Brazil, the largest country in South America, has a lot to offer, from the bustling metropolis of São Paulo to the spectacular Amazon rainforest, Brazil is a country full of wonders. But that is not all, because it also harbours countless opportunities for ambitious investors who want to enter the real estate market. The Brazilian real estate market impresses with its strong economic growth, diversity of market segments and attractive profitability prospects.

Brazil offers lucrative investment opportunities accessible at very reasonable prices, especially in emerging neighbourhoods and on the outskirts of major cities, locations that enjoy a vibrant culture, stunning nature, and a lively music scene.

The country offers a wide range of opportunities for investors and property seekers due to its rapid urbanisation, high birth rates, and the presence of both affordable high-growth regions (such as Minas Gerais) and emerging nomadic centres (such as Florianopolis, also known as Floripa.)

Today we look at the country’s real estate sector. A great advantage of Brazil is that, unlike other countries, owning a property there does not automatically make you a tax resident (in our article 50 countries where you do not become a tax resident, even if you own a home you can find more countries with this feature). In addition, ç when you buy a property in Brazil you are given a tax identification number (as in almost all countries). Thus, Brazil can be a very practical solution for those who are or want to be Perpetual Traveller and need a legal compliance residence.

Why should I consider investing in Brazil?

Brazil has a strong economy that has been growing steadily in recent years. The country offers a wide range of investment opportunities in various sectors such as tourism, infrastructure, and energy. With its abundant natural resources and an emerging middle class, Brazil has the potential to become a leading real estate investment market.

The Brazilian real estate market is extremely diverse and offers a wide range of investment opportunities. In the country’s major cities, such as São Paulo and Rio de Janeiro, there is a thriving residential and commercial real estate market.

The coastal regions are highly sought after for the purchase of holiday properties, especially in the states of Santa Catarina and Bahia. Inland, on the other hand, agricultural areas abound, allowing investment in agribusiness. Depending on their preferences and strategic objectives, investors can choose from a wide range of markets.

Brazil is also experiencing a growing influx of international tourists, which increases the demand for vacation properties. As an investor, you can benefit from this trend and make considerable profits. It is worth taking a look at the favourite cities of digital nomads and perpetual tourists.

Other demographic factors

The demand for housing is continuously increasing due to population growth and rising living standards. Therefore, rents and property prices are rising, especially in metropolitan areas.

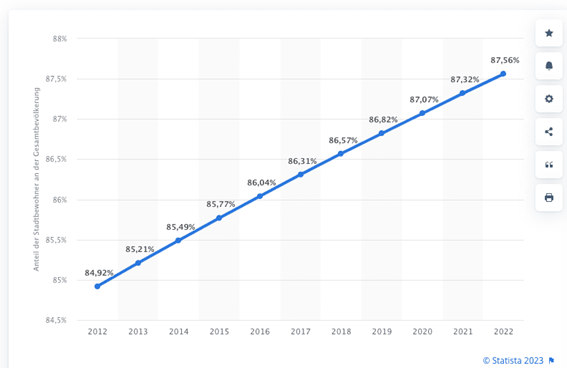

Rapid “urbanisation” is one of the decisive factors that make Brazil an extremely attractive real estate market. Current statistics show that Brazil has one of the highest urbanisation rates in Latin America.

The fact that more than 85% of the population lives in urban areas makes these population centres rife with real estate investment opportunities. This trend is further boosted by continued economic growth and the steady creation of new jobs in cities.

Degree of urbanisation in Brazil from 2012 to 2022

Degree of urbanisation in Brazil from 2012 to 2022

In 2022, there were 5570 municipalities in the country, and almost half (44.8%) of this total had a population of more than 10,000 inhabitants. These 2495 municipalities were home to 12.8 million people. Most of the country’s population (57% of the total) lived exclusively in 319 municipalities, indicating that the population is concentrated in urban centres with more than 100,000 inhabitants.

Moreover, Brazil continues to show a positive demographic development, which in the long term translates into an increase in demand for housing and real estate. According to official statistics from the Brazilian Institute of Geography and Statistics (IBGE), the annual birth rate in Brazil in 2021 was approximately 12.4 births per 1000 inhabitants. This positive demographic development indicates that housing and real estate will maintain the current high demand in the future.

CPF: the key to real estate investment in Brazil

CPF: the key to real estate investment in Brazil

When investing in Brazilian real estate, foreigners must follow certain steps: an important requirement is to apply for the CPF (Cadastro de Pessoas Físicas), a tax identification number for individuals.

With this convenient service, you can apply for the CPF whether you are in Brazil or abroad. They help you register with the Brazilian tax authorities and submit the necessary documents. Within 90 to 120 days, you will receive the approval or rejection of your application.

Of course, if you are going to invest in a property with the support of our partners in Brazil, they can also help you directly with the CPF.

Having a Brazilian CPF will open you many doors in Brazil: with this document you will be able to invest, bank and do business in Brazil. In addition, the CPF facilitates digital nomadism and makes it easier for you to travel, as most online transactions require you to present a CPF.

Whether you are a Brazilian citizen or a foreigner, you have the option to apply for a CPF as long as you own assets or rights in Brazil that are publicly registered. This includes real estate, vehicles, boats, aircraft, bank accounts and investments in the financial and capital markets.

It is important to note that a CPF alone is not enough to open a bank account or business in Brazil as a non-resident: you will need other documents, such as the Carteira de Registro Nacional Migratório (National Migrant Registration Card), a valid passport and proof of address and income.

Start your real estate adventure in Brazil

You have a wide range of options for investing in Brazilian real estate, from land and flats to commercial premises and holiday homes. To facilitate the process, we recommend that you consult experienced real estate agents and legal advisors.

However, there are certain restrictions for foreigners intending to purchase real estate in Brazil: the purchase of agricultural land is generally prohibited for non-residents, regardless of the intended use. We encourage you to check the laws and regulations in force to ensure that your future investments comply with all legal provisions.

Although there are restrictions, foreign investors and non-residents still have good options for buying property in Brazil: in urban areas there are no restrictions for non-residents to buy land, industrial plots, flats, and houses.

Please note that in border and national security areas it is common to be required to obtain a permit to approve the purchase of real estate, regardless of the size of the property.

If you own a property in Brazil and wish to sell it, two interesting tax exemptions are available to you: if the sale price is less than BRL 440,000 and you have had no comparable transactions in the last five years, you are exempt from capital gains tax.

Rental payments to non-residents from Brazilian sources are subject to a final withholding tax of 15%, while other payments to non-residents from Brazilian sources are generally subject to a final withholding tax of 25% —unless a lower tax rate applies under a double taxation treaty.

In addition, you can benefit from the other exception if you sell a property and acquire another residential property for the same or a higher price within a maximum period of 180 days. In this case, the sale would not be taxed directly. However, please note that if the value of the property acquired is lower than the sale price of the property sold, the difference will be taxed. It should also be noted that there is no real estate tax in Brazil.

The step-by-step procedure for acquiring real estate

If you invest in real estate in Brazil, you have the option of obtaining a residence permit. You can access this solution if you make a minimum investment of BRL 700,000 (approximately USD 144,000) in properties in the northern and northeastern states or BRL 1 million (approximately USD 205,000) in properties in other regions. Note that this rule only applies to urban properties, so forget about it if you intend to invest in rural properties.

To avoid losing your residence permit, you must spend at least 30 days a year in Brazil during the period of validity and ensure that the property is kept in good condition. After two years, your stay will be indefinite.

As mentioned above, to buy a property in Brazil, you need to apply for a CPF number (remember, this is the tax identification number for individuals). If you already have a residence permit, you will have to provide your RNE number (Registro Nacional de Extranjeros).

For the purchase of urban real estate, in addition to your CPF, you will need the following documents: passport, proof of residence and certified birth or marriage certificate with translation. If you wish to purchase a rural property, additional requirements apply, such as proof of residence in Brazil and a maximum surface area limit for the property.

Please note that in addition to the deeds, real estate agents and certifications, you as the buyer will have to pay the land transfer tax (ITBI) yourself. In most regions of the country this tax is between 2 and 3% of the purchase price.

Once you have completed the purchase of the property, you will be able to transfer the transaction price, but please note that only residents can open bank accounts in Brazil. Therefore, you will need to transfer the amount from a foreign bank account. The Central Bank of Brazil will require you to provide proof of the purpose of the transfer, such as a deed of sale or a private agreement.

Please note that this is a general overview of the basic requirements, and you may need to consider other legal aspects that we have not mentioned here.

An efficient tax structure is likely to remain interesting

Brazilian holding companies offer entrepreneurs and investors an interesting solution to improve financial matters related to real estate optimisation: they allow an efficient structuring of rental income, transfer tax, inheritance tax and real estate capital gains. They also provide non-residents with access to the Brazilian capital markets, which opens up a wide range of investment opportunities.

The main advantage of a Brazilian holding company is that it offers an optimised tax structure to take advantage of all possible tax benefits: By properly setting up and managing a holding company, you can significantly reduce your tax burden on real estate income and capital gains, allowing you to protect your assets and maximise your profitability.

However, it is important to note that holding companies in Brazil are primarily suitable for domestic investments, and less so for international investments and cryptocurrency trading. The legal and tax requirements for holding companies are complex and require knowledge and experience to comply with them properly.

When setting up and managing a holding company, it is advisable to consult local partners and experienced advisors who can help you understand all the legal requirements, complete the necessary forms, and keep the process running smoothly. Our partners are available to help you set up your own holding company and offer comprehensive advice.

The cost of setting up a holding company is usually around EUR 2,000 —which includes the necessary registration fees and the support of local partners. In addition, there are ongoing accounting fees to ensure the proper administration of the company.

It is important to underline that the tax implications of a holding company depend on several factors, such as the specific structure and the income generated. Therefore, individual advice is essential to find the perfect solution for your personal situation.

In addition, the Brazilian government has introduced several tax incentives to encourage investment in the real estate market. These include reduced tax rates for the purchase of new properties and the possibility to deduct certain taxes. These tax advantages add even more attractiveness to the Brazilian real estate market and increase the potential for investment.

If you want to know more about this great real estate investment opportunity, do not forget that Denationalize.me is at your disposal. If you want to acquire a legal compliance residence in the country, for example, you can rely on us to help you apply for a Brazilian tax identification number. Neither the tax identification number nor the residence creates an actual tax liability in Brazil.

Conclusion

Overall, Brazil offers discerning investors an attractive option for real estate investments. With its strong economy, diverse markets, attractive profitability potential, and beneficial legal framework, Brazil offers a most favourable environment for successful real estate investments.

Of course, we must not forget that the country also has its problems: corruption, violence and lack of security (especially in certain urban areas) is, as in many other Latin American countries, an issue to be taken into account.

Although, on the other hand, investing in real estate in Brazil for a minimum of BRL 700,000 in the north or northeast of the country, or 1 million in the rest of the country, comes with an additional prize, a residence permit which, after four years and having spent enough time in the country, allows you access to Brazilian citizenship.

In any case, it is important to do your due diligence, understand the conditions and requirements of the local market and, if you do not have in-depth knowledge or good contacts there, rely on experienced real estate agents and legal advisors. With careful planning and informed analysis, investors can benefit from the potential of the Brazilian real estate market and earn high returns over the long term. We at Denationalize.me will be happy to assist you in this process.

Did you like our blog article?

Support us by purchasing our products and services. Or build up a passive income by recommending us as an affiliate! And don't forget to check out Christoph's travel blog christoph.today!

Secret Knowledge Video Course

Learn Everything that You Need to Know for a Life as a Perpetual Traveler

Watch Video CourseEncyclopedia Collection

Acquire Expansive Knowledge about Banking, Companies, Citizenships, and Emigration.

Order eBooks

CPF: the key to real estate investment in Brazil

CPF: the key to real estate investment in Brazil