at least if you do not live in a country with a heavy tax burden). We focus on how we can help you form, transfer, manage and administer companies. Our content offers an in-depth look at the different USA LLCs and illustrates how we help our clients bring their business visions to life…

And another favourite has just arrived on our recommended list!

The Catawba Digital Economic Zone (CDEZ) represents a remarkable innovation in the world of the digital economy: as a special economic zone, this revolutionary Native American reservation offers a unique combination of regulatory flexibility and the latest technologies specifically tailored to the needs of digital businesses.

With its ability to transform traditional business landscapes, the CDEZ is an attractive option for entrepreneurs and investors seeking an efficient and forward-looking environment in which to do business. At the same time, the advantages inherent in the typical US LLC structure remain fully intact in this special economic zone.

Pioneering breakthrough in the US digital economy

Born out of a visionary partnership between members of the Native American Catawba Nation and innovation-driven US entrepreneurs, the CDEZ is positioning itself as the premier jurisdiction for digital assets. It was introduced at the end of 2022.

This preferred status is underscored by the historic adoption of the Uniform Law Commission’s proposed amendments to the Uniform Commercial Code (UCC) in the United States, which established an advanced regulatory framework for the handling of digital assets such as FinTechs, cryptocurrencies, NFTs and other constantly and frenetically evolving technologies.

The CDEZ responds to regulatory ambiguity in the fast-paced world of emerging technologies by creating a legal ecosystem that fosters innovation while providing minimal regulatory barriers. With its precise definitions and classifications for different types of digital assets, it creates fertile ground for digital businesses. It is in line with SEC regulations, which until now discouraged many entrepreneurs from using LLCs.

This legal innovation has been made possible by the unique autonomy of Native American tribes, which have a self-governing capacity similar to that of states. This freedom allows them to enact and administer their own trade and commerce laws, as long as they remain consistent with US federal law.

The zone is administered by the Zone Authority, which is responsible for researching, creating, amending, and approving regulations. The Zone Authority is governed by a board of 5 commissioners appointed by elected leaders, Catawba Corporations (the nation’s business arm) and the for-profit management entity. The Zone Authority is supported by a team of experts in areas such as Web3, FinTechs, digital assets and blockchain governance. The Digital Economic Zone reports on transparency to the General Council of the Catawba Nation twice a year and to the Catawba Executive Committee every three months.

In this novel legal framework, the CDEZ offers the opportunity to run your business with digital independence and legal certainty, regardless of your physical location. Naturally, it is a great pleasure for us to make this promising opportunity known to you and to all Perpetual Tourists around the world.

What are the advantages of the CDEZ?

The advantages are many and forward-looking. The Catawba Indian Nation, the only federally recognised tribe in South Carolina, has not only regained its autonomy after losing its recognition in 1959, but has established a new digital jurisdiction in the United States.

This innovative economic zone is staffed by a team of Web 3.0 experts who were inspired by the Estonian e-residency programme and developed a simplified platform for e-residents in the United States. The key difference in Catawba is that the e-residency process is instantly accessible and does not require a physical card.

With a few clicks, local and international entrepreneurs can now easily open a US offshore account, open US bank accounts, conduct their business online in a secure and regulated environment and bypass the unnecessary red tape often associated with setting up a company.

Unlike other US states, such as Delaware (which do not yet have specific Web 3.0 regulations and continue to rely on traditional methods), the CDEZ handles everything digitally.

This digital efficiency, complemented by fast and direct email communication and a shared Discord server, ensures that decisions and regulations are flexibly adapted to community members’ suggestions.

Any resident or citizen who is not on an international blacklist can set up a company in the Catawba Digital Economic Zone. Here, no one cares where you come from. Setting up in Catawba does not require a lot of documentation either: no passport, no proof of residence, no bank references… just a name, an address, an ID, and a selfie. The process is completed within 24 working hours.

Of course, Catawba e-residency, like Estonian e-residency, does not grant the right to physical residence in the country —which, in most cases, you will want to avoid at all costs anyway. Note that tax residency in the US carries with it a tax liability. What electronic residency does allow you is access to Catawba’s digital infrastructure for business purposes.

Of course, you can also set up an LLC at Catawba with Denationalize.me and leave everything to us.

Catawba’s e-residency does not include support with tax or administrative questions regarding LLCs and does not help you with the application for a tax identification number (EIN), which is also necessary to set up an LLC in the CDEZ.

And how much does all this cost?

The SEZ clearly stands out from other jurisdictions in terms of cost-effectiveness. A comparative table prepared by the CDEZ shows a detailed analysis of the prices and conditions of the various jurisdictions, in which Catawba appears to be the most economically advantageous.

When looking for a suitable jurisdiction for your offshore business, simplicity, accessibility, first-class infrastructure and thriving financial opportunities are key. A key feature of the CDEZ is the simplicity of registering various forms of company, which is particularly attractive to Perpetual Tourists. Costs are in line with other attractive US states, such as Wyoming, and can be offered as a complete package through Denationalize.me.

The CDEZ has certain similarities with Próspera, a special economic zone in Honduras that aims to create an attractive environment for international companies and investors. Both the CDEZ and Próspera demonstrate that the creation of special economic zones with customised legal and economic frameworks can provide fertile ground for the development of digital and technological innovation.

In addition to competitive costs and low bureaucracy, this special zone also offers an attractive regulatory process that allows for active participation in the establishment of business regulations. You can consult both the regulations already adopted and those in the voting process on the CDEZ website.

The innovation of the CDEZ lies in its transparency and the direct involvement of business. Opinions can be expressed directly via Discord or the form on their website, and the Advance Notice of Proposed Rulemaking (ANPRM) indicates the deadlines for commenting on upcoming regulations.

These aspects make the CDEZ a highly competitive option compared to other jurisdictions. Perpetual travellers, digital nomads, freelancers, those engaged in e-commerce, software developers, online coaches and consultants, content creators, startups, and anyone else doing business online and remotely will leave their business in good hands with the Catawba option. However, the area is especially interesting for companies with digital assets, such as Bitcoin and so on.

Which state should I choose for my LLC —is Catawba, Wyoming, or Delaware better?

Which state should I choose for my LLC —is Catawba, Wyoming, or Delaware better?

To choose the most appropriate state with which to enter the US market, it is essential to analyse the advantages of the most well-known US jurisdictions, such as Wyoming and Delaware.

Below are the key steps Catawba has taken to differentiate itself from these jurisdictions:

Catawba vs. the Wyoming Special Economic Zone.

- Definitions specific to digital assets

The CDEZ was created to offer an even more competitive alternative to Wyoming for digital assets. While Wyoming does not explicitly define a legal classification for NFTs, the Catawba Digital Economic Zone innovates by clarifying their status as digital securities or consumer goods.

- Flexible legal models

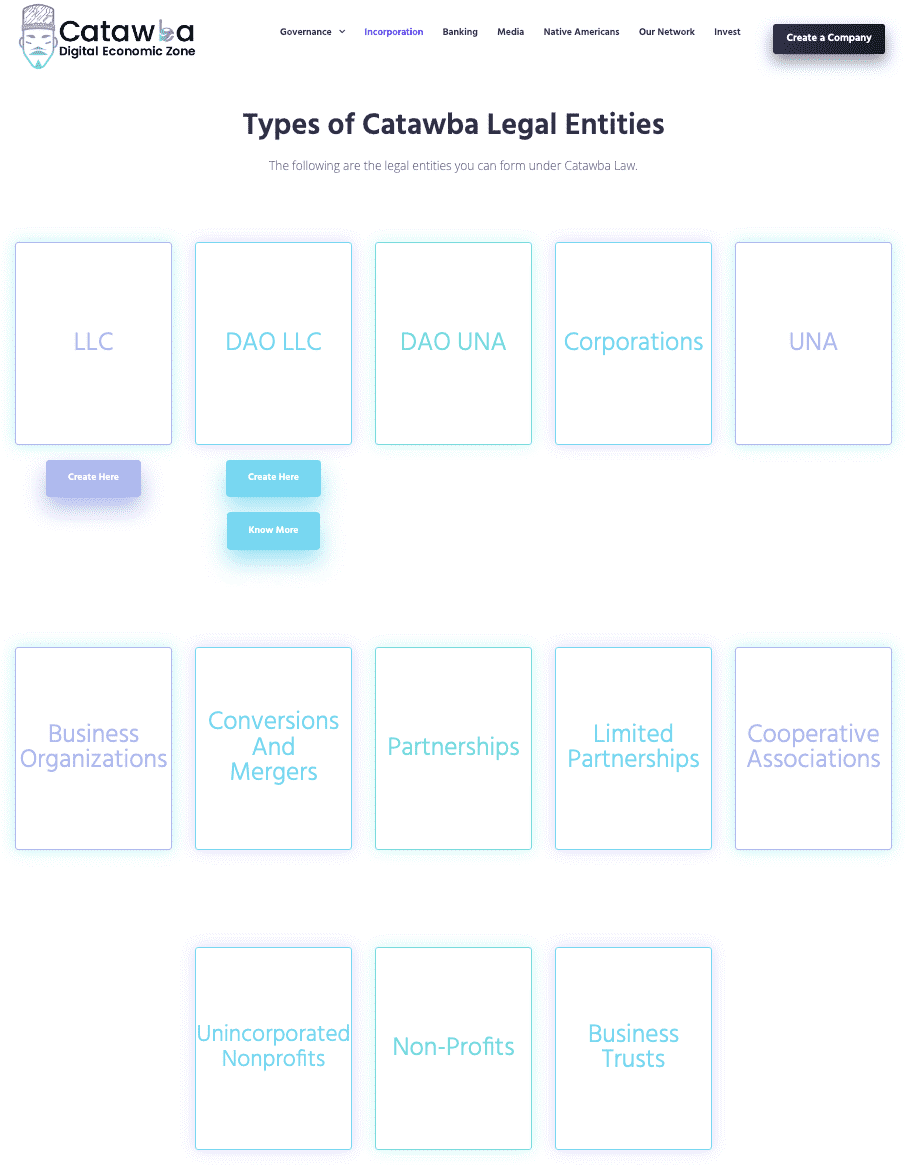

In Catawba, companies can adopt different legal forms – from LLCs to C-Corps – all of which can be managed remotely. Alternative dispute resolution mechanisms are possible, while Wyoming requires the inclusion of these mechanisms in bylaws or smart contracts.

- Unincorporated Nonprofit Association (UNA)

While both jurisdictions allow decentralised autonomous organisations (DAOs) to be formed into an LLC, the CDEZ offers an additional unique option to form a DAO in the form of a UNA. This flexibility allows DAOs to be governed primarily by their principles or by an operating agreement, allowing for greater flexibility while maintaining limited liability.

- Regulatory flexibility

While Wyoming reviews its regulations every two years, the Catawba Digital Economic Zone holds regulatory meetings partly every 15 days. This makes the CDEZ much more flexible in assessing and adopting new regulations, ensuring that companies operating in the zone are always up to date and compliant with the latest laws. This is crucial in a market as fast-changing as the cryptocurrency market.

Catawba vs. the Delaware Digital Economic Zone

- Removing bureaucratic hurdles

The CDEZ laws were developed and improved with the aim of ending Delaware’s monopoly on US company registration. This was achieved by eliminating unnecessary bureaucracy and fees, and providing an online solution for company registration, payments and updating.

This is a feature rarely found in the state laws of older jurisdictions such as Delaware.

- Substantial savings

Delaware LLCs are better known, but the CDEZ offers similar advantages at a lower cost. More specifically, it eliminates the franchise tax. That is, the annual fees for a Delaware LLC are significantly higher in comparison (about EUR 500 more).

- Express filing

The Catawba Digital Economic Zone offers immediate registration processing, whereas the Delaware process can take up to 10 working days. CDEZ LLCs are usually registered within 24 hours.

- Efficient online platform

Unlike Delaware, where paperwork and face-to-face meetings are involved, the CDEZ has introduced an online platform that streamlines the process. This means that all procedures are handled digitally, allowing for a more efficient service tailored to the needs of a modern company.

And now, you ask, what about Florida?

Florida is the state we recommend most often and where we incorporate the most companies. In general, Florida offers stability and access to traditional networks and markets along with legal certainty. The CDEZ, on the other hand, offers an innovative alternative with a focus on digital technologies. Florida remains the recommended choice for all service providers with a B2B focus. In fact, Florida is the only state in the USA where we have our own offices for mail forwarding and local support (although we can of course also register companies in all other states).

The choice between the Catawba Digital Economic Zone and Florida for your company incorporation depends on different priorities tailored to specific business needs and objectives. Florida, with its long history as a business-friendly state, offers transparent corporate registration, while Catawba (which follows in the tradition of Delaware and Wyoming) anonymises the managers of an LLC. Anonymity has advantages, but it can also be a disadvantage in certain cases (to open certain bank accounts or to give more security to our clients). Those who are willing to be transparent with their Florida LLC (i.e. anyone can find their company in the commercial register in a matter of seconds and know who the managers are) enjoy a higher level of transparency and a better reputation.

In contrast, the CDEZ positions itself as an innovative hub for digital and technology-driven companies. Focused on digital assets and cutting-edge technologies such as cryptocurrencies and blockchain, the CDEZ offers a customised legal structure where transparency is not a major concern. This specialisation provides a dynamic and flexible platform for companies that want to operate in the digital sector and supports innovative business models that rely on agility and rapid adaptation to technological changes.

Another key advantage over Florida is its speed: you can register your company in a matter of one day, instead of the usual 10 days in Florida. In addition, and this is really unique, the LLC can be formed at any time in the past: this means that your new LLC formation can have been in business for 10 or more years if it is important to you that it should be. In other words, Catawba offers pre-built company formation. Of course, it should be made clear that the area has not been in existence that long.

Remember that we are not talking about a situation where you must choose between “one or the other”. If you want, you can combine both structures… And you can also form several LLCs in Florida and Catawba.

Both places have their unique advantages. If you want to find out which destination suits you best in your specific case, do not hesitate to book a consultation with us.

The banking system

LLCs in Catawba can also use Wise, Stripe, Mercury and so on. In fact, there is an extensive list of banking alternatives in both the US and the EU, with over 30 options.

As the CDEZ is new, original, and different from any previous structure, the issue of the banking system is still evolving today. They have recently adopted a regulatory code for banking and financial services. This code allows financial services companies and banks to be licensed under the laws of the Indian Nation of Catawba and the regulation of the Zone Authority. The CDEZ’s invitation to prospective regulators and financial experts underlines its commitment to maintaining the integrity and stability of the financial sector within the zone. There is currently cooperation with the Pinnacle Bank of Iowa, also managed by Native Americans.

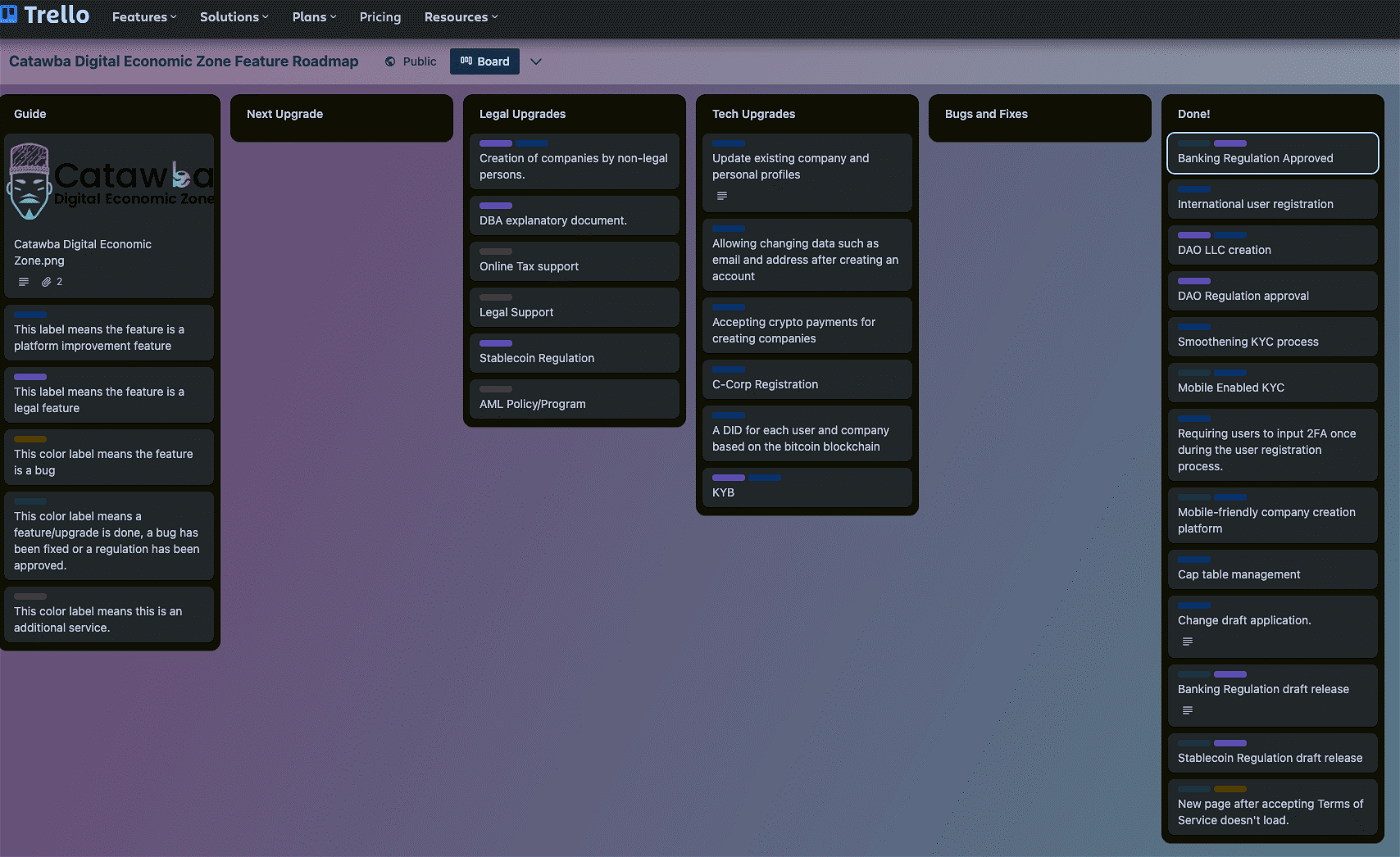

They even have a publicly available functional roadmap that further underlines how supportive they are of technology and shows their more agile approach. Entrepreneurs in the crypto world who want to clarify certain doubts from a legal point of view can also submit their regulatory proposals here.

How the CDEZ is innovating in the digital marketplace

How the CDEZ is innovating in the digital marketplace

The CDEZ exemplifies the evolution of Special Economic Zones (SEZs) from traditional models to digital innovation. SEZs were originally conceived as catalysts for economic growth and technological advancement, and the CDEZ has successfully translated this concept to the online marketplace.

The CDEZ has achieved this because it has constantly adapted its regulations to the evolution of the digital market. This can only be achieved by avoiding introducing unnecessary obstacles for companies located in its area while creating a dynamic and innovation-friendly environment.

A key aspect of the CDEZ is the progressive regulation of digital assets. Catawba was one of the first US jurisdictions to legalise the use of blockchain technology and establish clear definitions for digital assets, virtual currencies, digital securities and NFTs.

These rules classify digital assets as personal property and thus create a sound legal basis for their use, ownership, and management. They ensure the protection of the rights of individuals and businesses in the digital financial sector and create a regulated environment for technological innovation.

In addition, the CDEZ has adopted some of the best practices from the banking laws of the states of South Dakota, North Dakota, and Wyoming to ensure balanced banking regulation. This allows CDEZ companies to benefit from a banking-friendly legal system that facilitates access to international financial systems. But do not forget that the money you deposit in the bank does not belong to you, but to the bank.

Another innovative step taken by the CDEZ is the recognition and regulation of DAOs (Decentralised Autonomous Organisations). DAOs, which operate as groups without centralised leadership and make decisions based on the blockchain, can be structured as LLCs in the CDEZ. This arrangement provides the limited liability protections and tax advantages of an LLC, while maintaining the unique characteristics of DAOs. In addition, the CDEZ plans to introduce a new legal form for DAOs: Unincorporated Nonprofit Associations (UNA), which will offer even more flexibility in governance.

Overall, the CDEZ demonstrates how an SEZ can take a leading role in the digital economy by constantly adapting to the needs of the digital market and introducing advanced legal structures.

With our extensive experience in establishing and managing LLCs, we will be happy to help you achieve your business goals in this innovative jurisdiction. Just get in touch with us!

How the CDEZ is innovating in the digital marketplace

How the CDEZ is innovating in the digital marketplace