Almost exactly 7 years ago I was preparing to emigrate and leave Germany (at the end of 2016). Staatenlos.ch (the German version of Denationalize.me) helped me prepare for my new life as a tax-free Perpetual Traveller. Thanks to this, I was able to start my life as a digital nomad smoothly with the arrival of 2017, despite having only one and a half months’ salary as start-up capital.

[Note: This guest post was written by Dennis, a Perpetual Tourist who is currently working with us].

Although I knew about the existence and functioning of Bitcoin back in 2013, at that time I was still too influenced by economic myths (such as the doctrine of the intrinsic value of things) to fully understand the potential of this cryptocurrency. Well, I will say in my defence that I was still fresh from both my economics course in college and my business administration syllabus. Thank goodness that Denationalize.me also shares its knowledge about economics… As my personal case shows, such abstract and general theories and information can have a very practical impact on your own life. In this article, I would like to tell you the 10 reasons why I am optimistic about the Bitcoin situation in 2024 (and indeed in the years to come).

Reason number 1: the rate of hodlers is steadily increasing.

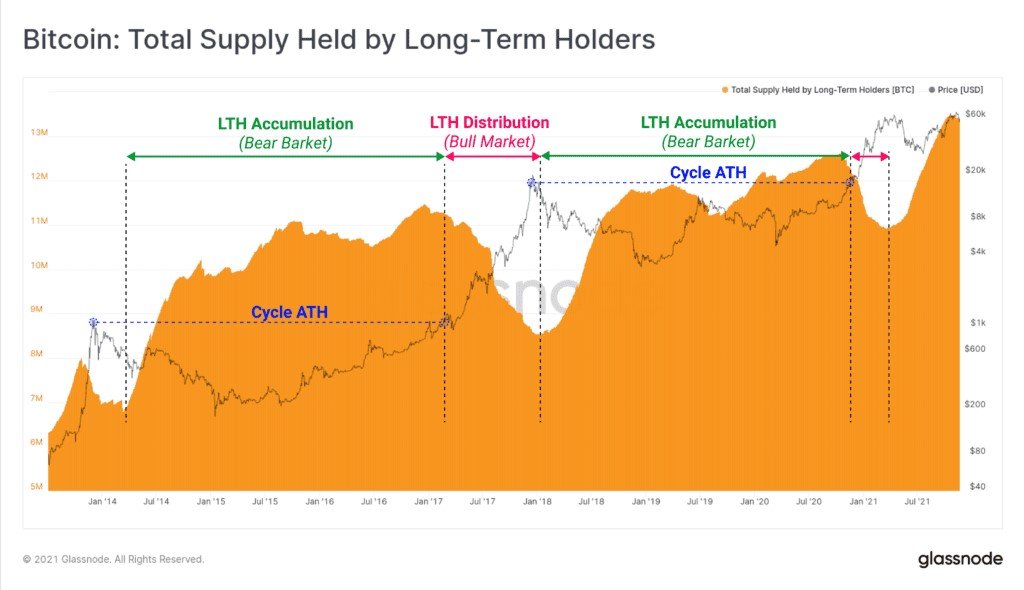

In the international Bitcoin scene, the word hodl means to hold Bitcoin for the long term instead of selling it in a bear market. One visibly frustrated and drunk Bitcoiner wrote the word in a forum during an early-stage bear market meaning that he would hold his bitcoins despite all the losses. Since then, long-term investors who do not sell their bitcoins despite volatility are called hodlers. The key is that the proportion of bitcoins held by these investors increases steadily with each market cycle. Naturally, this is partly due to the fact that many of the early bitcoin portfolios have been lost forever, but with each cycle, which initially launches many short-lived adventurers into the market, more and more truly loyal investors emerge.

We have reached a point where, although prices have risen sharply again, the rate of hodling is steadily increasing. Fewer and fewer Bitcoiners are willing to exchange their valuable satoshis for reprintable fiat money. Although the hodling rate is likely to fall again in the next bull market, there are many indications that it will continue to rise in the long term. More and more truly reputable escrow services will emerge, where it will become easier and easier to lend your Bitcoin rather than release it to the market. When I talk about reputability, I mean from the perspective of big, old capital that, unlike some cryptocurrency enthusiasts, would rather put their money in BlackRock than in the latest hype-inflated project of decentralised finance. After all, these companies always end up the same way: they either go bankrupt after 3 years or end up in trouble with the US regulatory authorities —as recently happened with the apparently global and independent crypto exchange Binance. Even previously sceptical small investors are relieved of the pressure to sell when their former trusted bank suddenly starts offering a fully regulated Bitcoin loan in line with its legal compliance requirements.

Why should person X empty their crypto-purse just to finance that longed-for single-family home when they can simply deposit Bitcoin as collateral for a fiat loan and still benefit from the price increase? A 100% Bitcoin loan to receive half a bitcoin’s worth of cash directly in hand? This is already a reality.

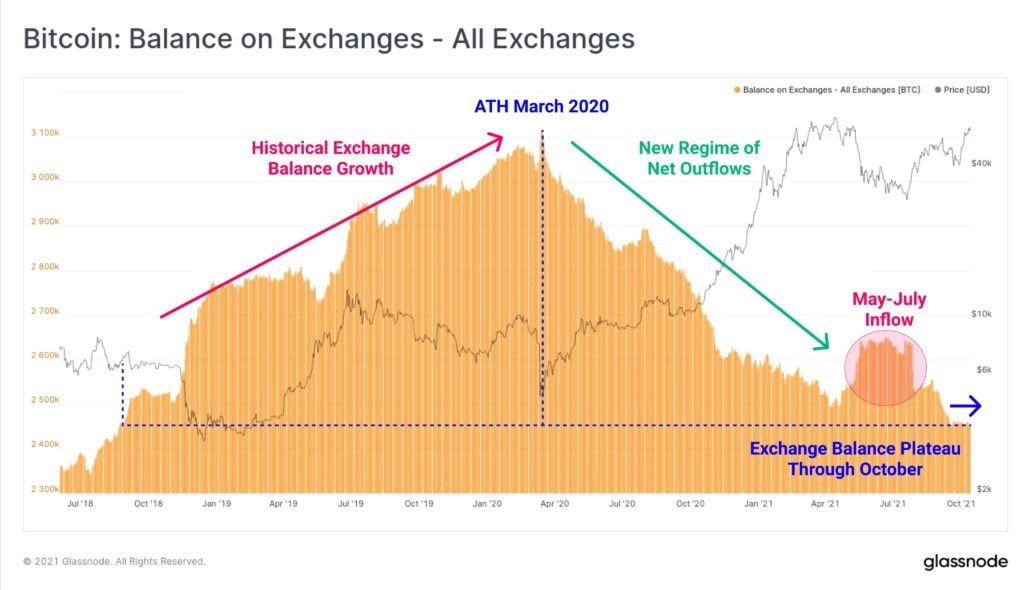

This hodler trend is also underpinned when looking at the numbers of bitcoins on the exchanges. While bitcoin trends on exchanges (which are considered highly liquid) grew in line with tradition until March 2020, since then we have seen a change in trend.

Source: https://twitter.com/glassnode/status/1448536629275070466/photo/1

However, the fact that less and less Bitcoin is available on the market has a huge impact on prices. This is because the price of a good can only be determined by the units actually traded: if there is a high demand for Bitcoin but only a fraction of the 21 million bitcoins are traded (between 2 and 2.5 million only), the growing demand is met by a shrinking supply, which inevitably leads to a soaring price. Whether the Bitcoin price actually reaches the moon is determined by the so-called Bull Market Multiplier.

Reason number 2: The effect of the Bull Market Multiplier

The market multiplier indicates by how many US dollars the total market capitalisation (price per x total amount) of an asset increases when you invest one US dollar in it. As demand is high and supply is scarce in a bull market, each additional dollar of demand can have a particularly strong upward impact on the price. As the rally continues, money enters the market on the demand side faster than commodities do on the supply side… and when the hodl rate is high, you simply have to wait a while until you find a price high enough for more hodlers to succumb and sell, adding their bitcoins to the supply side.

According to a Bank of America research note, this market multiplier even reached 118 in the last Bitcoin bull run. Figures that high seem crazy at first glance, but just the other day cryptocurrency data analyst James Van Straten tweeted that $350 million triggered a jump in market capitalisation of $40 billion in one day. This would equate to a market multiplier of 114, even before the current bull run. Other sources are more cautious with their figures, but confirm that Bitcoin is already close to the all-time high multiplier of 4.88 of the last bull market. We therefore see no need to talk about surreal values of 118 to recognise that the bull market multiplier will have an increasingly positive effect on the Bitcoin price.

If we were to take seriously what former BlackRock CEO Steven Schoenfield said about the next three years after the approval of a spot Bitcoin ETF, as much as $200 billion would flow into the market, which is only 2% of BlackRock’s assets under management. If we remain conservative at this point and assume both that the hodl rate will not increase and that the market multiplier will remain constant at only 4.88, we can calculate the Bitcoin price increase over three years as follows:

200 billion USD*4.88/21 billion USD= 46.476 USD net profit (or 105% of 06/12/2023 values).

And this doubling of the price takes place under otherwise unchanged conditions. Of course, the mere admission of a spot ETF would have numerous psychological consequences for the market.

Reason number 3: the next US ETF Spot.

The US capital market remains the largest and most important market in the world, despite (or precisely because of) the access barriers imposed by the SEC. The approval of a spot ETF (i.e. an ETF that would be obliged by regulation to actually buy the nominally declared Bitcoin in the market) would open up completely new and bureaucratically simplified access routes for institutional buyers of Bitcoin. But above all, Bitcoin’s public reputation would be greatly enhanced if asset management giants and Bitcoin ETF issuers, such as BlackRock, came to play on the same side. Criminal darknet money and environmental scandals are a thing of the past: Bitcoin is getting a good reputation and is suddenly considered sustainable.

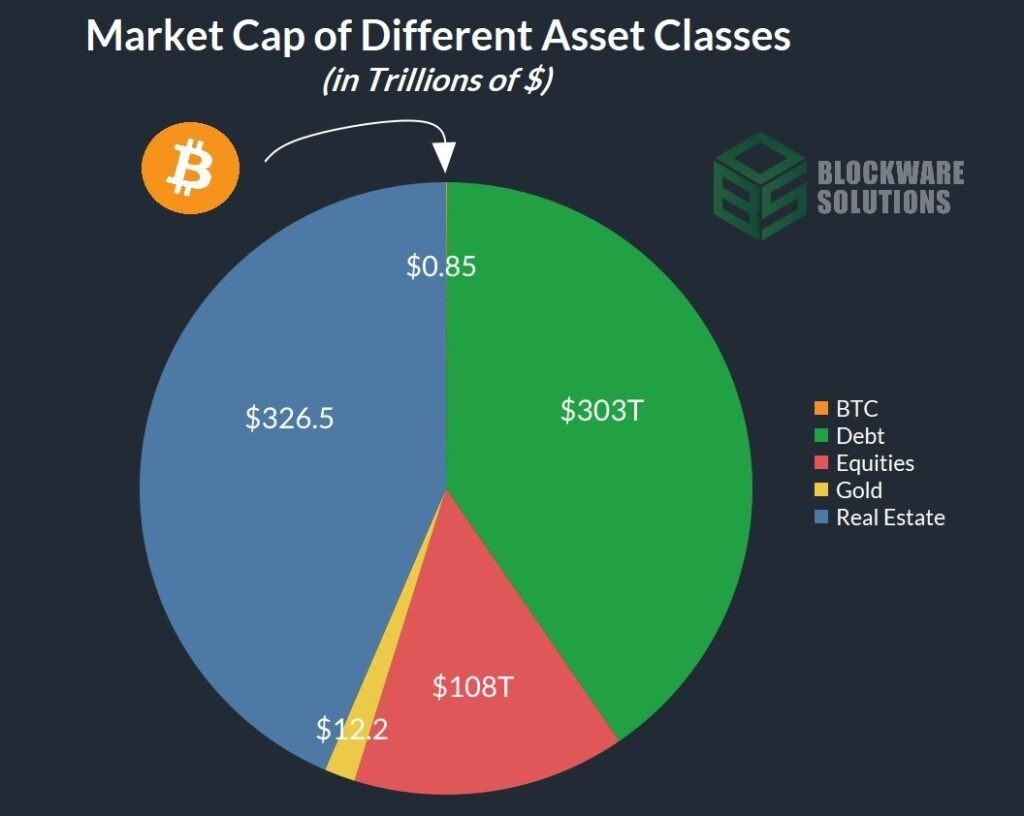

Bitcoin is ready to attract the billions of investments in other asset classes that are trying to flee inflation… but Bitcoin comes with full resistance to censorship, mobility, scarcity, programmability, divisibility and much more.

Source: Blockware Solutions

Nor should we underestimate the political influence that strengthening the Bitcoin lobby through ETFs would bring. How can any politician want to fight Bitcoin when the pension funds of millions of voters and the family offices of wealthy campaign sponsors are now knee-deep in Bitcoin investments? And with what face can your local banking advisor and the mainstream media continue to ridicule Bitcoin when one of its largest shareholders personally promotes the cryptocurrency? Bitcoin is growing slowly but steadily, which gradually facilitates its adoption.

Reason number 4: on the S-curve to mass adoption

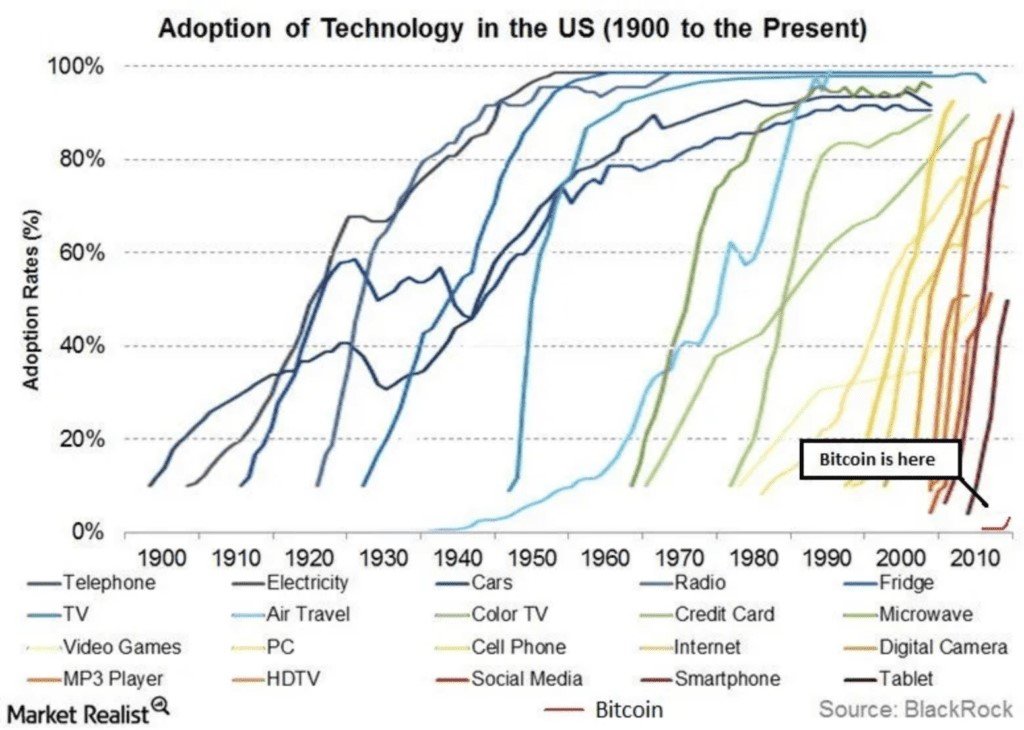

Although Bitcoin is also a network through which payments can be processed, it is first and foremost a new technology. While it benefits from the network effect, the fear that Bitcoin could be replaced by a much better network (as MySpace did with Facebook) does not apply here, because Bitcoin is not only a network, but also a technology. Bitcoin is comparable to the internet: the internet is a network (the network of networks) but, above all, it is a basic technology on top of which many other layers of applications can be developed. Today we use the internet to surf the web, to make phone calls and even to trade Bitcoin. Neither Hypertext Transfer Protocol (HTTP), nor Skype, nor WhatsApp, nor Bitcoin could think of deploying a completely new computer network around the world to run their offline application on it. We have the Internet and the winner takes all. However, in the case of Bitcoin, it still has to take time before everyone really uses it at the level at which the internet is used. Be that as it may, we can be optimistic in the medium term, because new technologies are often adopted on so-called S-curves: an S-curve is characterised by the fact that it roughly follows the line of the letter S, meaning that adoption is slow at first, then jumps exponentially and flattens out sharply towards the end.

Source: https://davethewave.substack.com/p/mass-adoption-and-the-s-curve

At first, it is always only the geeks, those who think differently and the rich who are interested in a new technology —or who can afford it to begin with. It is difficult to estimate where Bitcoin adoption currently stands. One could, for example, count all Bitcoin wallets containing at least one US dollar in satoshis: we would be talking about some 67 million wallets. Naturally, most Bitcoin users have several wallet addresses with more than one US dollar equivalent. On the other hand, many people share bitcoins at individual exchange addresses. We will probably never know exactly, but if we put 67 million users as an average, this would amount to only 0.8% of the world’s population. Crypto.com estimates the number of Bitcoin users worldwide at 219 million, which would also be only 2.7%. We still cannot talk about mass adoption!

I think most people would agree with me that mass adoption would not only increase the value of Bitcoin through the network effect, but also attract more retail money to the market. Many have already observed that, from cycle to cycle, Bitcoin gains are declining in percentage terms. But what if we are only at the inflection point before entering the S-curve? If this is the case, we could still be in for the biggest bull market in Bitcoin history. Of course, this is only one of many hopes for this market, but it is based on the observation of many previous technological adoptions.

Reason number 5: the FASB’s adjustment of accounting methods

The Financial Accounting Standards Board (FASB) sets accounting standards for companies in the United States. An adopted amendment to FASB standards will introduce the fair value accounting method for cryptoassets. While Bitcoin has always depreciated, from 2025 onwards it can be accounted for at the current market price. Potential price gains may now finally encourage companies to save in Bitcoin or build up reserves in a similar way to private individuals. It goes without saying for all cryptocurrency enthusiasts that this bureaucratic refinement will also guarantee a large cash flow in the cryptocurrency market in the future. This is one of the main reasons why I am optimistic about 2024.

Reason number 6: Bitcoin’s halving is approaching

The next halving of Bitcoin will take place around the second half of April 2024. This means that miners’ block rewards will suffer a steep 50% reduction. Today, we still have an inflation of 900 bitcoins per day, which miners could theoretically release to the market every day, and which the market has been buying up until now. After the halving, only 450 new bitcoins per day will be mined. Therefore, as long as demand remains the same or grows as it has done so far, the new supply will be halved from block to block. As all key Bitcoin figures are accessible to everyone, the halving is already discounted, so this April day will not be a special event for traders as usual. In the medium term, however, the new market conditions will be reflected in the price, at least according to the 4-year bull cycle theory: according to this theory, the halving always brings a very good investment year a few months later. So, if history repeats itself again, 2024 and 2025 will bring us excellent returns in Bitcoin. This sixth reason alone is already a great bullish signal for most Bitcoiners.

Recently, however, the theory of 4-year bullish cycles in the middle has increasingly come under attack in favour of the central bank theory: according to this theory, Bitcoin cycles are mainly caused by the monetary policy of central banks. Of course, one might ask with scepticism whether an asset class as small as Bitcoin is really more influenced by these macroeconomic factors than by sector-specific developments. There is no doubt that too much money through quantitative easing will not be detrimental to the Bitcoin, as one of the selling points of the Bitcoin is inflation.

Reason number 7: the printing presses are counterattacking

What bitcoin definitely does not need is a really deep recession. If people run out of money to eat, they are much more likely to sell their crypto assets than, say, the property they live in… no matter how confident they are in the value of Bitcoin. To avoid a serious recession, the US Fed will be forced to lower interest rates again sooner rather than later. Globally, central banks have already entered the QE phase again. Whether central banks influence the Bitcoin cycle or not, it is clear that investors are much more willing to invest in what they still consider a risky asset like Bitcoin in an economically flexible environment.

Reason number 8: The nation-state dilemma

If Bitcoin continues to rise and establishes itself as gold 2.0 (which, in my opinion, will inevitably happen, as Bitcoin will become harder to find than gold after the halving that will begin in April), it will be a matter of time before the first states and their banks add bitcoins to their balance sheets, which will strengthen Bitcoin and weaken state power over money. Until now, hard assets such as gold have been hoarded to defend against a speculative attack on one’s own currency in case of doubt: one can always throw gold on the market at a lower value to be paid for in one’s own currency. This would boost demand for its own currency in the short term because everyone would want to buy this cheap gold. However, in a desired future where Bitcoin is the hardest and most popular asset, central banks and governments will have to stock up on this asset to be able to counter possible attacks on their currencies.

Naturally, these ideas remain purely speculative, but if individuals, businesses, and institutions are already thinking about the above points and are increasingly optimistic about Bitcoin, why should it be any different with state actors? El Salvador has paved the way for change with the introduction of Bitcoin as a currency and the accumulation of state Bitcoin reserves. Who will be next? Indonesia? Javier Milei’s Argentina? And what about the current rumour that Qatar’s sovereign wealth fund wants to invest billions in Bitcoin? Beyond small states like Bhutan… what if larger states are already secretly mining to quietly fill their Bitcoin wallets? Is the Bitcoin mining hash rate (which continues to skyrocket despite the bear market and the impending halving) an indication that state actors are already deep in the game?

At the moment, all this remains speculation and hope, but these theories do not fail to push states to be the first to act. After all, the state that gets in first will get the lion’s share of bitcoins for little money and will be able to reorganise its own national budget. The last ones to jump on the bandwagon are gambling with the future of their own country…

As long as all states distrust the Bitcoin project, the situation will remain the same. Nobody has an advantage or a disadvantage. However, if a major state like the US were to announce today that the Fed had put bitcoins on the balance sheet, the market would explode and all other state actors would be forced to follow suit in order not to miss the train. In any case, it remains far from clear that this theoretical scenario will become a reality in the next cycle —although I am optimistic about it.

Reason number 9: the end of the gerontocracy.

It is logical and natural that the people who have lived the longest are those who have had the longest time to accumulate wealth. It is also a fact that, especially in the capital-rich West, the average age of the population tends to be very old. Naturally, Bitcoin appeals to an audience that tends to be young, familiar with modern technology —and often even digital natives. For example, the famous investor Warren Buffet, 93, is known for not even having a computer in his office… despite running Berkshire Hathaway, the world’s largest holding company, which invests in all sorts of more traditional sectors. His vice-chairman Charlie Munger passed away a few days ago, which brings me to the point I want to make.

At the risk of sounding a little macabre, it must be said that demographics and biology also play in Bitcoin’s favour in the medium term. Capital is moving from the financial gerontocracy to a generation for whom intangible values are now as obvious and logical as the fact that nothing can be expected from the pyramid scheme that is the state pension system. Of course, there are also many older Bitcoin investors and age alone does not prevent anyone from understanding and appreciating Bitcoin. However, my reasoning does apply to the majority of the elderly population.

Reason number 10: All price models can break down.

There are numerous price prediction models in the international Bitcoin scene. As with my price prediction above, experts try to sketch an idea of the price trend over the next few years using values that are expected to be as conservative as possible: charts are analysed and halving cycles are considered, but all these models can quickly break down (and break upwards) if a few billionaires or a few big companies like Google or Apple become convinced of the virtues of Bitcoin and go all in. As Michael Saylor’s example shows, this is not merely a pipe dream, and could happen at any time. If, for example, Apple alone were to put its $162 billion of cash reserves into Bitcoin, we would practically double the price of Bitcoin overnight with the current bull market multiplier of 4.88 —which would immediately go through the roof. No pricing model has taken into account black swan events, which certainly happen often in the Bitcoin arena.

Additional reason: Bitcoin as a driving force

When the Bitcoin price explodes, many altcoins tend to follow suit. Although none of the altcoins actually outperform Bitcoin in the long run and most of them only outperform Bitcoin at the beginning and for a maximum of one Bull Run, it is sometimes possible to make large profits on a wide variety of projects in the whirlwind that Bitcoin generates around it. This is often not sustainable and requires precise knowledge of which projects are worthwhile. However, although regulatory hurdles will tighten considerably in the next Bull Run, resourceful traders can also benefit from all the above-mentioned reasons in favour of Bitcoin in other non-Bitcoin projects. Lest you get your hopes up, the benchmark in a Bull Run should always be the Bitcoin and not the US dollar.

And finally, the disclaimer

This article is not intended as financial or investment advice. Bitcoin teaches people personal and individual responsibility. Anyone who does not want to assume this responsibility should leave the investment world in general and the Bitcoin in particular.

Did you like our blog article?

Support us by purchasing our products and services. Or build up a passive income by recommending us as an affiliate! And don't forget to check out Christoph's travel blog christoph.today!

Secret Knowledge Video Course

Learn Everything that You Need to Know for a Life as a Perpetual Traveler

Watch Video CourseEncyclopedia Collection

Acquire Expansive Knowledge about Banking, Companies, Citizenships, and Emigration.

Order eBooks